Understanding the PMT Function in Excel for Loan Payment Calculations

The PMT function is a financial function in Excel that is used to calculate the periodic payment for a loan or mortgage. It is used to calculate the payment that needs to be made at fixed intervals over a specified period of time in order to pay off a loan with a constant interest rate.The syntax of the PMT function is as follows:

Syntax

=PMT(rate, nper, pv, [fv], [type])

Where:

- rate: This is the interest rate per period of the loan. If the annual interest rate is 8%, and the loan is paid monthly, then the rate should be 8%/12, which is the monthly interest rate.

- nper: This is the total number of payment periods for the loan. For example, if the loan is for 3 years, and payments are made monthly, then the total number of payment periods would be 3*12=36.

- pv:This is the present value, or the amount of the loan. For example, if the loan is for $10,000, then the present value would be 10000.

- [fv] (optional):This is the future value, or the amount of the loan that remains to be paid at the end of the loan term. If this parameter is not specified, then Excel assumes that the future value is zero.

- [type] (optional): This parameter specifies when payments are due. If payments are due at the beginning of the period, then type should be set to 1. If payments are due at the end of the period, then type should be set to 0 or omitted.

The PMT function returns the periodic payment that needs to be made to pay off the loan. This value is negative, indicating a cash outflow or payment.

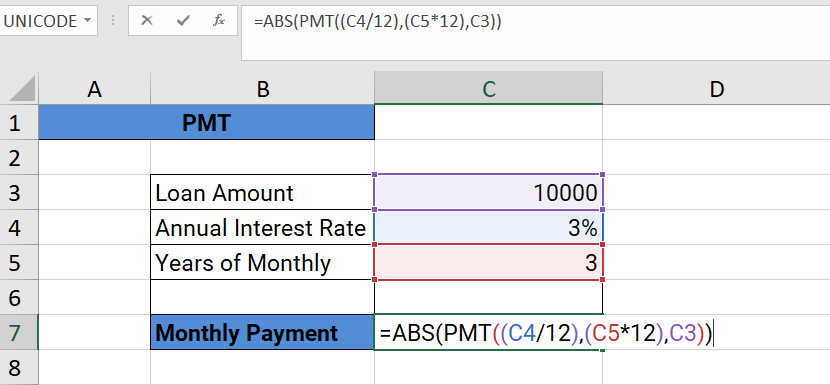

For example, suppose you want to calculate the monthly payment for a $10,000 loan with an annual interest rate of 3%, to be paid back over 3 years with monthly payments. The formula would be:

=PMT((C4/12),(C5*12),C3)

This would return a value of -$290.81, indicating that the monthly payment should be $290.81 in order to pay off the loan over 3 years with monthly payments.

If you want to convert the negative value to a positive value, you can use the ABS function:

=ABS(PMT((C4/12),(C5*12),C3))

This would return a value of $290.81

In summary, the PMT function is a useful tool for calculating loan payments in Excel. By understanding the syntax of the function and its parameters, you can use it to determine the periodic payment needed to pay off a loan over a specified period of time, given a constant interest rate.

Output

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions