Simplified Management of GST and Service Tax in Tally Prime

GST:

- GST, or Goods and Services Tax, is a comprehensive indirect tax levied on the supply of goods and services at each stage of the production and distribution chain.

- It is designed to replace multiple indirect taxes that were previously imposed by the central and state governments.

- The primary goal of GST is to create a more efficient and transparent taxation system.

Service Tax:

- Service tax in India is levied as an indirect tax.

- Service tax is a tax levied by the government on service providers on certain service transactions but is actually borne by the customers.

- It is categorized under Indirect Tax and came into existence under the Finance Act, 1994.

Rate of Service Tax in India:

- The government periodically revises service tax rates during every financial budget session.

- The current rate of service tax in India is 15%.

- Any changes in these rates are usually announced by the finance minister.

- This rate must be paid by individuals and service providers if the value of the services provided exceeds ₹10 lakh rupees in a single financial year.

- This addition to the service tax rules does not apply to the Union Territory.

| JS Enterprises | |

|---|---|

| ADDRESS | 20/5, Andavar complex, Kesavalu St, Kamarajanar Rd, Attur- 636102 |

| MOBILE NO | 9785621230 |

| jsenterprises@gmail.com | |

| WEBSITE | Jsenterprises.in |

| Against the Field | Action to be Performed |

|---|---|

| Description | Advertising services |

| HSN/ SAC | 998361 |

| Taxability | Taxable |

| Integrated Tax | 18% |

Input tax credit to GST

01-07-23 JS Enterprises had a closing CENVAT (Service Tax Input Credit) balance of Rs. 50,000.

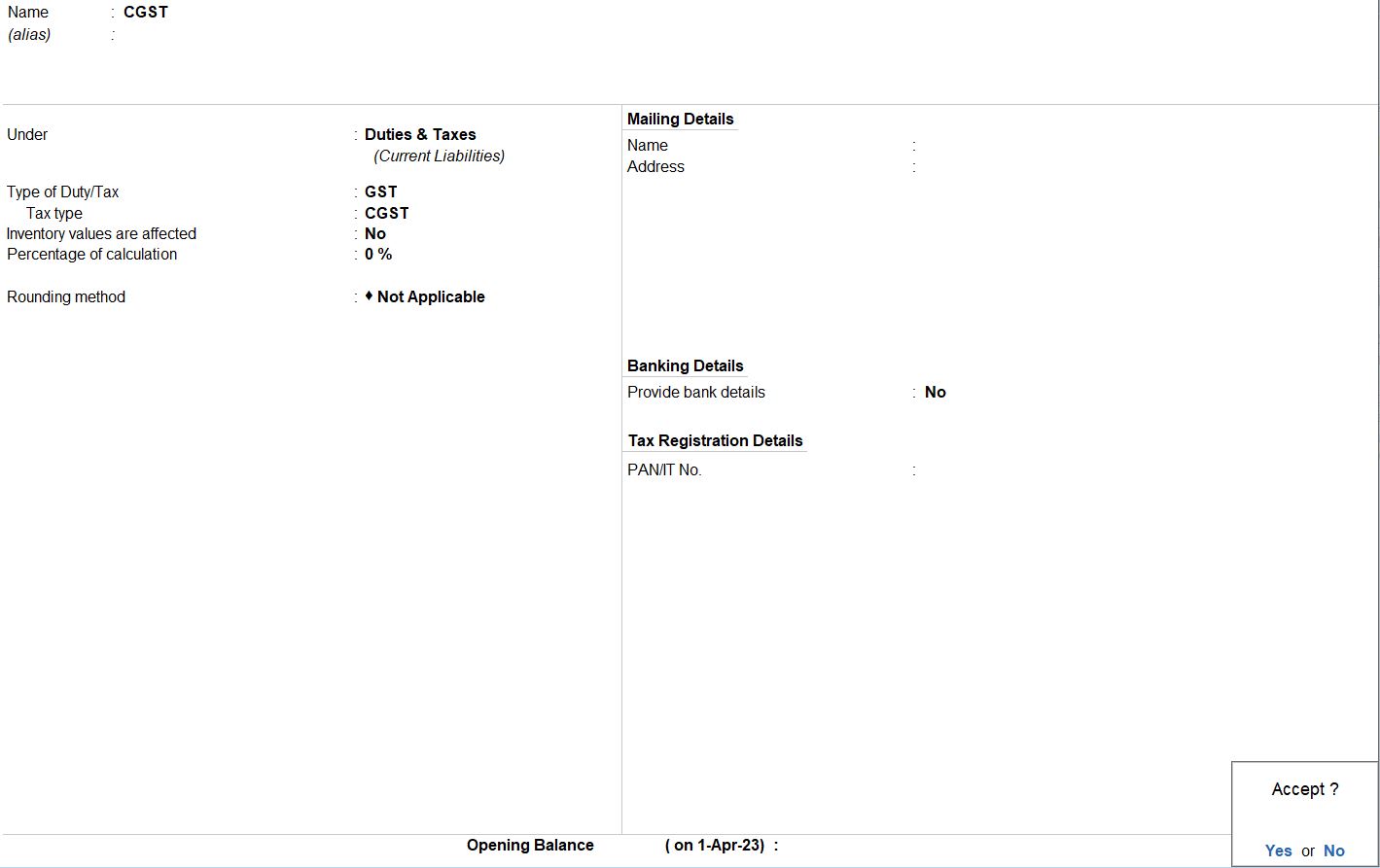

| Central Tax | |

|---|---|

| Name | Central Tax |

| Under | Duties & Tax |

| Type of duty/tax | GST |

| Tax type | Central Tax |

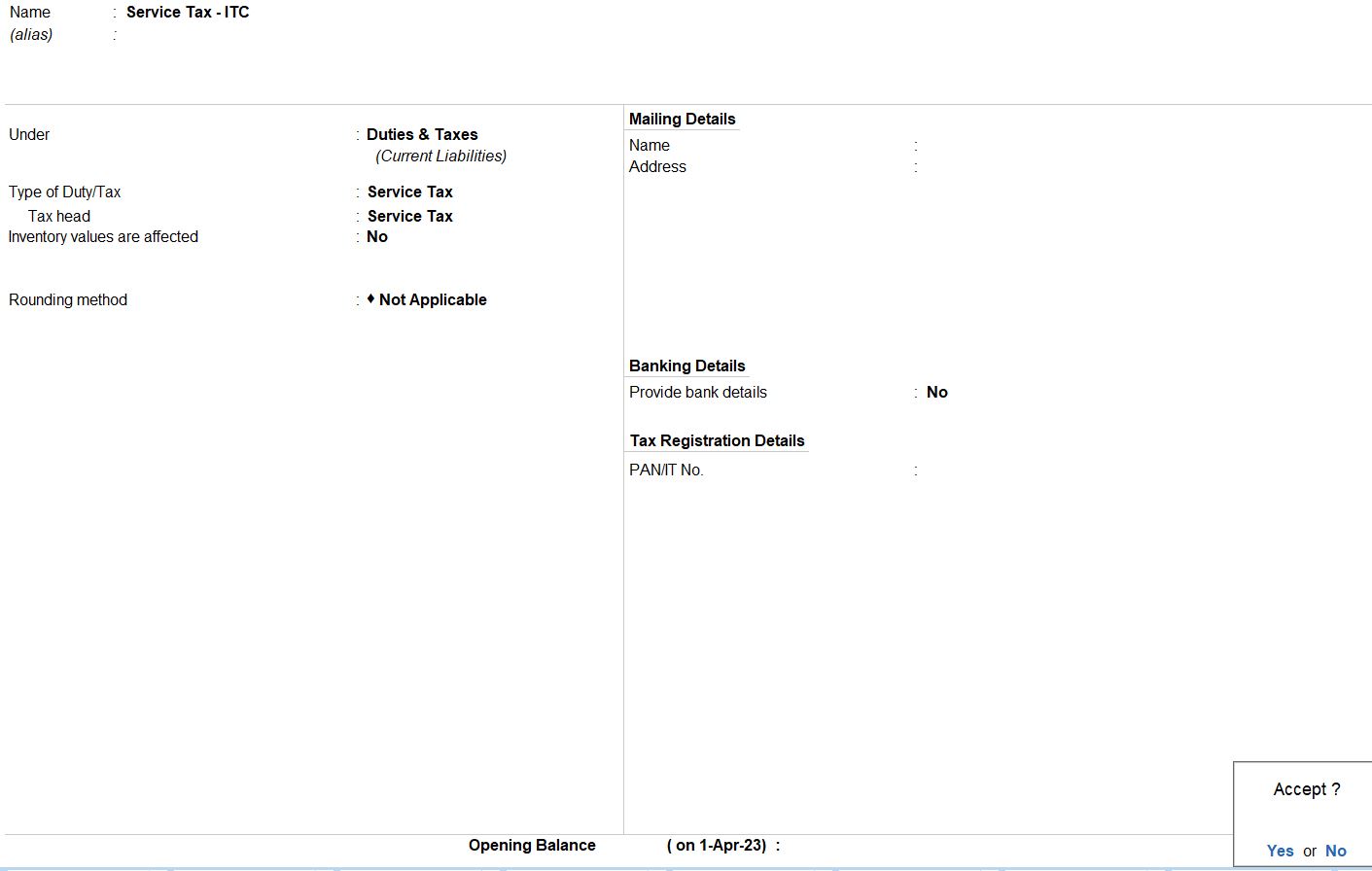

| Service Tax | |

|---|---|

| Name | Service Tax @14% |

| Under | Duties & Tax |

| Type of duty/tax | Service Tax |

| Tax Head | Service Tax |

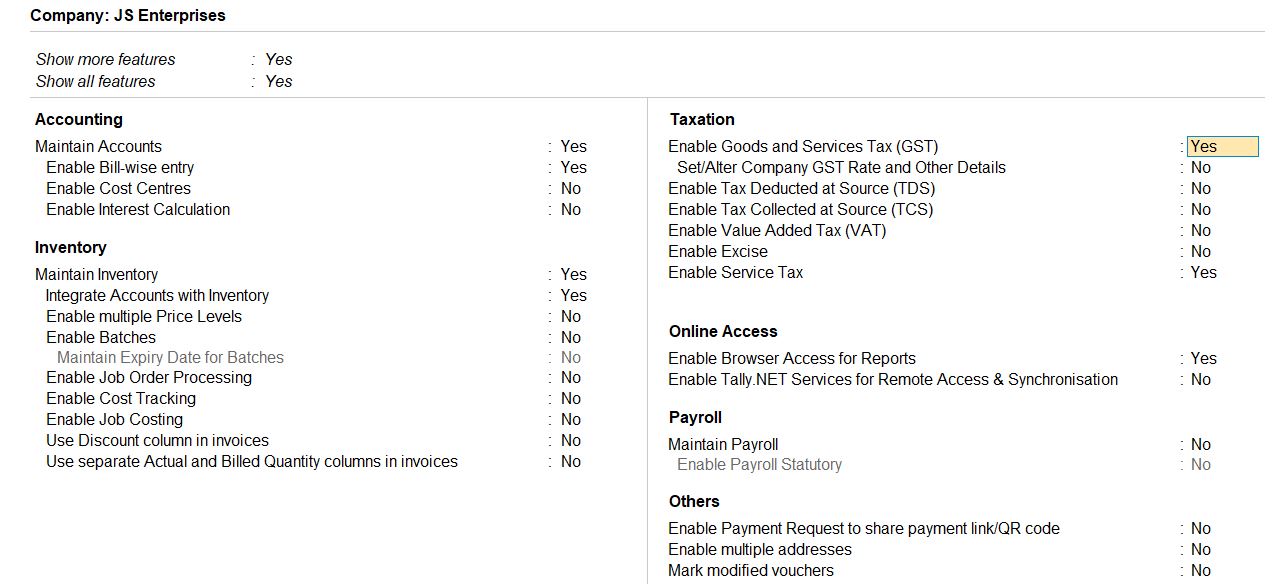

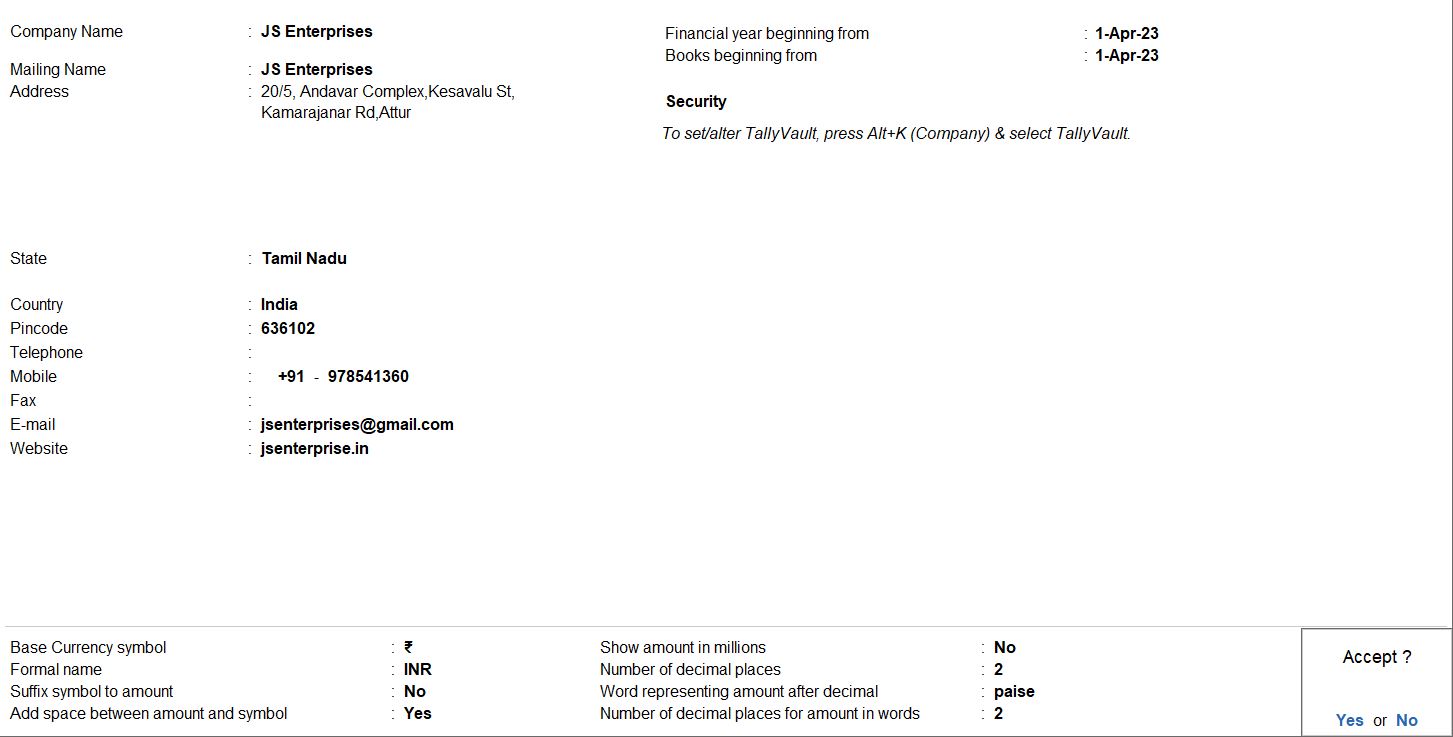

Company Creation:

- Go to Gateway of Tally.

- Select "Company" under "Master" or press Alt + K.

- Choose "Create Company" and fill in the following details:

- Company Name: JS Enterprises

- Address: 20/5, Andavar Complex, Kesavalu St, Kamarajanar Rd, Attur-636102

- Mobile No: 9785621230

- Email: jsenterprises@gmail.com

- Website: Jsenterprises.in

- Enable Goods and Services Tax (GST):

- Under "Statutory & Taxation Features," set "Enable Goods and Service Tax (GST)" to "Yes."

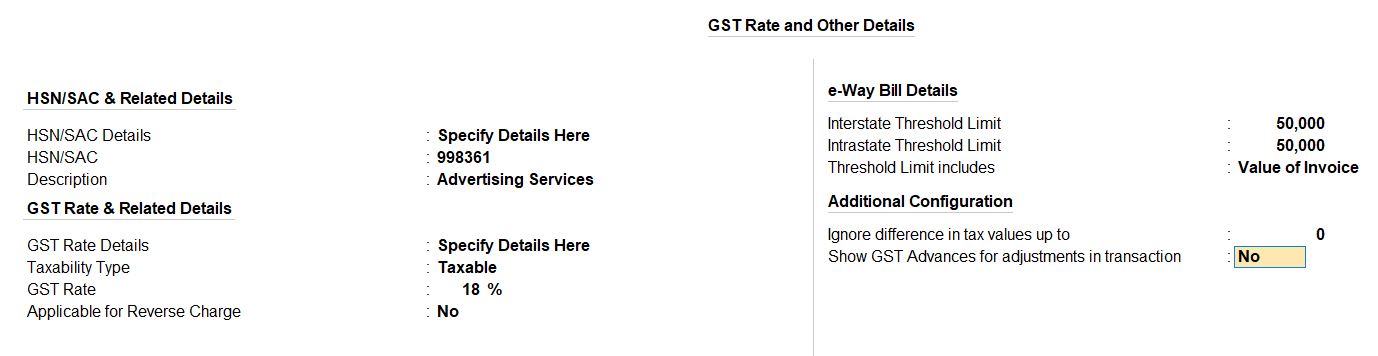

- Set/alter Company GST Rate and other Details:

- Against the field "Description," enter "Advertising services."

- HSN/SAC: 998361

- Taxability: Taxable

- Integrated Tax: 18%

- Save the company details.

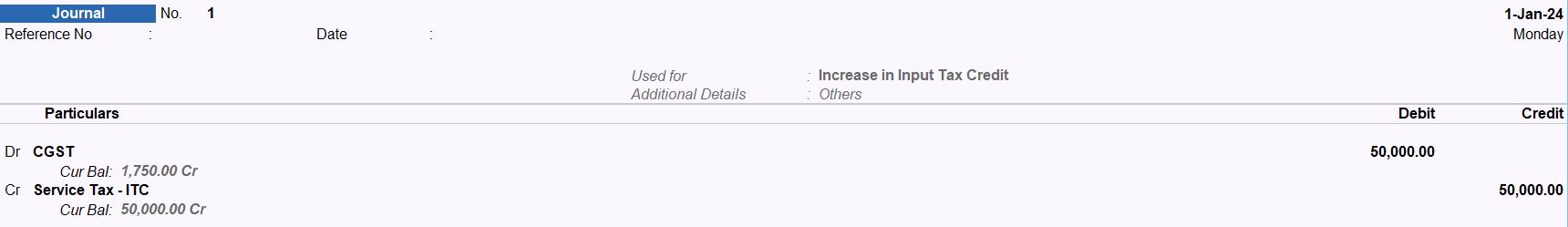

Input tax credit to GST

01-07-23 JS Enterprises had a closing CENVAT (Service Tax Input Credit) balance of Rs. 50,000.

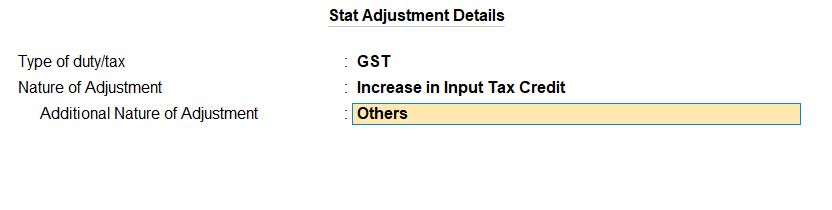

Input tax credit to GST:

- Select Journal voucher or press F7.

- Press Alt + J for the Stat Adjustment option.

- Type of Duty/Tax: GST (Goods and Services Tax)

- Nature of Adjustment: Increase in Input Tax Credit

- Additional Nature of Adjustment: Others

Entries:

- Debit (DR): CGST (Central Goods and Services Tax) - ₹50,000

- Credit (CR): Service Tax - ITC (Input Tax Credit) - ₹50,000

Explanation:

- The debit entry represents an increase in the Input Tax Credit for CGST, indicating that the company is claiming additional CGST as Input Tax Credit.

- The credit entry reflects the corresponding adjustment in the Service Tax - ITC ledger, ensuring that the accounting equation remains balanced.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions