Auto Bank Reconciliation in Tally Prime

The following would be Recording in Journal Using Double Entry System. Do the Posting Process from Journal Entries and Prepare The Trial Balance, Trading A/C, Profit & Loss A/C, Balance Sheet, and bank reconciliation statement also in The Books of M/S. Navin Pvt Ltd for the following year 2021 to 2022.

| Particular | DR | CR |

|---|---|---|

| Capital | 100,000 | |

| Indian Bank | 122.54 | |

| Bank loan | 50,000 | |

| Cash | 100,000 | |

| Reserves | 30,000 | |

| Machinery | 35,000 | |

| Bill Payable | 7,000.54 | |

| Typewriter | 31,000 | |

| Unpaid Expenses | 10,000 | |

| Furniture | 25,000 | |

| Bill Receivable | 5,878 |

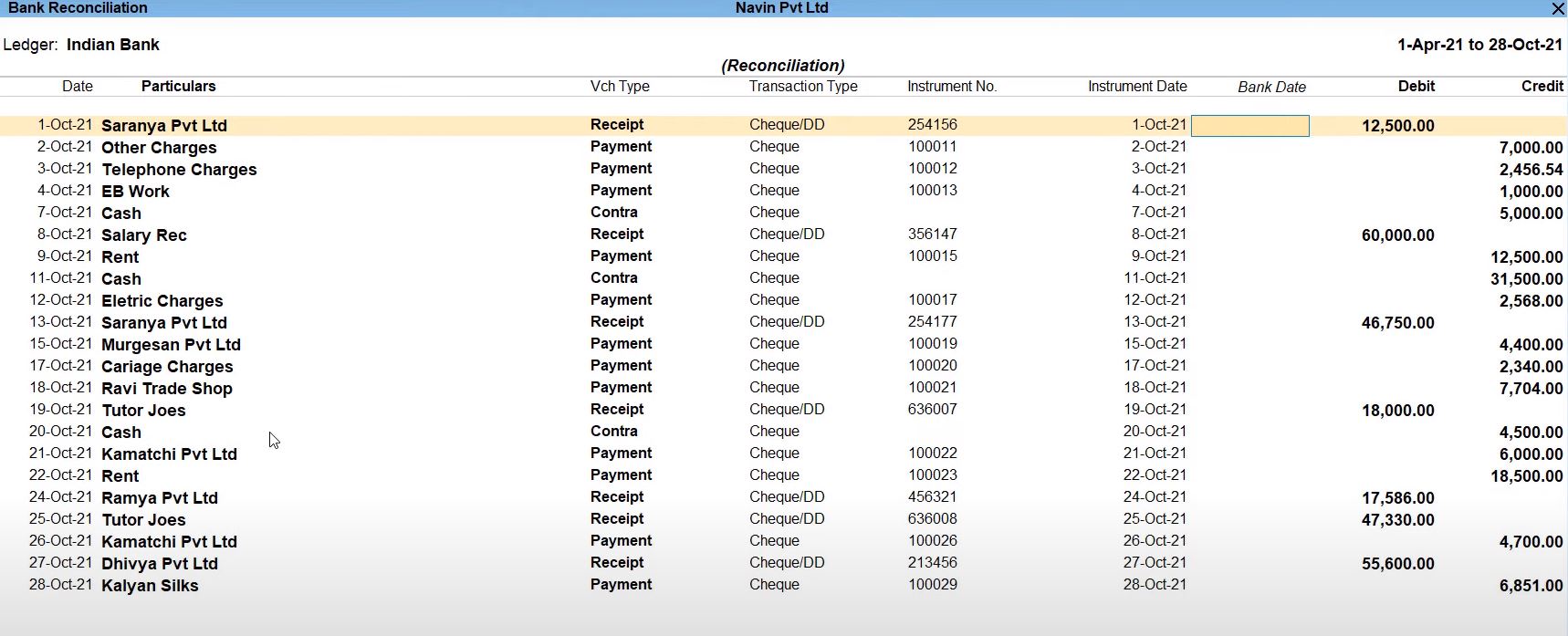

TRANSACTION DURING THE PERIOD OF OCTOBER:

- Oct 01 Amount Received Saranya Pvt Ltd Rs.12500.Ch. No.254156

- Oct 02 Amount paid to Other Charges Rs.7000.Ch. No.100011

- Oct 03 Paid Telephone Charge Rs. 2456.54 Ch. No.100012

- Oct 04 Amount paid toEB work Rs. 1000.Ch. No.100013

- Oct 07 AmountWithdraw from bankRs.5000.

- Oct 08 Salary Received Rs.60000.Ch. No.356147

- Oct 09 Paid Rent Rs.12500. Ch. No.100015

- Oct 11 AmountWithdraw from bankRs.31500

- Oct 12 Paid Electric Charge Rs.2568.Ch. No.100017

- Oct 13 Amount Received MR. Saranya Pvt Ltd Rs.46750.Ch. No.254177

- Oct 15 Amount Paid Mr. Murugesan pvt ltd Rs. 4400.Ch. No.100019

- Oct 17 Amount paid to Carriage Charges Rs. 2340.Ch. No.100020

- Oct 18 Amount transfer to Ravi trade shop Rs. 7704.Ch. No.100021

- Oct 19 Amount Received from MR. Tutor Joes Pvt Ltd Rs. 18000.Ch. No.636007

- Oct 20 AmountWithdraw from bank Rs. 4500.

- Oct 21 Amount paid by Mr. Sri Sai Kamatchi Pvt Ltd Rs.6000. Ch.No.100022

- Oct 22 Paid Rent Rs. 18500.Ch. No.100023

- Oct 24 Amount Received from Mr. Ramya Pvt Ltd Rs.17586.Ch. No.45632

- Oct 25 Amount Received from MR. Tutor Joes Pvt Ltd Rs. 47330.Ch. No.636008

- Oct 26 Amount paid to Mr. Sri Sai Kamatchi Pvt Ltd Rs. 4700.Ch. No.100026

- Oct 27 Amount Received from Mr. Dhivya Pvt Ltd Rs.55600.Ch. No.213456

- Oct 28 Amount paid to Mr. Kalyan Silks Pvt Ltd Rs.6851.Ch. No.100029

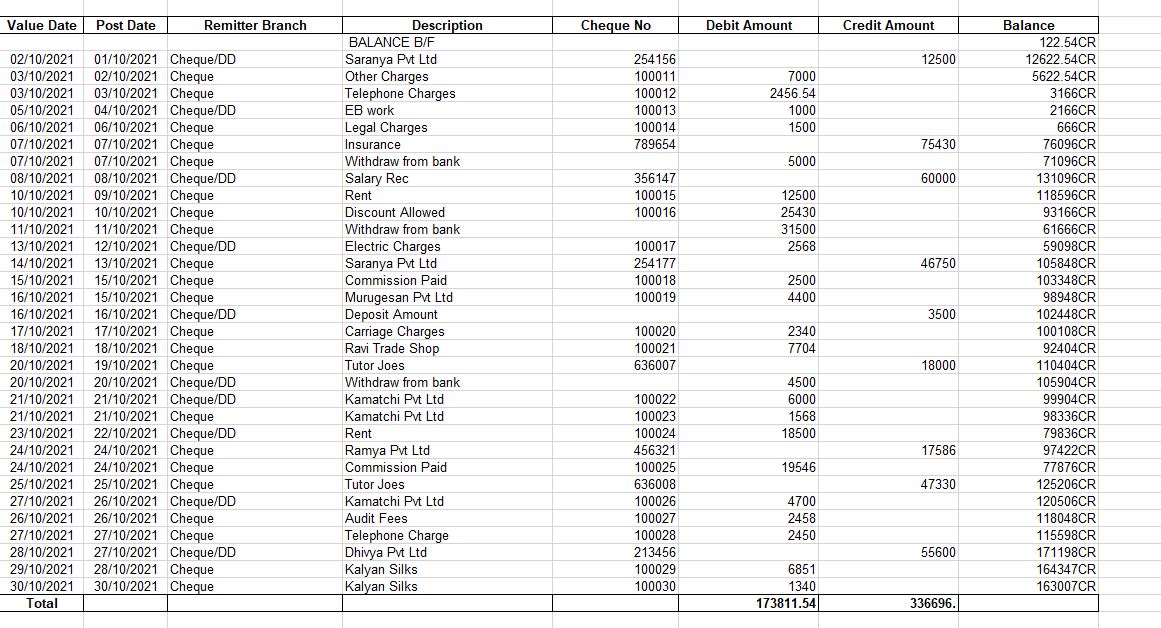

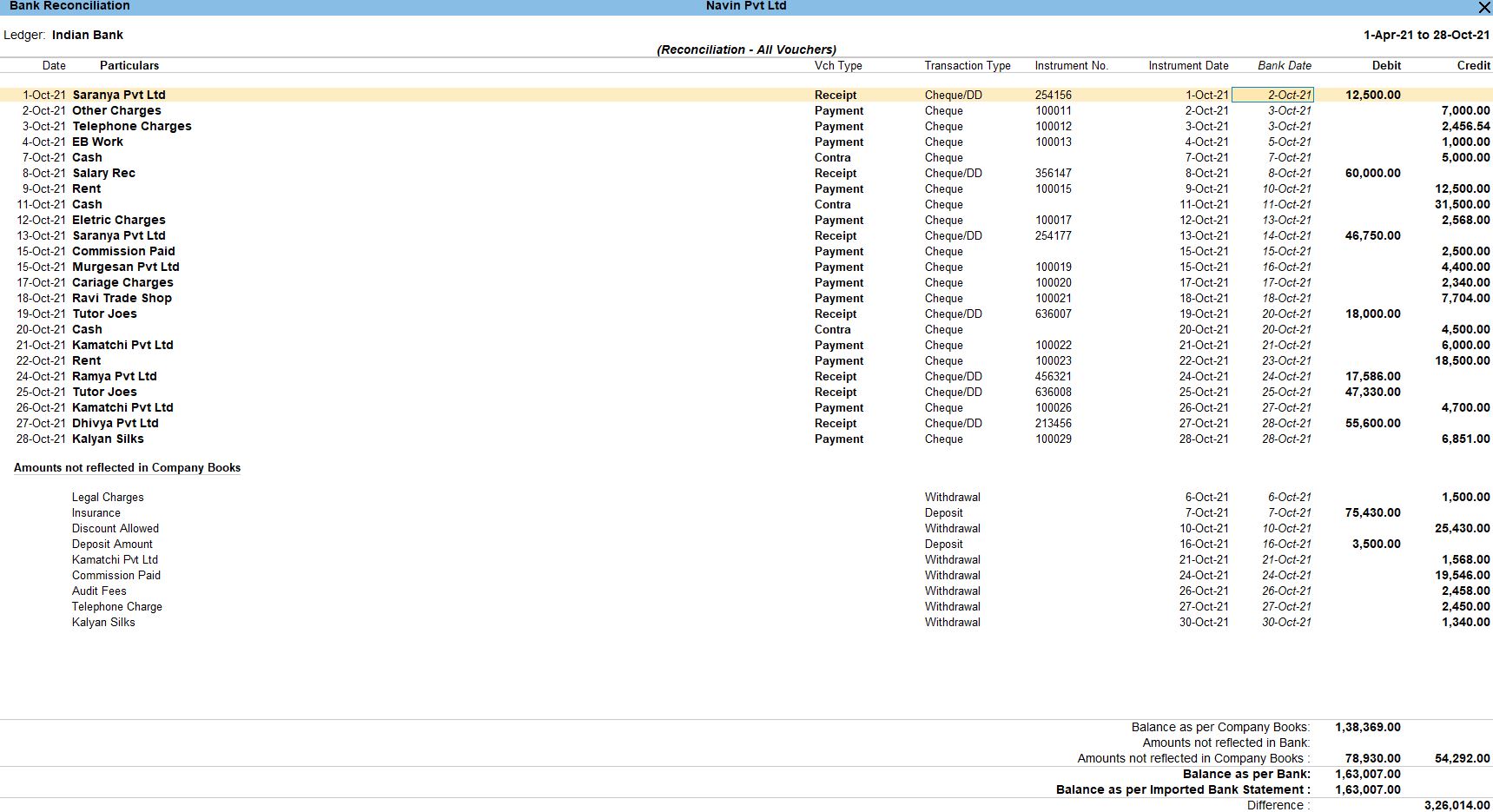

BANK STATEMENT FOR THE MONTH OF OCTOBER:

| INDIAN BANK, 28, Shopping Complex Omalur Road, Salem-636016. | |||||

|---|---|---|---|---|---|

| Date | Particular | Reference | Dr | Cr | Balance |

| 1-10-2021 | Balance B/D | 122.54 | |||

| 2-10-2021 | Saranya Pvt Ltd | 254156 | 12,500 | 12,622.54 | |

| 3-10-2021 | Other Charges | 100011 | 7,000 | 5,622.54 | |

| 3-10-2021 | Telephone Charge | 100012 | 2,456.54 | 3,166 | |

| 5-10-2021 | EB work | 100013 | 1,000 | 2,166 | |

| 6-10-2021 | Legal Charges | 100014 | 1,500 | 666 | |

| 7-10-2021 | Insurance | 789654 | 75,430 | 76,096 | |

| 7-10-2021 | Withdraw from bank | 5,000 | 71,096 | ||

| 8-10-2021 | Salary Received | 356147 | 60,000 | 131,096 | |

| 10-10-2021 | Rent Paid | 100015 | 12,500 | 118,596 | |

| 10-10-2021 | Discount Allowed | 100016 | 25,430 | 93,166 | |

| 11-10-2021 | Withdraw from bank | 31,500 | 61,666 | ||

| 13-10-2021 | Electric Charge | 100017 | 2,568 | 59,098 | |

| 14-10-2021 | Saranya Pvt Ltd | 254177 | 46,750 | 105,848 | |

| 15-10-2021 | Commission Paid | 100018 | 2,500 | 103,348 | |

| 16-10-2021 | Murugesan Pvt Ltd | 100019 | 4,400 | 98,948 | |

| 16-10-2021 | Deposit Amount | 3,500 | 102,448 | ||

| 17-10-2021 | Carriage Charges | 100020 | 2,340 | 100,108 | |

| 18-10-2021 | Ravi trade shop | 100021 | 7,704 | 92,404 | |

| 20-10-2021 | Tutor Joes Pvt Ltd | 636007 | 18,000 | 110,404 | |

| 20-10-2021 | Withdraw from bank | 4,500 | 105,904 | ||

| 21-10-2021 | Sri Sai Kamatchi | 100022 | 6,000 | 99,904 | |

| 21-10-2021 | Sri Sai Kamatchi | 100023 | 1,568 | 98,336 | |

| 23-10-2021 | Rent Paid | 100024 | 18,500 | 79,836 | |

| 24-10-2021 | Ramya Pvt Ltd | 458632 | 17,586 | 97,422 | |

| 24-10-2021 | Commission Paid | 100025 | 19,546 | 77,876 | |

| 25-10-2021 | Tutor Joes Pvt Ltd | 636008 | 47,330 | 125,206 | |

| 27-10-2021 | Sri Sai Kamatchi | 100026 | 4,700 | 120,506 | |

| 26-10-2021 | Audit Fees | 100027 | 2,458 | 118,048 | |

| 27-10-2021 | Telephone Charge | 100028 | 2,450 | 115,598 | |

| 28-10-2021 | Dhivya Pvt Ltd | 213456 | 55,600 | 171,198 | |

| 29-10-2021 | Kalyan Silks | 100029 | 6,851 | 164,347 | |

| 30-10-2021 | Kalyan Silks | 100030 | 1,340 | 163,007 | |

| Closing | 163007 | ||||

Balance as per company book :

Balance as per passbook :

| Opening Balance | 197,000.54 |

| Gross Profit | ----- |

| Net Loss | 6,906 |

| Balance Sheet | 232,733.54 |

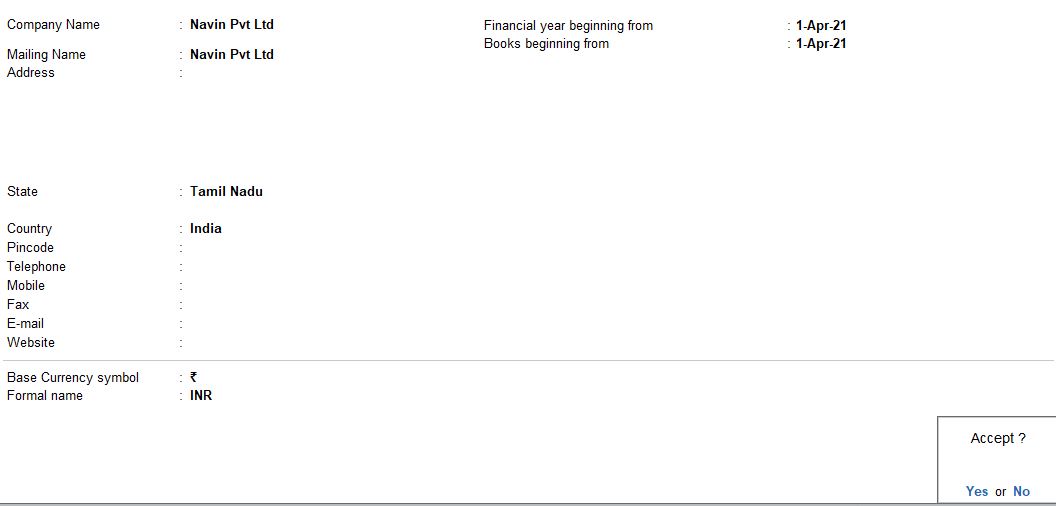

Create a New Company

- Go to the Gateway of Tally.

- Select "Create Company" or "Alt+ K" (exact wording may vary based on your version).

Fill Company Information:

- Company Name: Enter "M/S. Navin Pvt Ltd" in the company name field.

- Address: Enter the company's registered address.

- Financial Year: Set the financial year to 2021-2022.

- Books Beginning From: Set the date to the start of the financial year (e.g., April 1, 2021).

- Security Control: Enter a password if required.

- Enable Goods and Services Tax (GST): Set as per your business requirements.

- Set/Alter GST Details: If applicable, enter GST details.

Save the Company:

- After entering all the required details, press Enter to save the company information.

- Tally Prime will ask you to confirm, press Y for yes.

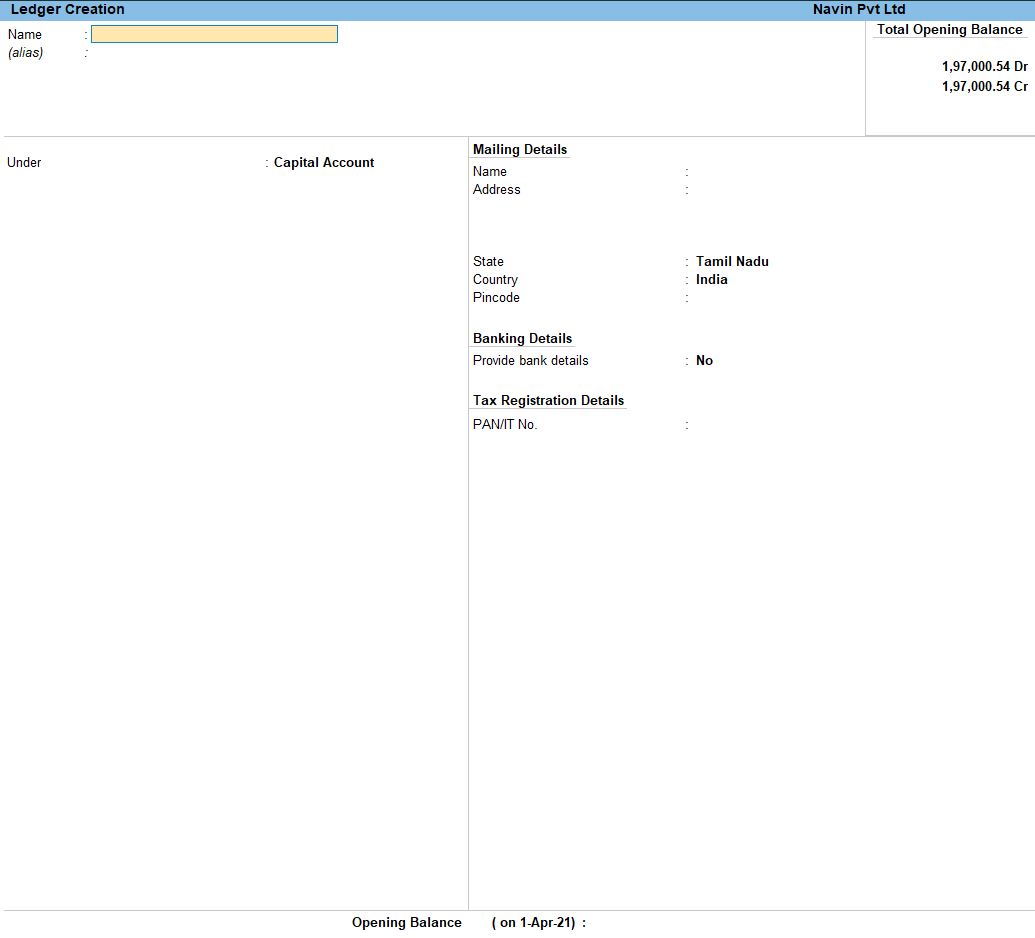

Create Ledger

- Select "Create" >"Accounts Masters">"Ledger">"Create".

Now, create each ledger account with its opening balance.

Capital Account:

- Name: Capital

- Under: Capital (Choose this group)

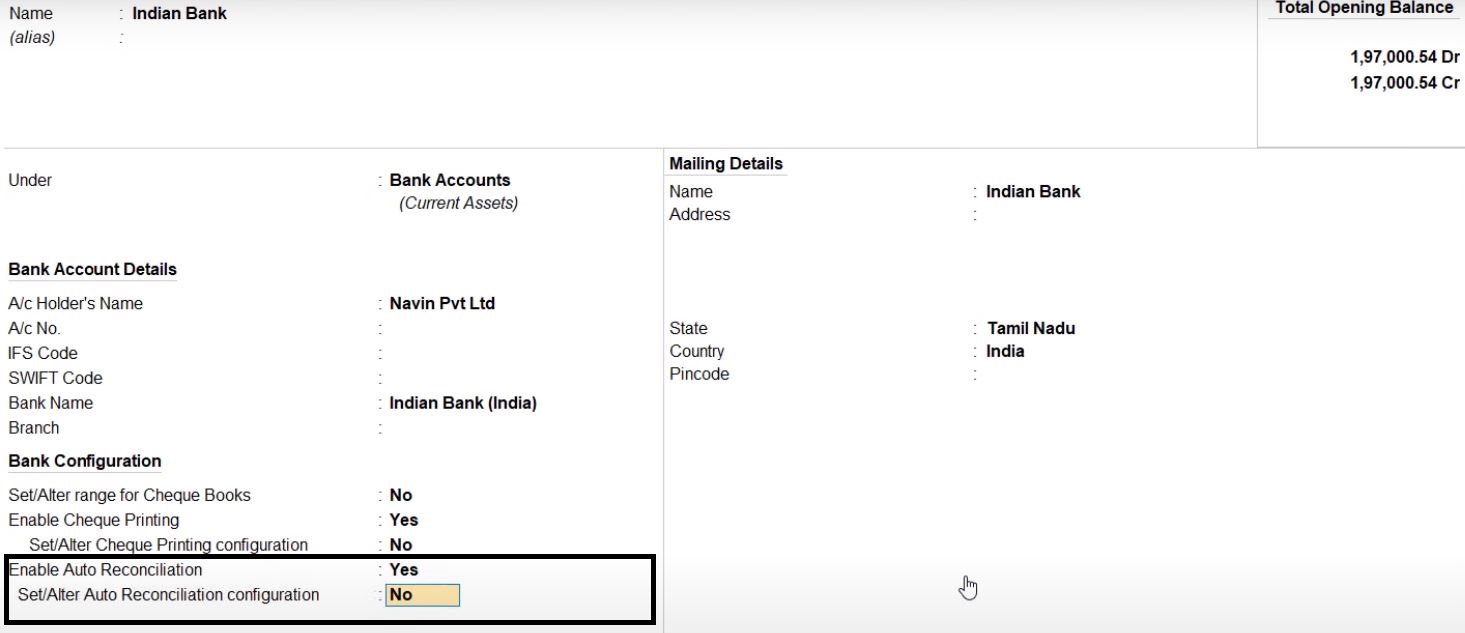

Indian Bank:

- Name: Indian Bank

- Under: Bank Accounts (or Bank)

Bank Loan:

- Name: Bank Loan

- Under: Loans (Choose this group)

Cash:

- Name: Cash

- Under: Cash-in-hand (or Cash)

Reserves:

- Name: Reserves

- Under: Reserves and Surplus (Choose this group)

Machinery:

- Name: Machinery

- Under: Fixed Assets (Choose this group)

Bill Payable:

- Name: Bill Payable

- Under: Sundry Creditors (Choose this group)

Typewriter:

- Name: Typewriter

- Under: Fixed Assets (Choose this group)

Unpaid Expenses:

- Name: Unpaid Expenses

- Under: Current Liabilities (Choose this group)

Furniture:

- Name: Furniture

- Under: Fixed Assets (Choose this group)

Bill Receivable:

- Name: Bill Receivable

- Under: Sundry Debtors (Choose this group)

For each ledger account, enter the opening balance in the respective "Opening Balance" field.

Save the Ledger Entries

- After entering all the details, press Enter to save each ledger entry.

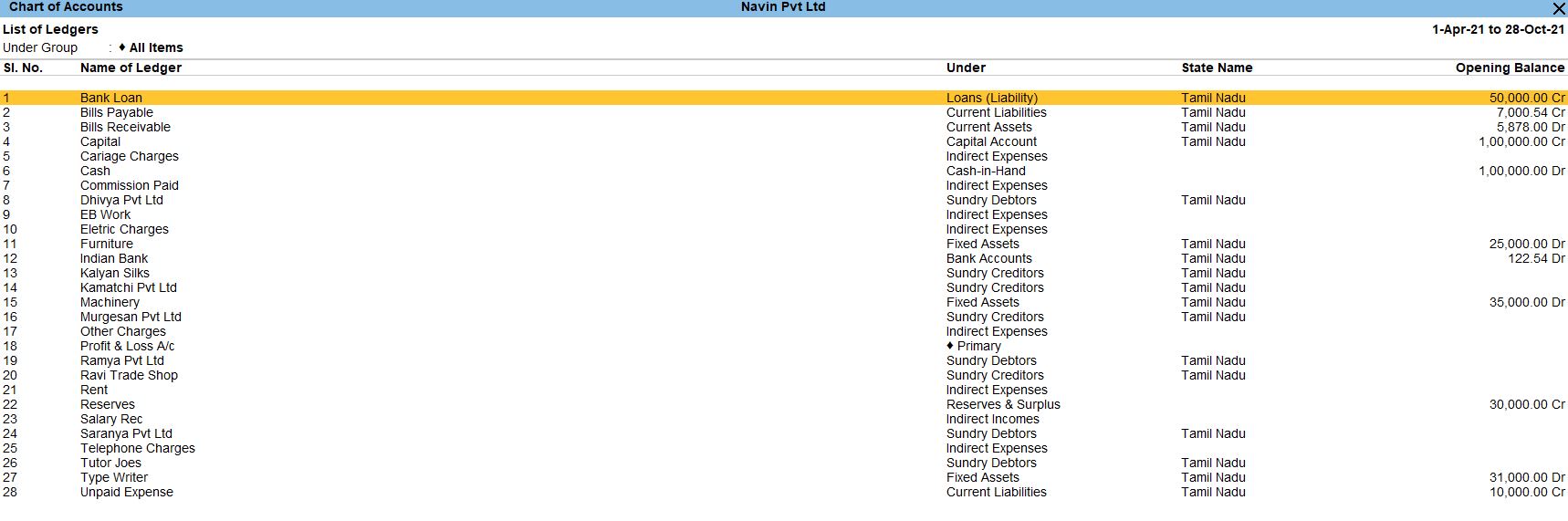

Select Chart of Accounts:

- Under the "Gateway of tally" menu, choose "Chart of Accounts" and then select "Groups" or "Ledgers."

TRANSACTION DURING THE PERIOD OF OCTOBER:

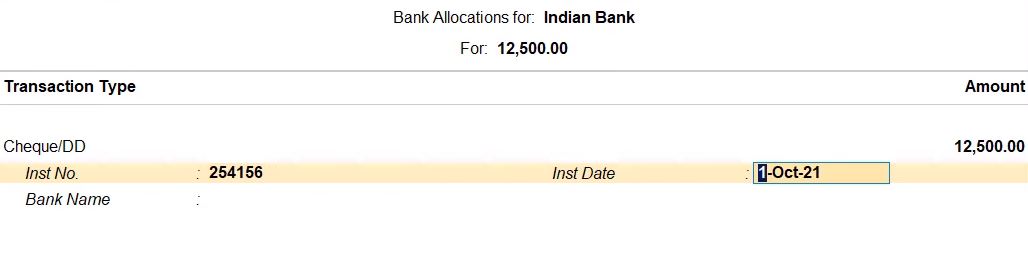

Oct 01 Amount Received Saranya Pvt Ltd Rs.12500.Ch. No.254156

Go to Gateway of Tally:

- Navigate to "Gateway of Tally."

Select Receipt Voucher:

- Choose "Vouchers" from the main menu.

- In the Accounting Vouchers screen, select "F6: Receipt“for a payment transaction.

Fill in Transaction Details

- Date: Set the transaction date to October 1st.

- Particulars:

- Debit: Select "Indian Bank.":

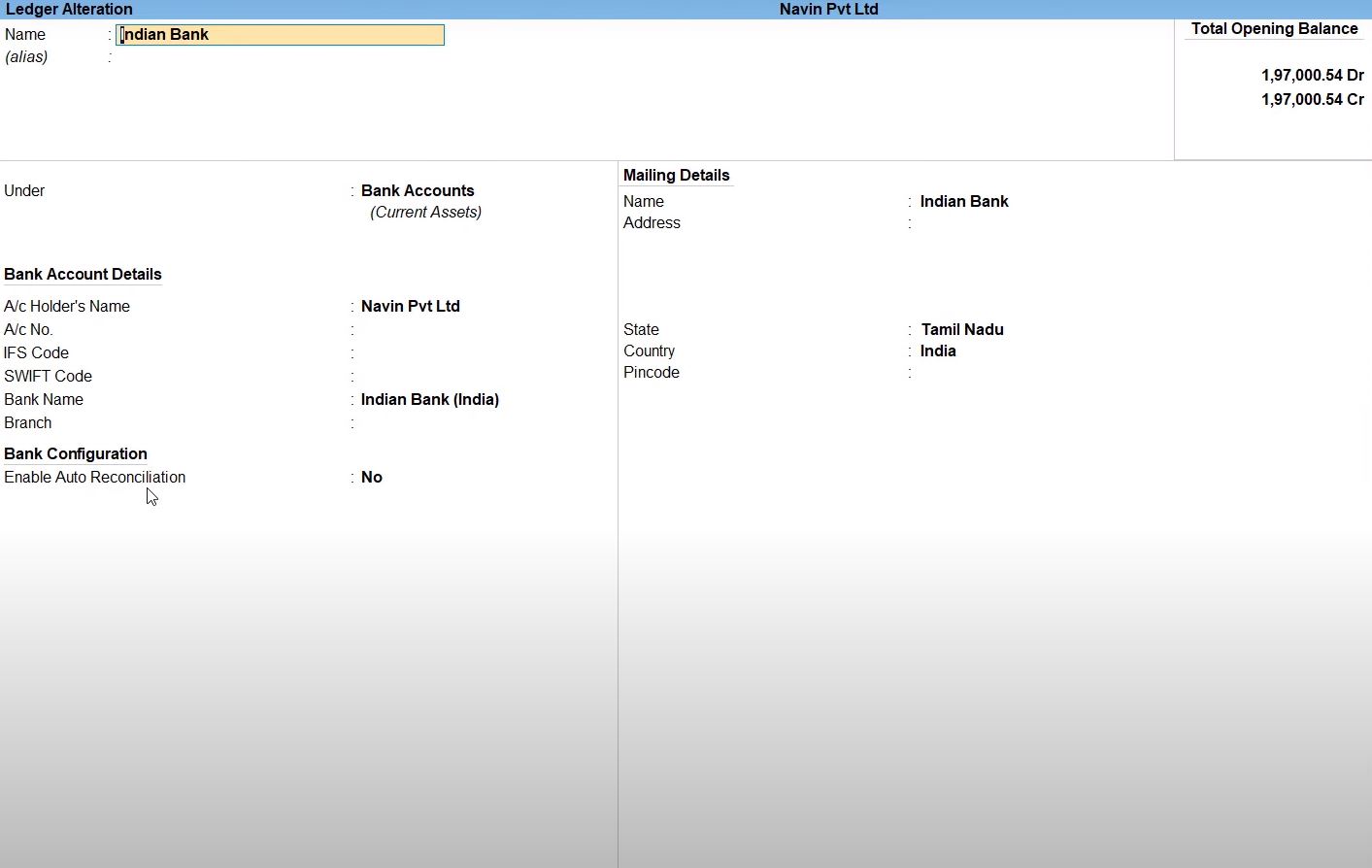

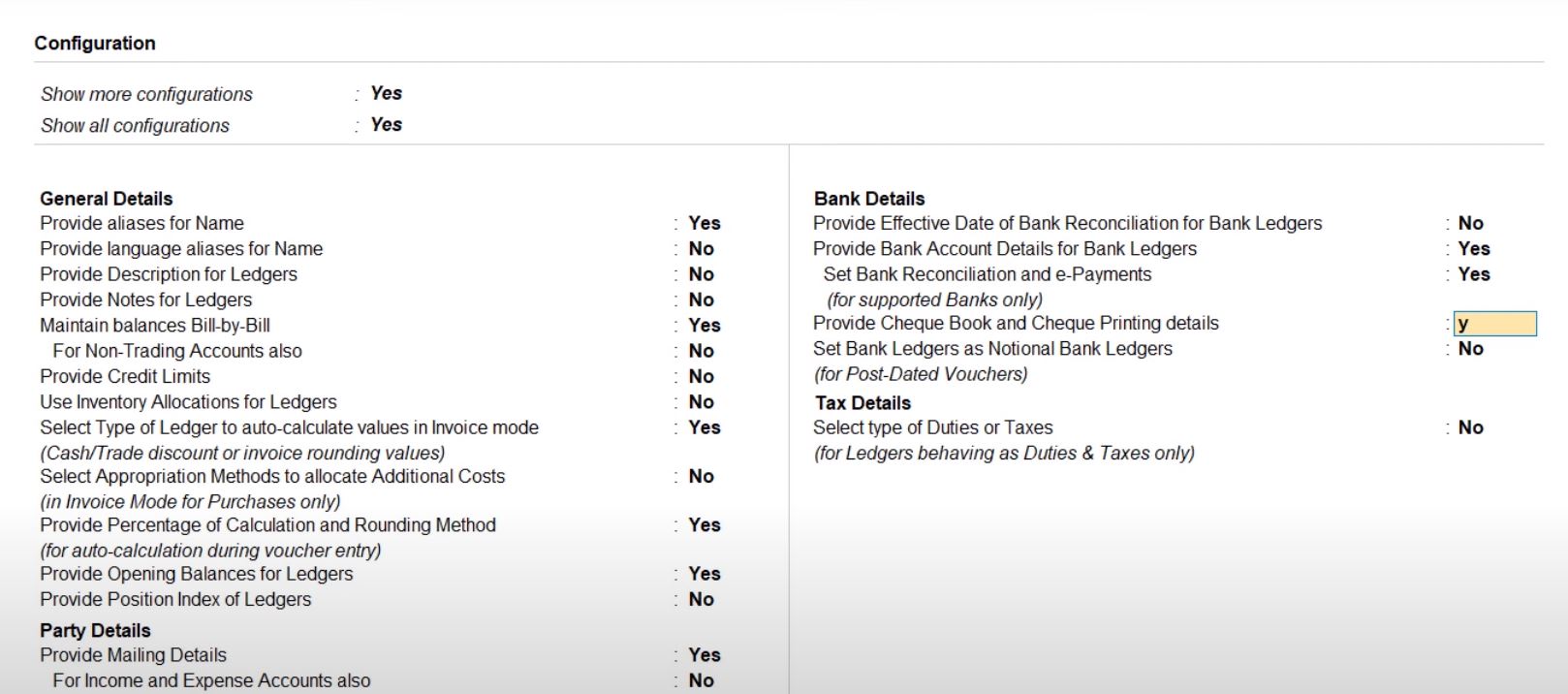

Alter Indian Bank

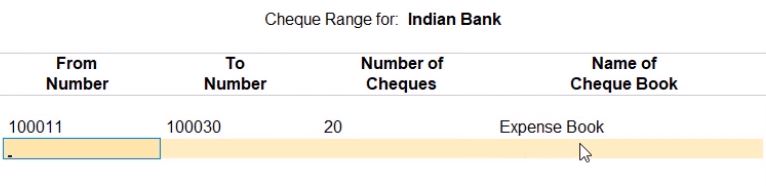

- Select Bank Ledger > Indian Bank > F12.

- Provide cheque Book and cheque Printing details Yes.

- Credit: Select "Saranya Pvt Ltd."

- Cheque No.: Enter Cheque No. 254156.

- Amount: Enter Rs. 12,500 in the respective fields.

Save the Voucher:

- Press Enter to save the voucher

follow the above steps for the transaction below.

- Oct 07 AmountWithdraw from bankRs.5000.

- Oct 13 Amount Received MR. Saranya Pvt Ltd Rs.46750.Ch. No.254177

- Oct 19 Amount Received from MR. Tutor Joes Pvt Ltd Rs. 18000.Ch. No.636007

- Oct 24 Amount Received from Mr. Ramya Pvt Ltd Rs.17586.Ch. No.45632

- Oct 25 Amount Received from MR. Tutor Joes Pvt Ltd Rs. 47330.Ch. No.636008

- Oct 27 Amount Received from Mr. Dhivya Pvt Ltd Rs.55600.Ch. No.213456

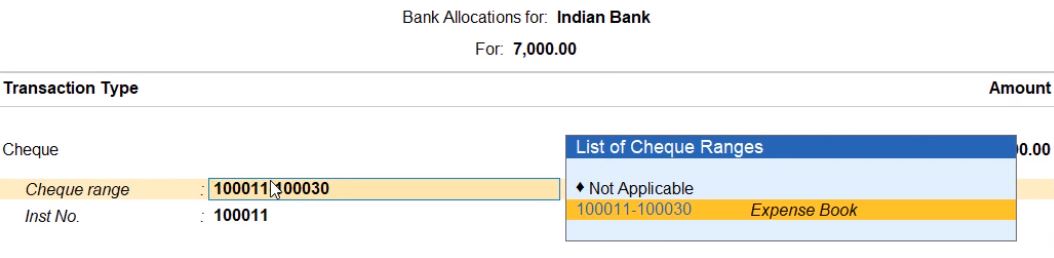

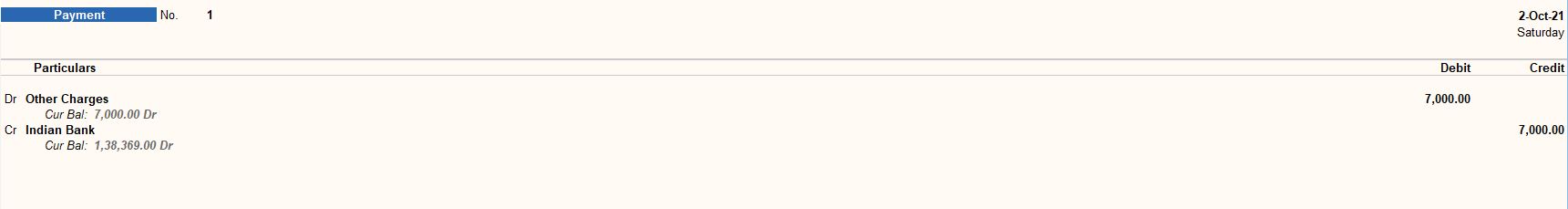

Oct 02 Amount paid to Other Charges Rs.7000.Ch. No.100011.

Go to Gateway of Tally:

- Navigate to "Gateway of Tally."

Select Payment Voucher:

- Choose " Vouchers" from the main menu.

Choose Voucher Type:

- Select "F5: Payment" for creating a payment voucher.

Enter Voucher Date:

- Enter the voucher date as October 2 or the relevant date.

Enter Payment Details:

- In the payment voucher, enter the payment details:

- Particulars: Other Charges

- Account: Other Charges (or the relevant salary ledger)

- Debit: Rs. 7,000

- Particulars: Indian Bank

- Account: Indian Bank (or the relevant bank ledger)

- Credit: Rs. 7,000

Enter Cheque Details:

- Below the payment details, enter cheque details:

- Payment by: Cheque

- Cheque No.: 100011

Narration:

- Enter any relevant narration like "Payment to Other Charges on Oct 2."

Save the Voucher:

- Press Ctrl + A to save the voucher.

follow the above steps for the transaction below.

- Oct 03 Paid Telephone Charge Rs. 2456.54 Ch. No.100012

- Oct 04 Amount paid toEB work Rs. 1000.Ch. No.100013

- Oct 08 Salary Received Rs.60000.Ch. No.356147

- Oct 09 Paid Rent Rs.12500. Ch. No.100015

- Oct 12 Paid Electric Charge Rs.2568.Ch. No.100017

- Oct 15 Amount Paid Mr. Murugesan pvt ltd Rs. 4400.Ch. No.100019

- Oct 17 Amount paid to Carriage Charges Rs. 2340.Ch. No.100020

- Oct 21 Amount paid by Mr. Sri Sai Kamatchi Pvt Ltd Rs.6000. Ch.No.100022

- Oct 22 Paid Rent Rs. 18500.Ch. No.100023

- Oct 26 Amount paid to Mr. Sri Sai Kamatchi Pvt Ltd Rs. 4700.Ch. No.100026

- Oct 28 Amount paid to Mr. Kalyan Silks Pvt Ltd Rs.6851.Ch. No.100029

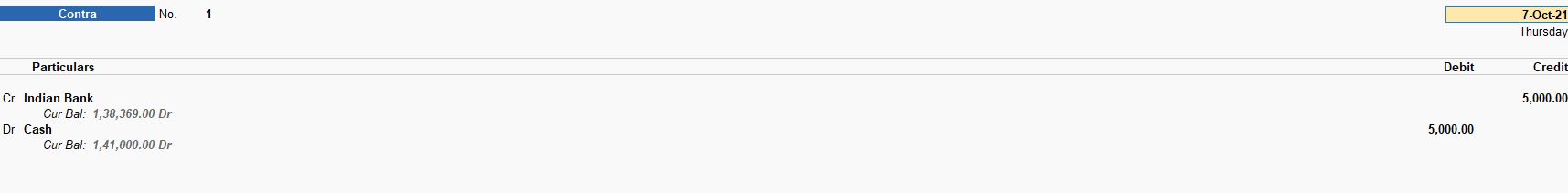

Oct 07 AmountWithdraw from bankRs.5000.

Go to Gateway of Tally:

- Navigate to "Gateway of Tally."

Select Contra Voucher:

- Choose " Vouchers" from the main menu.

Choose Voucher Type:

- Select "F4: Contra" for creating a Contra voucher.

Enter Voucher Date:

- Enter the voucher date as October 7 or the relevant date.

Enter Contra Details:

- In the Contra voucher, enter the Contra details:

- Particulars: Cash

- Account: Cash (or the relevant Cash ledger)

- Debit: Rs. 5,000

- Particulars: Indian Bank

- Account: Indian Bank (or the relevant bank ledger)

- Credit: Rs. 5,000

Narration:

- Enter any relevant narration like "Withdrawal from Indian Bank on Oct 7."

Save the Voucher:

- Press Ctrl + A to save the voucher.

follow the above steps for the transaction below.

- Oct 11 AmountWithdraw from bankRs.31500

- Oct 18 Amount transfer to Ravi trade shop Rs. 7704.Ch. No.100021

- Oct 20 AmountWithdraw from bank Rs. 4500.

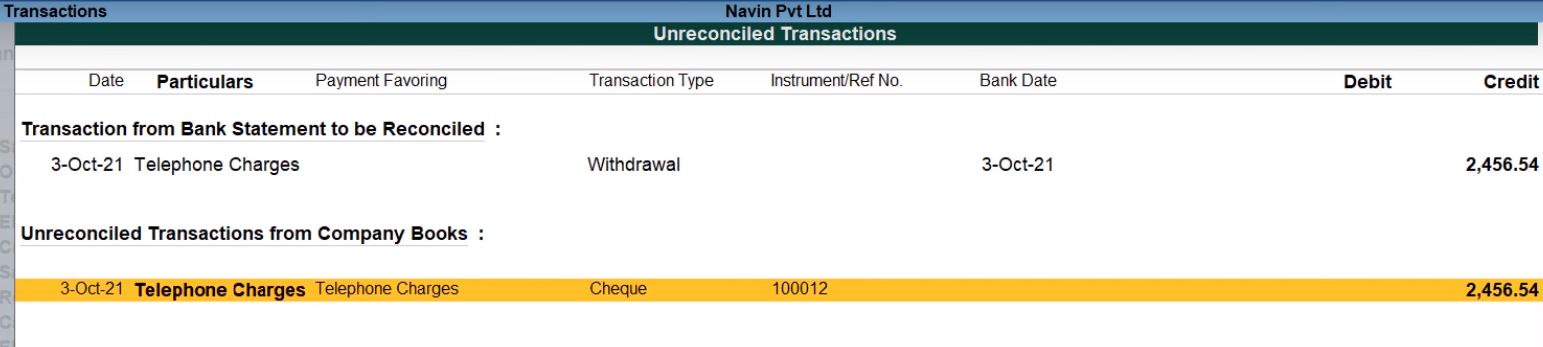

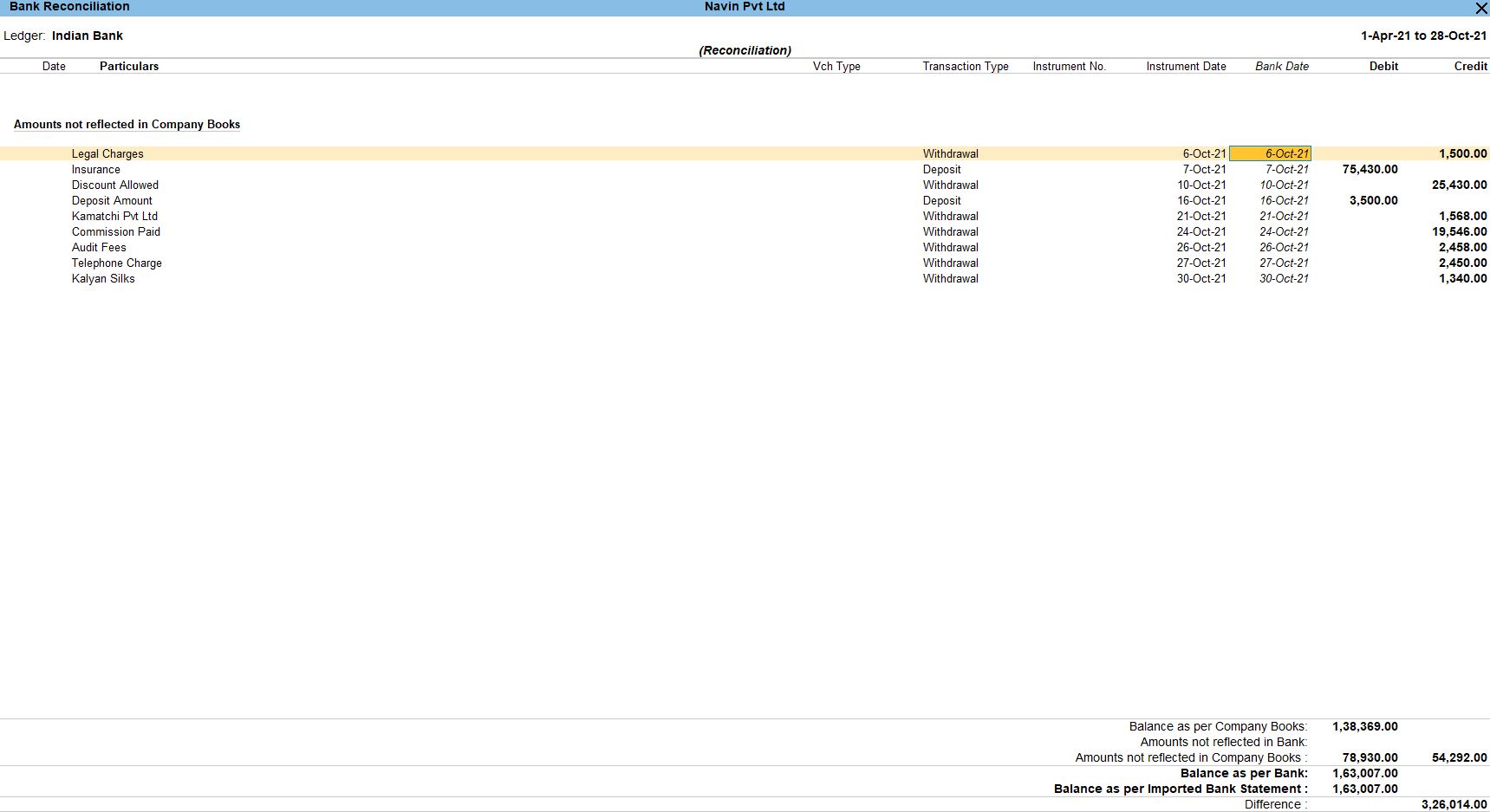

Auto Bank Reconciliation Statement

Enter Bank Transactions:

- Go to the Gateway of Tally.

- Select Ledger from the main menu, Enter Bank ledger.

- Select "Banking" from the main menu.

- Enter all your bank transactions such as payments, receipts, and other relevant entries.

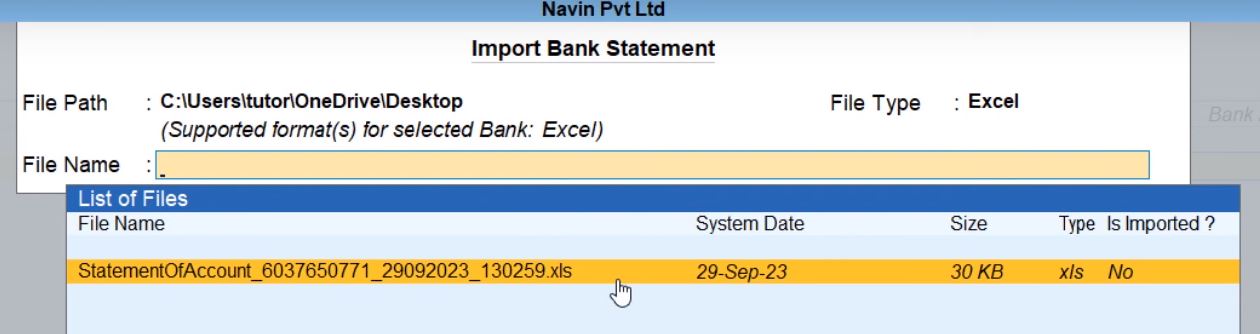

Import Bank Statement:

- Obtain a copy of your bank statement in a format supported by Tally Prime (CSV or Excel).

- Go to the Gateway of Tally.

- Select "Banking" and then "Bank Reconciliation."

Import Excel Statement:

- Go to the Gateway of Tally.

- Select "Bank Details" and then "Bank Statement."

- Select the Reconcile Unlinked or Reconcile All Unlinked

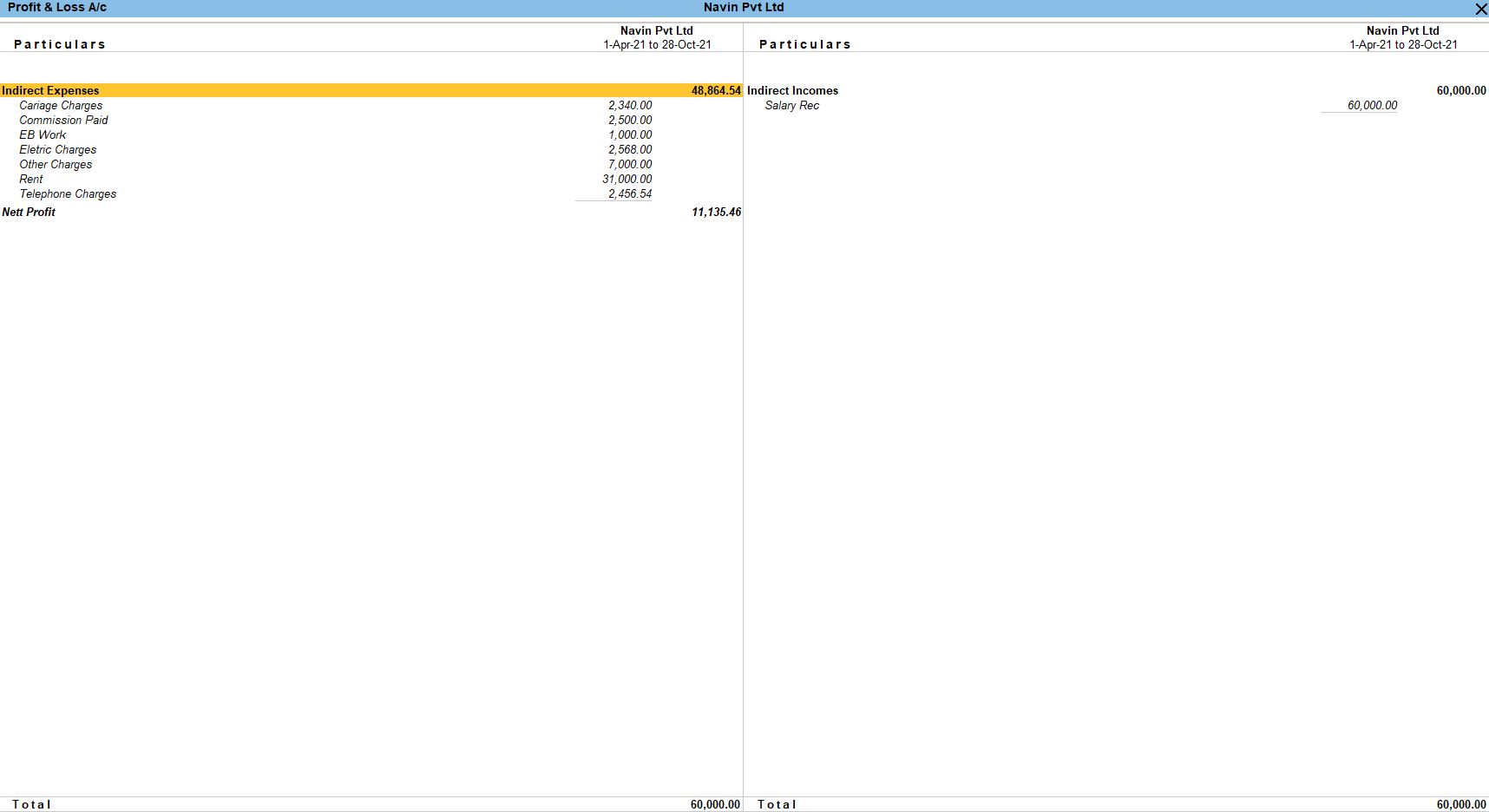

Profit and Loss

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Reports:

- From the Gateway of Tally, go to "Reports" by selecting it from the main menu.

Financial Reports:

- Under "Reports," navigate to "Profit & Loss" in the "Financial Reports" section.

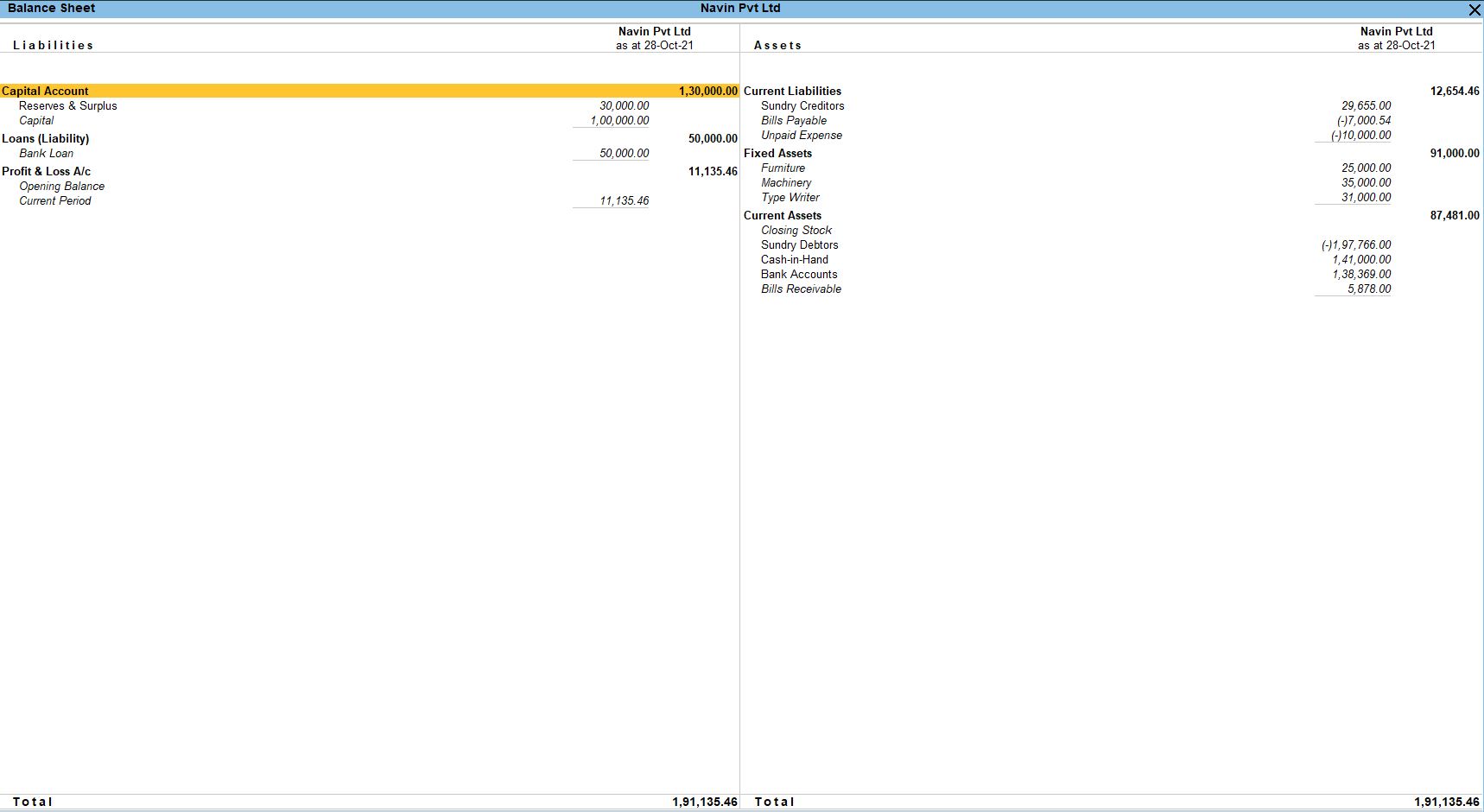

Balance Sheets

Go to Gateway of Tally:

- You'll start at the Gateway of Tally, which is the main screen.

Access Reports:

- From the Gateway of Tally, go to "Reports" by selecting it from the main menu.

Financial Reports:

- Under "Reports," navigate to "Balance Sheet" in the "Financial Reports" section.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions