Efficient Input Tax Credit Adjustment in Tally Prime

Transferring Input tax credit to GST

Transfer of closing balance of input tax credit to GST

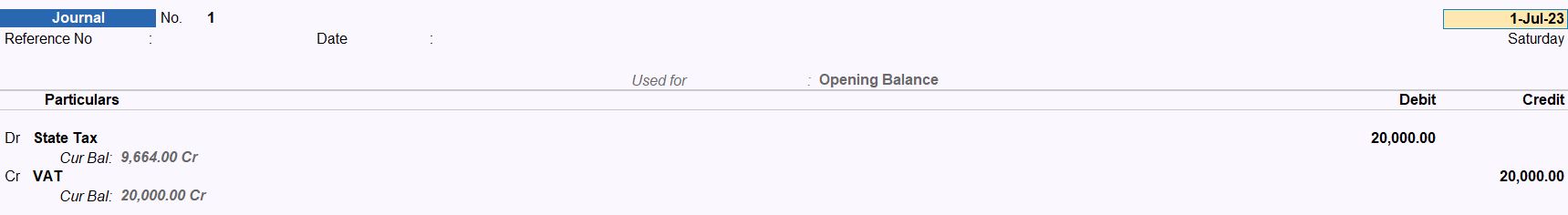

01-07-2017 We transferred the input VAT credit of Rs. 20,000 to state tax ledger.

01-07-2017 We transferred the CENVAT credit of Rs. 5,000 to central tax ledger.

Input Tax Credit Set Off

15-07-23 Adjust the following input credit against available tax liability:

| Input Tax Credit | Liability Amount |

|---|---|

| Central Tax – Rs. 1,41,300 | Central Tax – Rs. 1,62,090 |

| State Tax – Rs. 1,41,300 | State Tax – Rs. 1,62,090 |

| Integrated Tax – Rs. 73,800 | Integrated Tax – Rs. 39,600 |

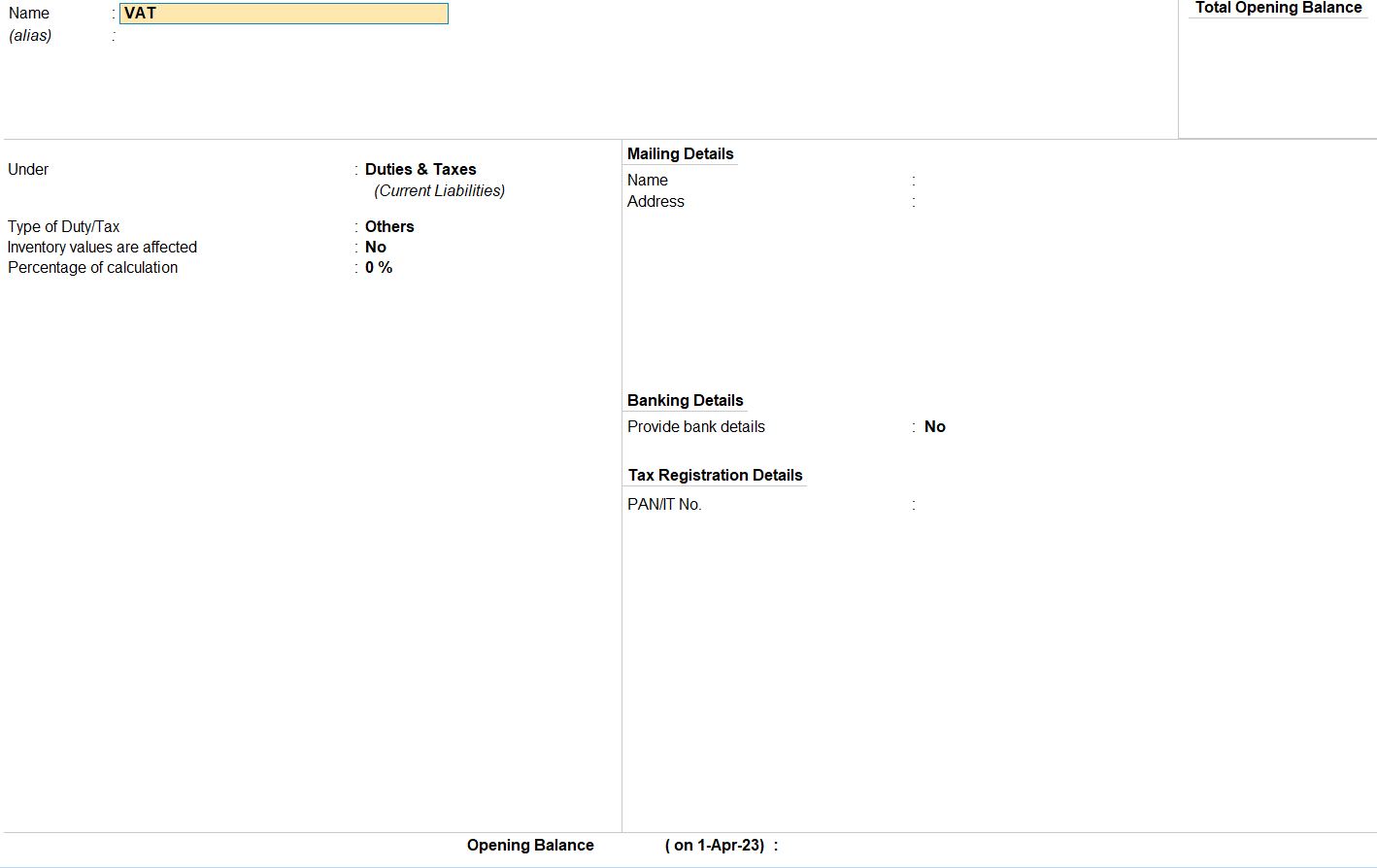

Ledger Creation

- Access Ledger Creation:

- Go to Gateway of Tally.

- Select "Accounts Masters" from the main menu.

- Choose "Ledgers" to access the ledger creation screen.

- Create Input VAT Ledger:

- Select "Create" under the single ledger option.

- Enter the name as "Input VAT".

- Under "Under", choose "Duties & Taxes" from the list of groups.

- Press Enter to save.

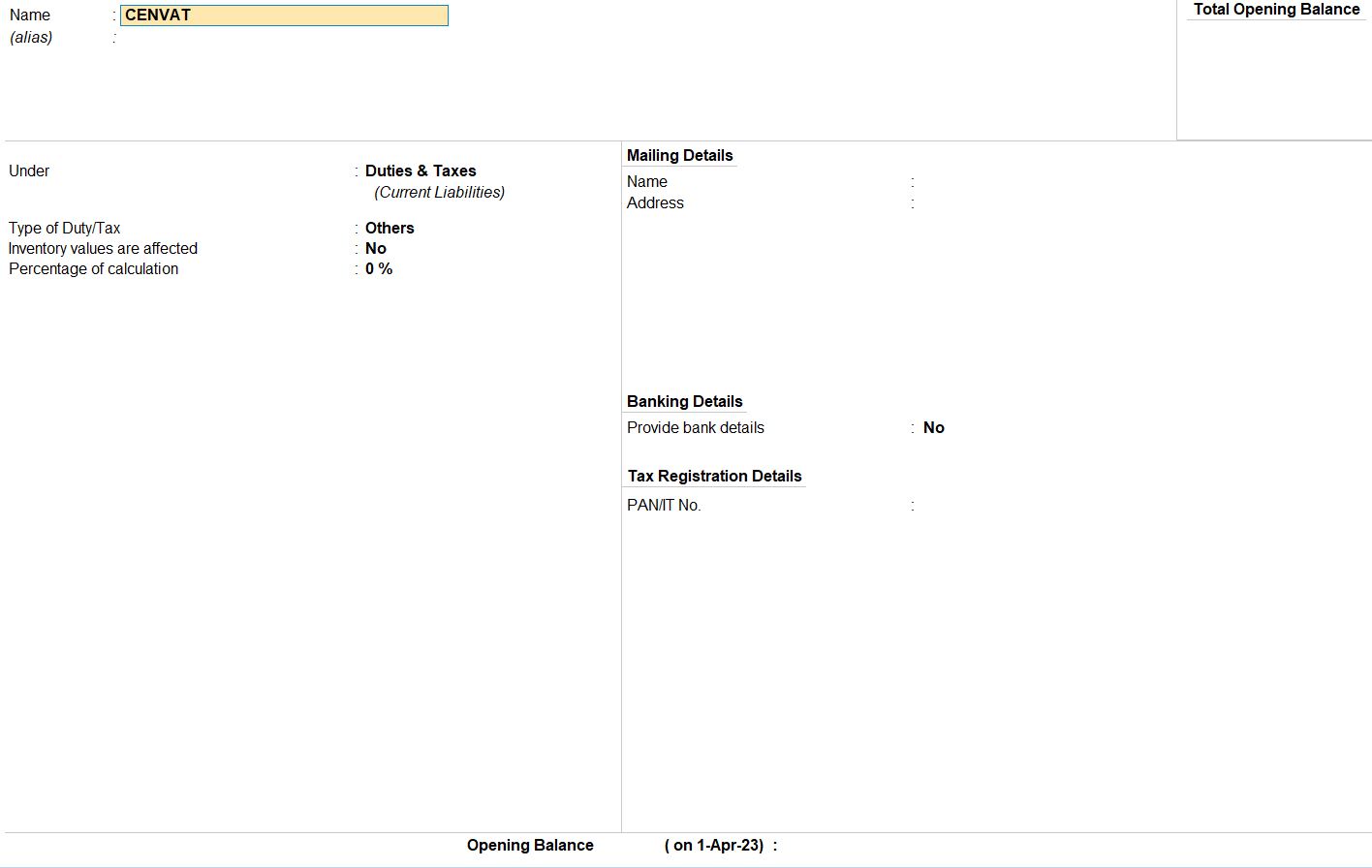

- Create Cenvat Ledger:

- Select "Create" under the single ledger option.

- Enter the name as "Cenvat".

- Under "Under", choose "Duties & Taxes" from the list of groups.

- Press Enter to save.

01-07-2017 We transferred the input VAT credit of Rs. 20,000 to the state tax ledger.

- Access Journal Voucher:

- Go to the Gateway of Tally.

- Select "Accounting Vouchers" from the main menu.

- Select Journal Voucher:

- Choose "F7: Journal" from the voucher types.

- Enter Date:

- Input the voucher date as "01-07-2017".

- Enter Narration:

- Add a narration explaining the transaction, for example, "Transfer input VAT credit to state tax ledger."

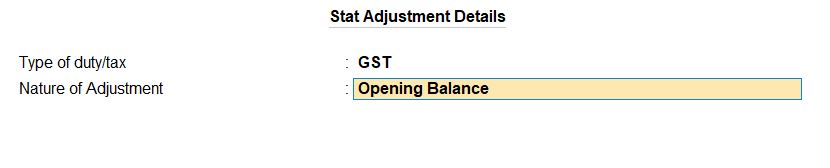

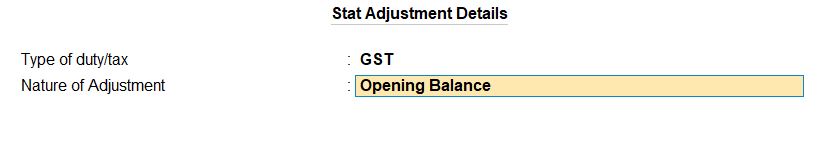

- Stat Adjustment:

- Press Alt + J to open the Stat Adjustment screen.

- Enter GST Details:

- In the Stat Adjustment screen, set the "Type of duty/tax" as GST.

- Choose "Nature of Adjustment" as Opening Balance.

- Debit SGST Ledger:

- Select the SGST ledger account and enter the amount of Rs. 20,000 in the Debit column.

- Credit Input VAT Ledger:

- Select the Input VAT ledger account and enter the amount of Rs. 20,000 in the Credit column.

- Save the Voucher:

- Press Ctrl+A to save the voucher.

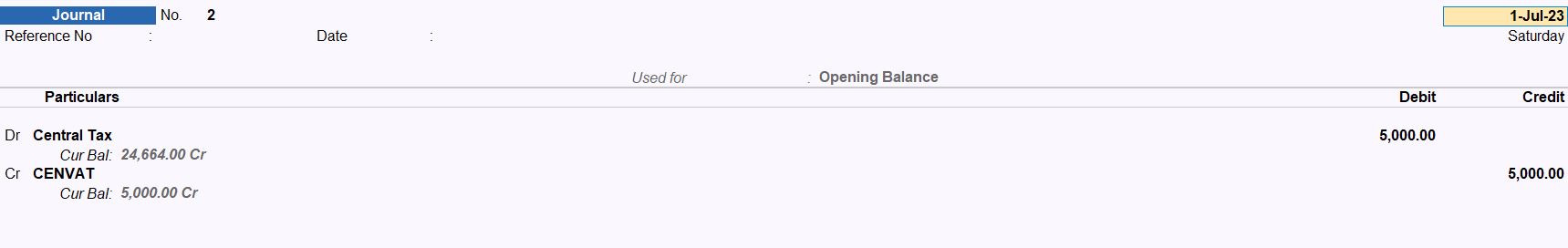

01-07-2017 We transferred the CENVAT credit of Rs. 5,000 to the central tax ledger.

Journal Voucher Entry in Tally

- Access Journal Voucher:

- Go to the Gateway of Tally.

- Select "Accounting Vouchers" from the main menu.

- Select Journal Voucher:

- Choose "F7: Journal" from the voucher types.

- Enter Date:

- Input the voucher date as "01-07-2017".

- Enter Narration:

- Add a narration explaining the transaction, for example, "Transfer CENVAT credit to central tax ledger."

- Stat Adjustment:

- Press Alt + J to open the Stat Adjustment screen.

- Enter GST Details:

- In the Stat Adjustment screen, set the "Type of duty/tax" as GST.

- Choose "Nature of Adjustment" as Opening Balance.

- Debit CGST Ledger:

- Select the CGST ledger account and enter the amount of Rs. 5,000 in the Debit column.

- Credit CENVAT Ledger:

- Select the CENVAT ledger account and enter the amount of Rs. 5,000 in the Credit column.

- Save the Voucher:

- Verify the details entered.

- Press Ctrl + A to save the voucher.

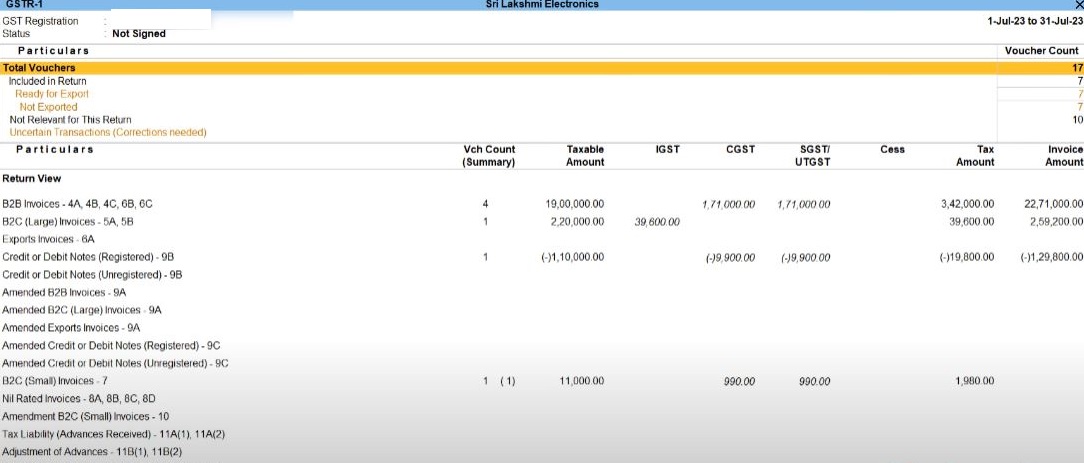

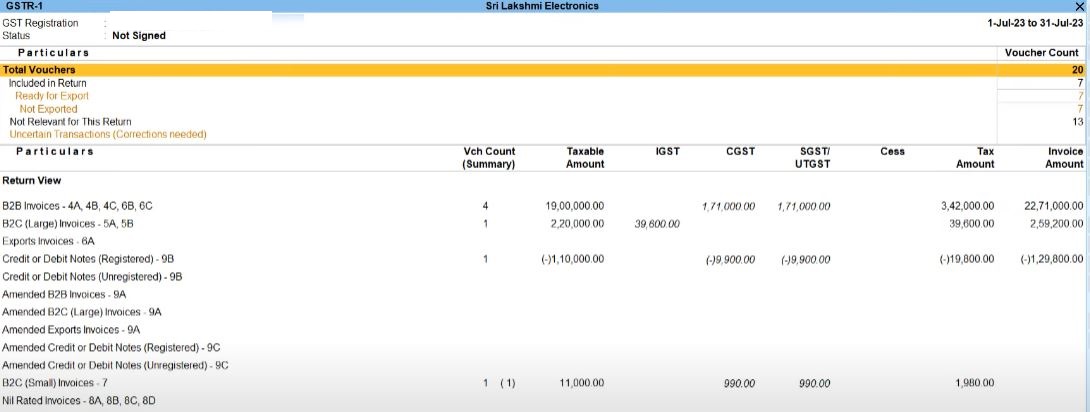

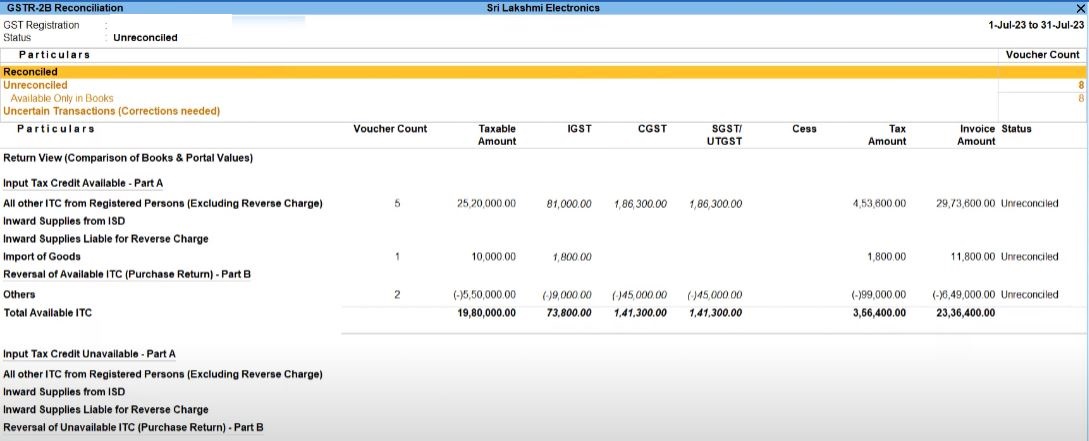

View Reports

- Gateway of Taly -> Display More Reports -> GST Reports

Journal Voucher Entry in Tally

- Access Journal Voucher:

- Go to the Gateway of Tally.

- Select "Accounting Vouchers" from the main menu.

- Select Journal Voucher:

- Choose "F7: Journal" from the voucher types.

- Enter Date:

- Input the voucher date.

- Enter Narration:

- Add a narration explaining the transaction, for example, "Decrease in tax liability with CGST adjustment."

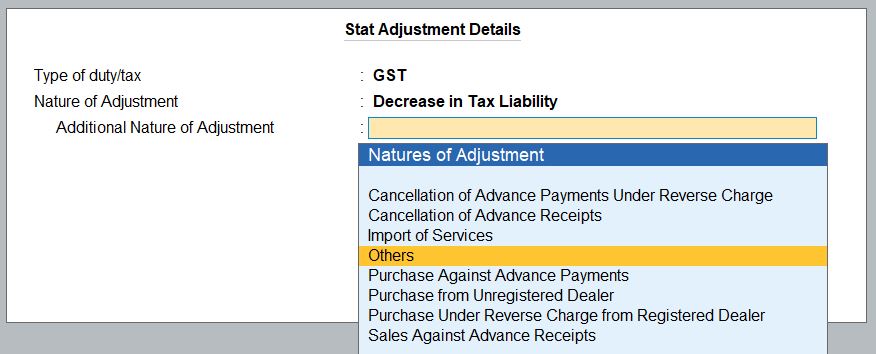

- Stat Adjustment:

- Press Alt + J to open the Stat Adjustment screen.

- Enter GST Details:

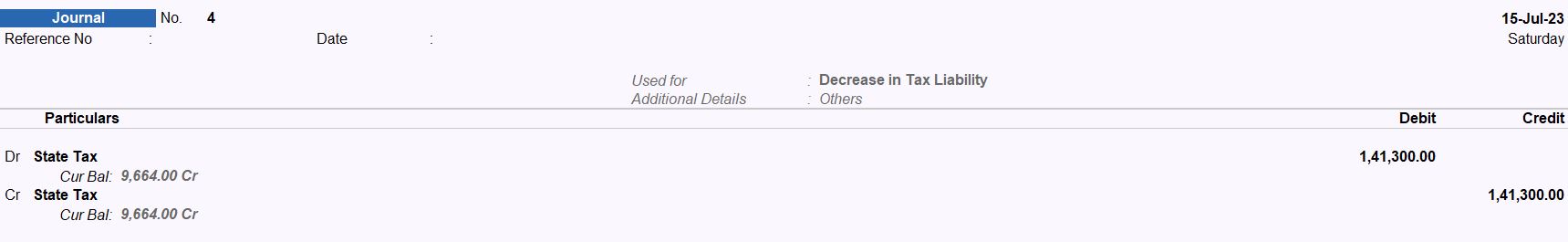

- Set the "Type of duty/tax" as GST.

- Choose "Nature of Adjustment" as Decrease In Tax Liability.

- Additionally, choose "Others" as the "Additional Nature of Adjustment."

- Debit CGST Ledger:

- Select the CGST ledger account and enter the amount of Rs. 141,300 in the Debit column.

- Credit CGST Ledger:

- Select the CGST ledger account again and enter the same amount of Rs. 141,300 in the Credit column.

- Save the Voucher:

- Verify the details entered.

- Press Ctrl + A to save the voucher.

Journal Voucher Entry in Tally

- Access Journal Voucher:

- Go to the Gateway of Tally.

- Select "Accounting Vouchers" from the main menu.

- Select Journal Voucher:

- Choose "F7: Journal" from the voucher types.

- Enter Date:

- Input the voucher date.

- Enter Narration:

- Add a narration explaining the transaction, for example, "Decrease in tax liability with CGST adjustment."

- Stat Adjustment:

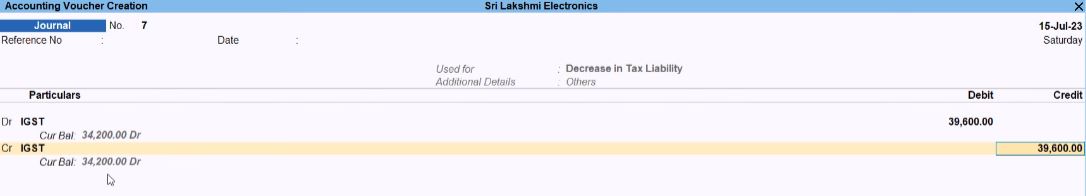

- Press Alt + J to open the Stat Adjustment screen.

- Enter GST Details:

- Set the "Type of duty/tax" as GST.

- Choose "Nature of Adjustment" as Decrease In Tax Liability.

- Additionally, choose "Others" as the "Additional Nature of Adjustment."

- Debit CGST Ledger:

- Select the CGST ledger account and enter the amount of Rs. 39,600 in the Debit column.

- Credit CGST Ledger:

- Select the CGST ledger account again and enter the same amount of Rs. 39,600 in the Credit column.

- Save the Voucher:

- Verify the details entered.

- Press Ctrl + A to save the voucher.

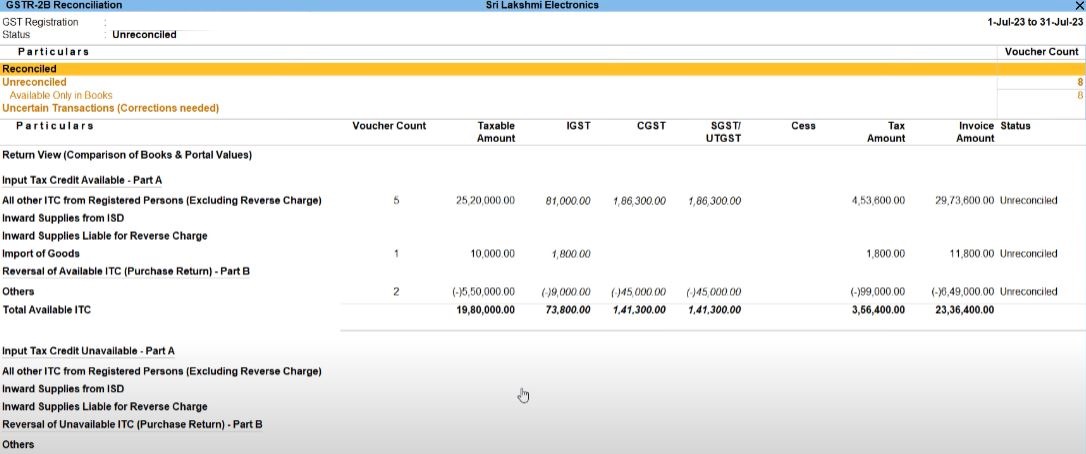

View Reports

- Gateway of Taly -> Display More Reports -> GST Reports

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions