Optimizing Project Finances: A Deep Dive into Job Costing in Tally Prime

What is job Costing?

- Job costing is an accounting method designed to help you track the cost of individual projects and jobs.

- If you have undertaken a client-specific project or job and you want to monitor the expenses and income related to it, then you can use Job Costing.

- Job costing is a systematic method of order-costing, which is applicable when you undertake projects or jobs as per a client’s specifications and requirements.

Features of job costing

- Using job costing, the cost of each job is ascertained separately. This, in turn, helps in finding out the profit or loss on each job.

- It enables management to detect those jobs which are more profitable and unprofitable ones.

- Job costing provides the base for determining the cost of similar jobs to be undertaken in future as a part of future planning.

- Helps in managing and controlling costs, by comparing the actual costs with the estimated cost. In short, the calculation of variances.

Who can use Job Costing?

- Textiles Industries

- Building Construction

- Tour Package

- School Dress Material related works

Job Costing Procedure

| DN Creators | |

|---|---|

| Stitching & Construction Project | |

| ADDRESS | Old No:2, New No:6, New Damu Nagar, Gandhipuram, Coimbatore-641012 |

| MOBILE NO | 93847 74998 |

| dncreators@gmail.com | |

| WEBSITE | Dncreators12covai.in |

Stitching Project

11-08-2023 We Receive a uniform stitching order from MKV Higher Secondary School net worth Rs.2,00,000.

12-08-2023 We receive an amount of Rs.1,20,000 from MKV Higher Secondary School through bank cheque no 254878.

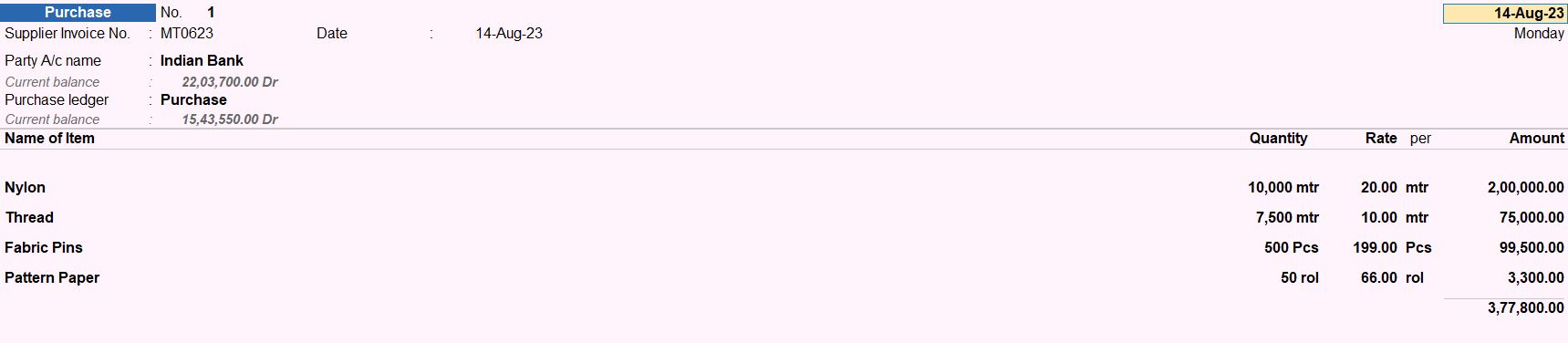

14-08-2023 Cash Purchased the following goods with Reference no: MT0623 with Tax. And transfer all goods from our main godown.

| Item | HSN Code | GST | Unit | Qty | Rate |

|---|---|---|---|---|---|

| Nylon | 55031000 | 18% | meter | 10000 | Rs. 20 |

| Thread | 55081000 | 12% | meter | 7500 | Rs. 10 |

| Fabric Pins | 731829 | 18% | Pcs | 500 | Rs. 199 |

| Pattern Paper | 48115990 | 12% | Roll | 50 | Rs. 66 |

16-08-2023 we transfer some goods from working fields.

| Item | Unit | Qty |

|---|---|---|

| Nylon | meter | 750 |

| Thread | meter | 3000 |

| Fabric Pins | Pcs | 150 |

| Pattern Paper | Roll | 12 |

17-08-2023 Record the usage of materials for Stitching work.

| Item | Unit | Qty |

|---|---|---|

| Nylon | meter | 598 |

| Thread | meter | 1500 |

| Fabric Pins | Pcs | 40 |

| Pattern Paper | Roll | 5 |

22-08-2023 After using goods in Stitching work, we transfer the remaining materials from the main location.

| Item | Unit | Qty |

|---|---|---|

| Nylon | meter | 152 |

| Thread | meter | 1500 |

| Fabric Pins | Pcs | 110 |

| Pattern Paper | Roll | 7 |

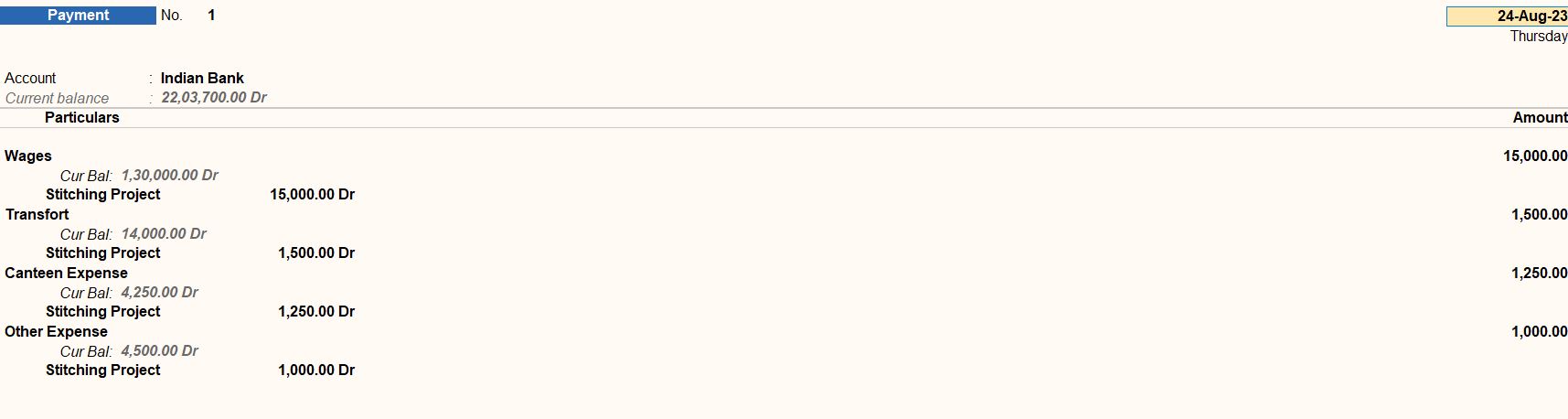

24-08-2023 recording and managing expenses is a crucial aspect of the construction project.

| Expenses | Amount (₹) |

|---|---|

| Wages | 15,000 |

| Transport | 1,500 |

| Canteen Expense | 1,250 |

| Other Expenses | 1,000 |

25-08-2023 we received the balance amount from MKV Higher Secondary School.

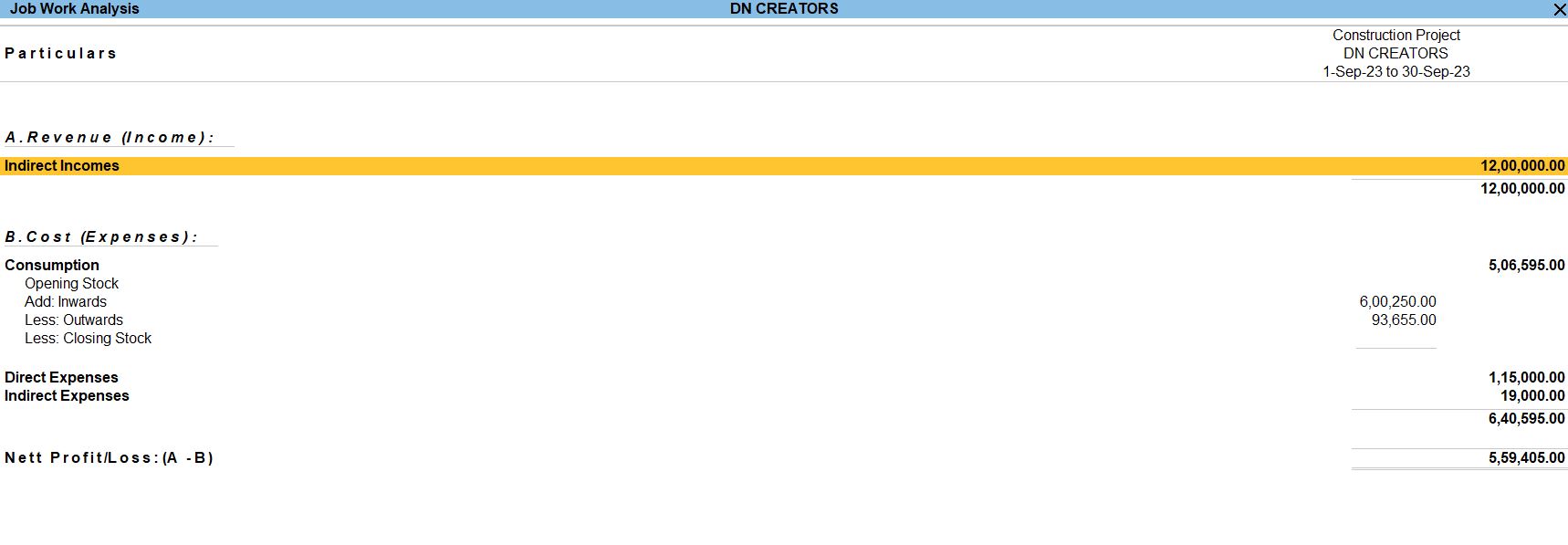

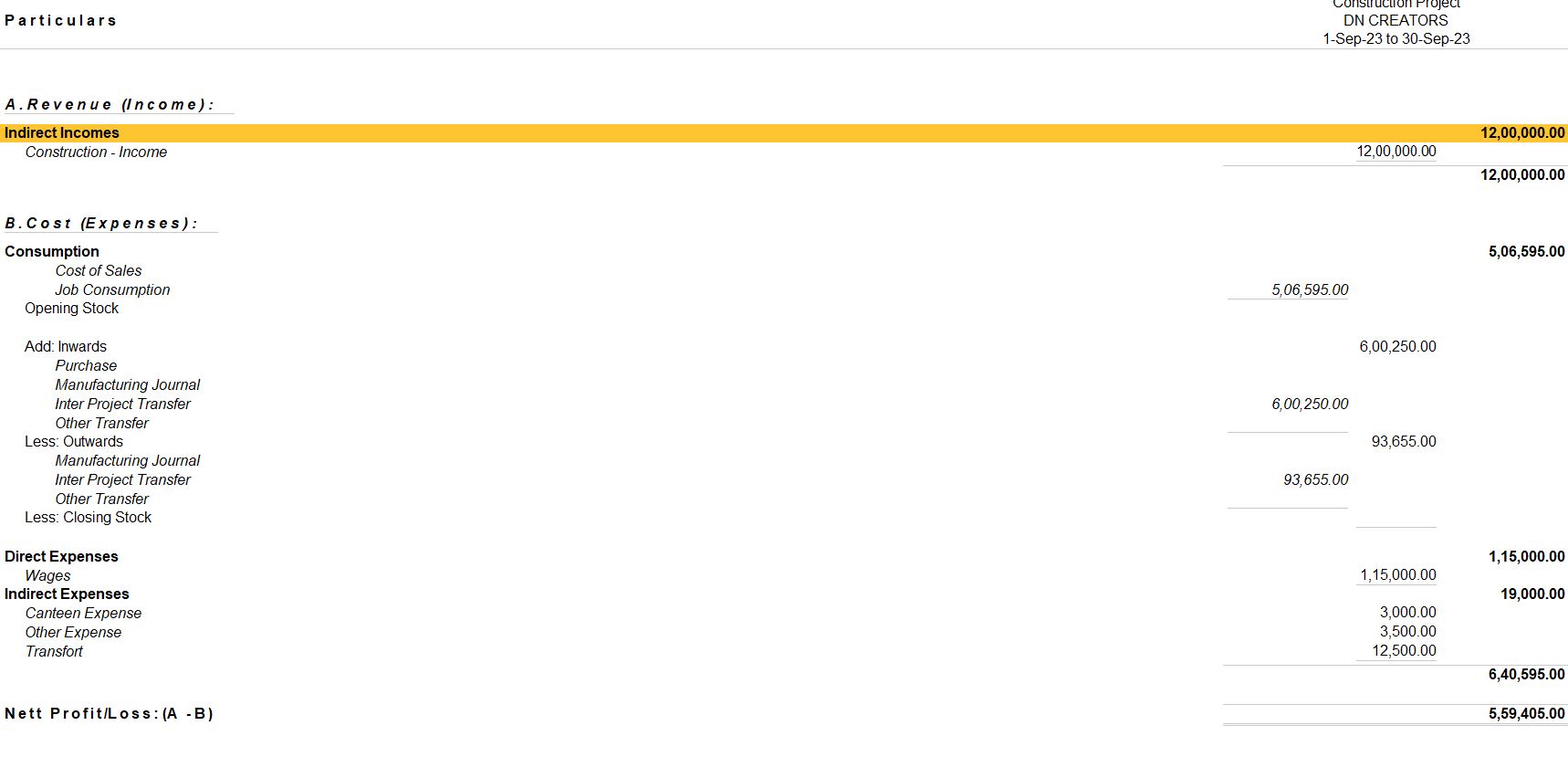

Construction Project

10-09-2023 We Receive a Building Construction order from Morden Builders net worth Rs.12,00,000.

15-09-2023 We receive an amount of Rs.8,50,000 from Morden Builders through bank cheque no 14785.

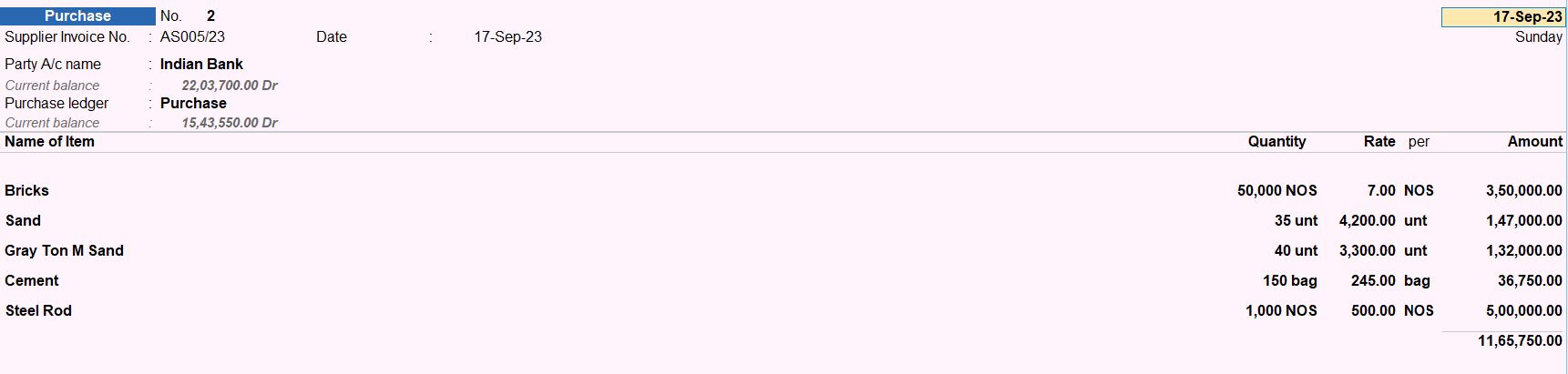

17-09-2023 Cash Purchased the following goods with Reference no: AS005/23 with GST. And transfer all goods from our main godown.

| Item | HSN Code | GST | Unit | Qty | Rate |

|---|---|---|---|---|---|

| Bricks | 690100 | 18% | Nos | 50,000 | Rs. 7 |

| Sand | 2505 | 5% | Unit | 35 | Rs. 4200 |

| Gray Ton M Sand | 680221 | 18% | Unit | 40 | Rs. 3300 |

| Cement | 68109100 | 12% | Bag | 150 | Rs. 245 |

| Steel Rod | 7214 | 18% | Nos | 1000 | Rs. 500 |

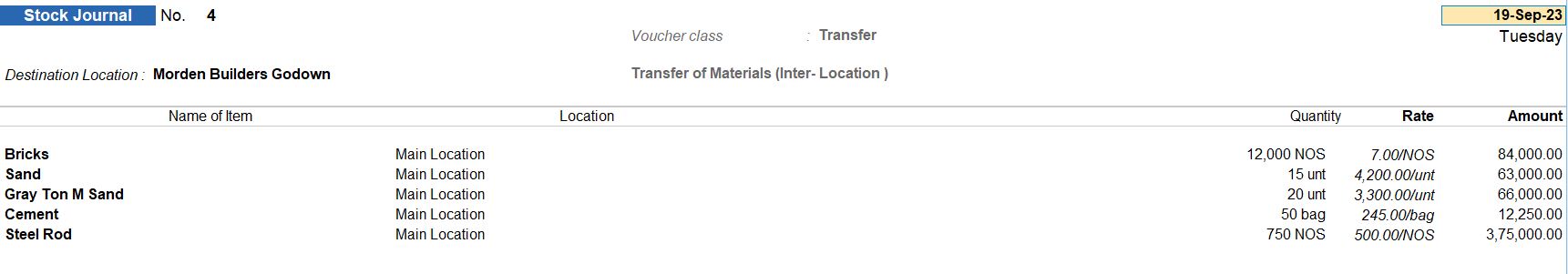

19-09-2023 we transfer some goods from project fields.

| Item | Unit | Qty |

|---|---|---|

| Bricks | Nos | 12,000 |

| Sand | Unit | 15 |

| Gray Ton M Sand | Unit | 20 |

| Cement | Bag | 50 |

| Steel Rod | Nos | 750 |

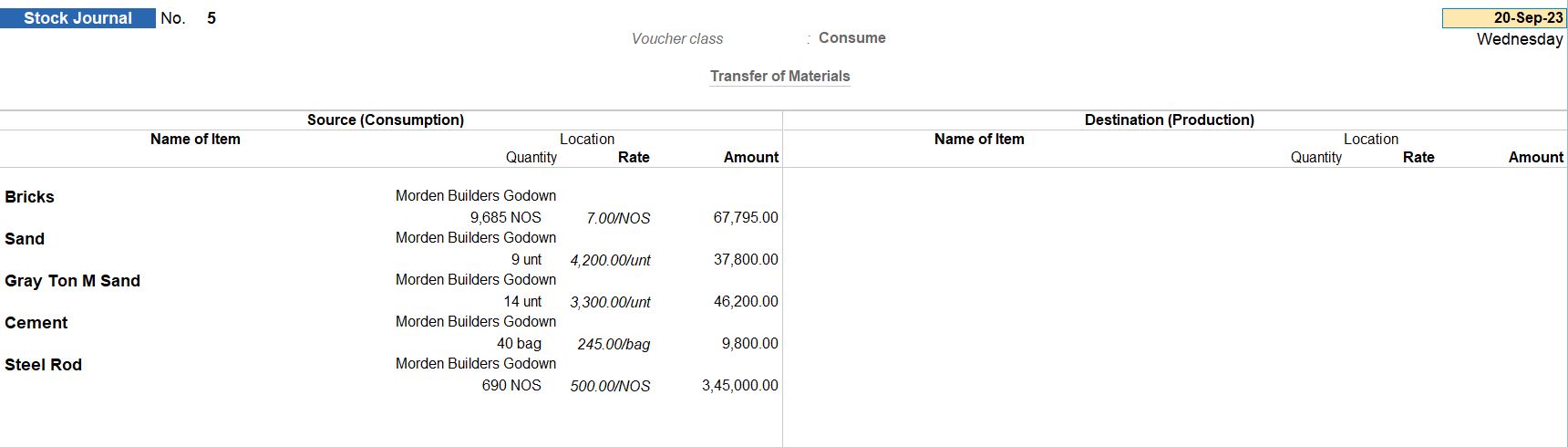

20-09-2023 Record the usage of materials for construction work.

| Item | Unit | Qty |

|---|---|---|

| Bricks | Nos | 9685 |

| Sand | Unit | 9 |

| Gray Ton M Sand | Unit | 14 |

| Cement | Bag | 40 |

| Steel Road | Nos | 690 |

23-09-2023 After using goods in construction work, we transfer the remaining materials from the main location.

| Item | Unit |

|---|---|

| Bricks | Nos |

| Sand | Unit |

| Gray Ton M Sand | Unit |

| Cement | Bag |

| Steel Road | Nos |

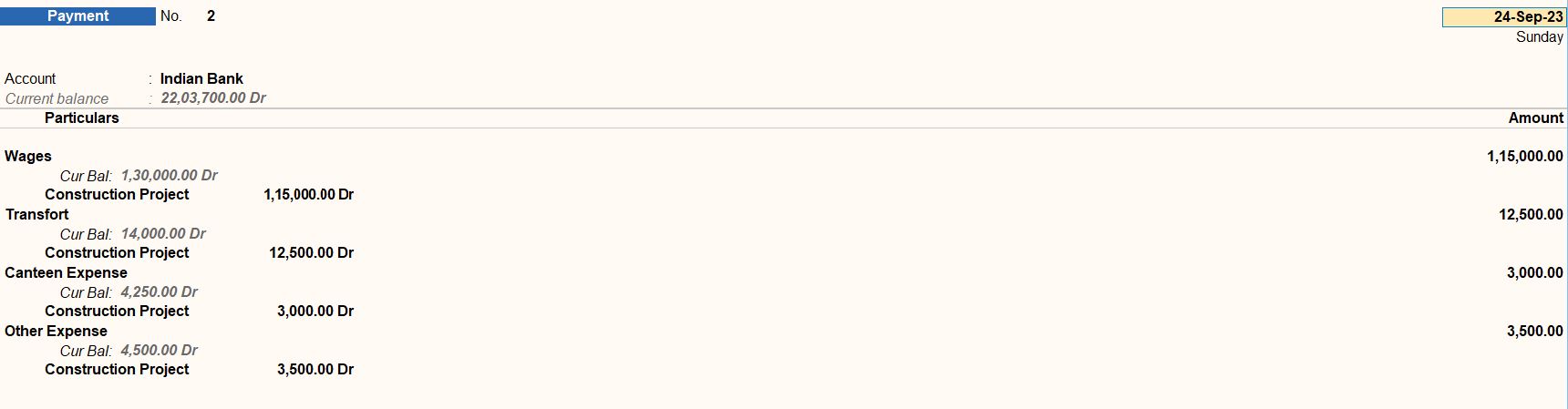

24-09-2023 recording and managing expenses is a crucial aspect of the construction project.

| Expenses | Amount (₹) |

|---|---|

| Wages | 1,15,000 |

| Transport | 12,500 |

| Canteen Expense | 3,000 |

| Other Expenses | 3,500 |

26-09-2023 we received the balance amount from Morden Builders.

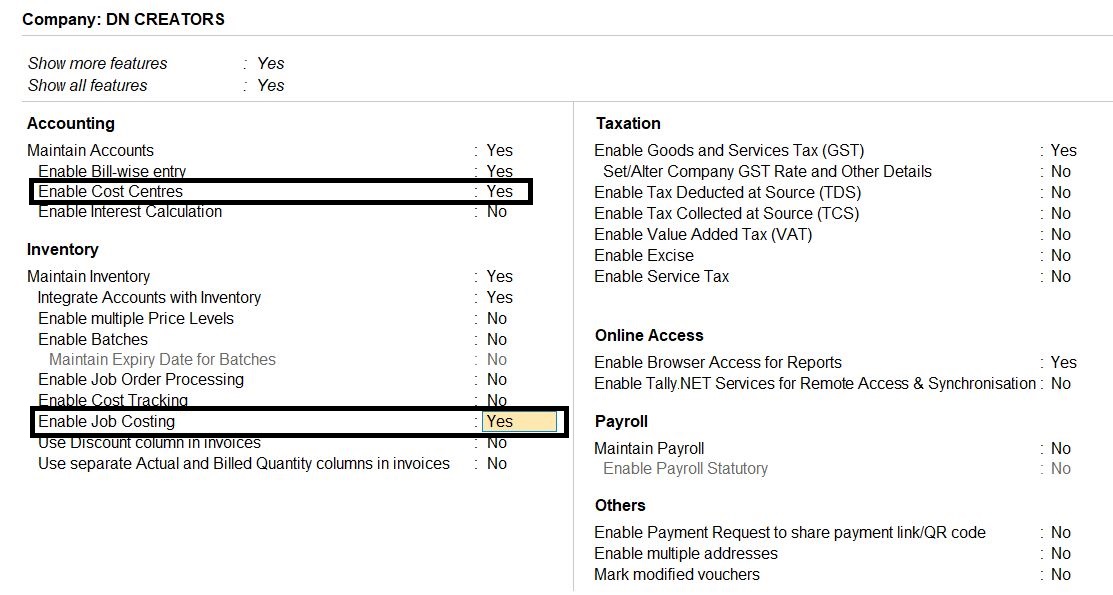

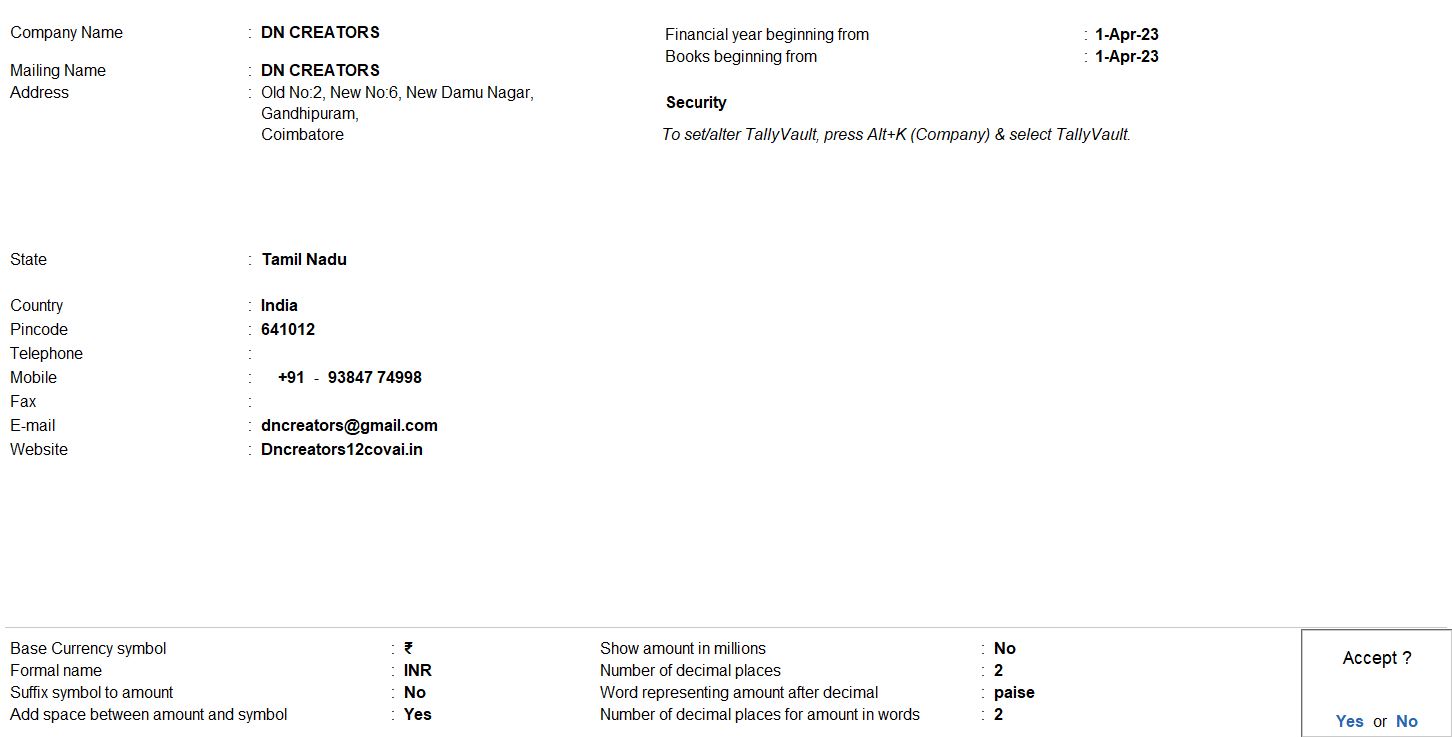

Company Creation

- Access Company Setup: From the Gateway of Tally screen, navigate to the "Company" menu.

- Create Company: Click on "Create Company" to start setting up the company profile.

- Enter Company Details:

- Company Name: Enter "DN Creators Stitching & Construction Project".

- Mailing Name: You can leave this field blank or enter the same name as the company name.

- Address: Input the address details:

- Old No:2, New No:6, New Damu Nagar, Gandhipuram, Coimbatore-641012

- Mobile Number: Enter "93847 74998" as the mobile number.

- Email: Input "dncreators@gmail.com" as the email address.

- Website: Enter "Dncreators12covai.in" as the website URL.

- Enable Cost Centres: Set this option to "Yes" to enable Cost Centres for the company.

- Enable Job Costing: Set this option to "Yes" to enable Job Costing for the company.

- Enable GST: Set this option to "Yes" to enable goods and service for the company.

- Configure Additional Settings: You may configure additional settings such as fiscal year details, taxation options, and other preferences as per your requirements.

- Save and Exit: Once you have entered all the necessary details and configured the settings, save the company profile.

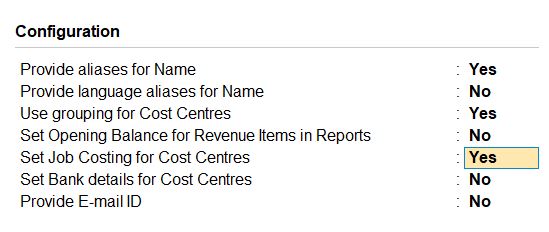

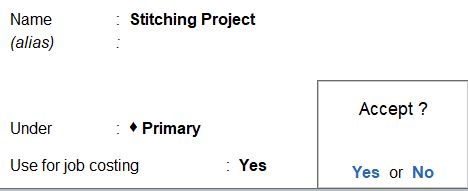

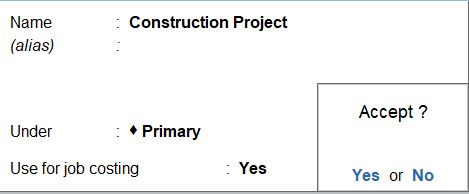

Cost Centre

- Access Cost Centre Setup: From the Gateway of Tally screen, navigate to the "Accounts" menu.

- Create Cost Centre: Under the "Accounts Info" menu, select "Cost Centres" to access the cost centre setup.

- Enter Cost Centre Details:

- Name: Enter "Stitching Project" as the name of the cost centre.

- Under: Choose "Primary" from the list of groups. This indicates that the cost centre will be a direct sub-group of the primary group.

- Use for Job Costing: Set this option to "Yes" to enable job costing for the cost centre. This allows you to track expenses related to specific projects or jobs.

- Save and Repeat: After entering the details for the "Stitching Project" cost centre, save the settings. Then, repeat the process to create the "Construction Project" cost centre with similar details.

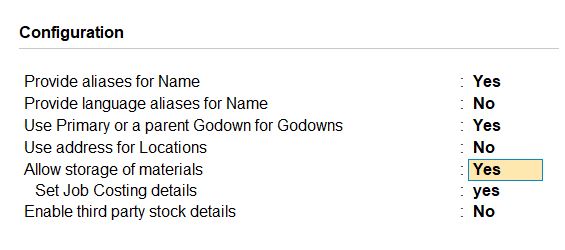

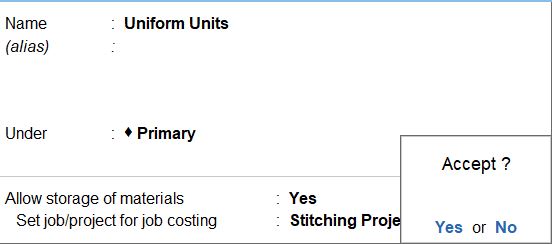

Godown

- Access Godown Location Setup: From the Gateway of Tally screen, navigate to the "Inventory" menu.

- Create Godown Location: Under the "Inventory Masters" menu, select "Godowns" to access the godown location setup.

- Enter Godown Location Details:

- Name: Enter "Uniform Units" as the name of the godown location.

- Under: Choose "Primary" from the list of groups. This indicates that the godown location will be a direct sub-group of the primary group.

- Allow Storage of Materials: Set this option to "Yes" to allow the storage of inventory items in this godown location.

- Set Job Costing Details: Set this option to "Yes" to enable job costing details for this godown location.

- Set Job/Project for Job Costing: Choose "Stitching Project" from the list of available projects. This associates the godown location with the specified project for job costing purposes.

- Save and Confirm: After entering the details for the "Uniform Units" godown location, save the settings.

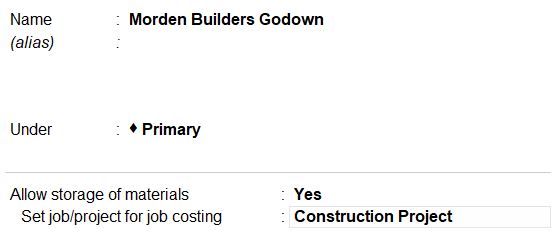

Morden Builders Godown

- Navigate to Location Creation:

- Open Tally Prime software.

- Go to Gateway of Tally.

- Choose "Inventory Info" or "Inventory" from the menu.

- Select "Godowns":

- Under Inventory Info, select "Godowns" to access godown creation.

- Create New Godown:

- Select "Create" to add a new godown.

- Enter Godown Details:

- Name: Enter "Morden Builders Godown" as the name of the godown.

- Under: Choose "Primary" to categorize it.

- Allow storage of materials: Set this option to "Yes" to allow storing materials in this godown.

- Set job/project for job costing: Choose "Construction Project" to assign this godown to a specific construction project for job costing purposes.

- Save Changes:

- After entering all the necessary details, save the godown.

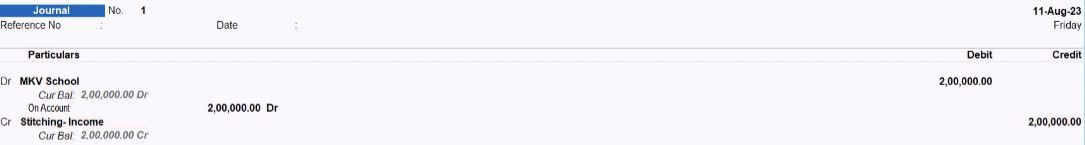

11-08-2023 We Receive a uniform stitching order from MKV Higher Secondary School net worth Rs.2,00,000.

- Access Journal Voucher Creation: From the Gateway of Tally screen, navigate to the "Accounting Vouchers" menu.

- Select Journal Voucher: Choose the option to create a new Journal Voucher.

- Enter Voucher Date: Set the voucher date as 11-08-2023.

- Enter Narration (Optional): You can provide a brief description/narration for the transaction if required.

- Enter Debit Entry:

- Account: Select "MKV School" as the account to be debited.

- Amount: Enter Rs. 2,00,000 in the debit column.

- Enter Credit Entry:

- Account: Choose "Stitching - Income" as the account to be credited.

- Amount: Enter Rs. 2,00,000 in the credit column.

- Save and Confirm: After entering all the details accurately, save the journal voucher.

12-08-2023 We receive an amount of Rs.1,20,000 from MKV Higher Secondary School through bank cheque no 254878.

- Access Receipt Voucher Creation: From the Gateway of Tally screen, navigate to the "Accounting Vouchers" menu.

- Select Receipt Voucher: Choose the option to create a new Receipt Voucher.

- Enter Voucher Date: Set the voucher date as 12-08-2023.

- Enter Narration (Optional): You can provide a brief description/narration for the transaction if required.

- Enter Credit Entry:

- Account: Select "MKV School" as the account to be credited.

- Amount: Enter Rs. 1,20,000 in the credit column.

- Enter Debit Entry:

- Account: Choose "Indian Bank" as the account to be debited.

- Amount: Enter Rs. 1,20,000 in the debit column.

- Enter Cheque Details (Optional): If required, you can enter the cheque number (254878) in the relevant field.

17-09-2023 Cash Purchased the following goods with Reference no: AS005/23 with GST. And transfer all goods from our main godown.

| Item | HSN Code | GST | Unit | Qty | Rate |

|---|---|---|---|---|---|

| Bricks | 690100 | 18% | Nos | 50,000 | Rs. 7 |

| Sand | 2505 | 5% | Unit | 35 | Rs. 4200 |

| Gray Ton M Sand | 680221 | 18% | Unit | 40 | Rs. 3300 |

| Cement | 68109100 | 12% | Bag | 150 | Rs. 245 |

| Steel Rod | 7214 | 18% | Nos | 1000 | Rs. 500 |

- Access Purchase Voucher Creation: From the Gateway of Tally screen, navigate to the "Accounting Vouchers" menu.

- Select Purchase Voucher: Choose the option to create a new Purchase Voucher.

- Enter Voucher Date: Set the voucher date as 17-09-2023.

- Enter Reference Number: In the "Reference" field, enter the reference number AS005/23.

- Enter Party Details:

- Account: Select "Indian Bank" as the party's account.

- Enter Purchase Ledger: Choose the "Purchase" ledger as the purchase ledger account.

- Enter Items:

- Item: Enter each item separately (Bricks, Sand, Gray Ton M Sand, Cement, Steel Rod).

- HSN Code: Enter the respective HSN codes for each item.

- GST: Specify the applicable GST rate for each item (18% for Bricks, Gray Ton M Sand, and Steel Rod; 5% for Sand; 12% for Cement).

- Unit: Enter the unit of measurement for each item (Nos for Bricks and Steel Rod, Unit for Sand and Gray Ton M Sand, Bag for Cement).

- Quantity: Input the quantity of each item purchased.

- Rate: Enter the rate per unit for each item.

- Transfer from Godown:

- Select the option to transfer the goods from the main godown.

- Specify the godown from which the goods are being transferred.

- Save and Confirm: After entering all the details accurately, save the purchase voucher.

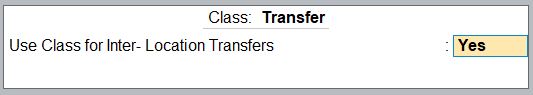

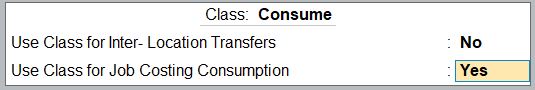

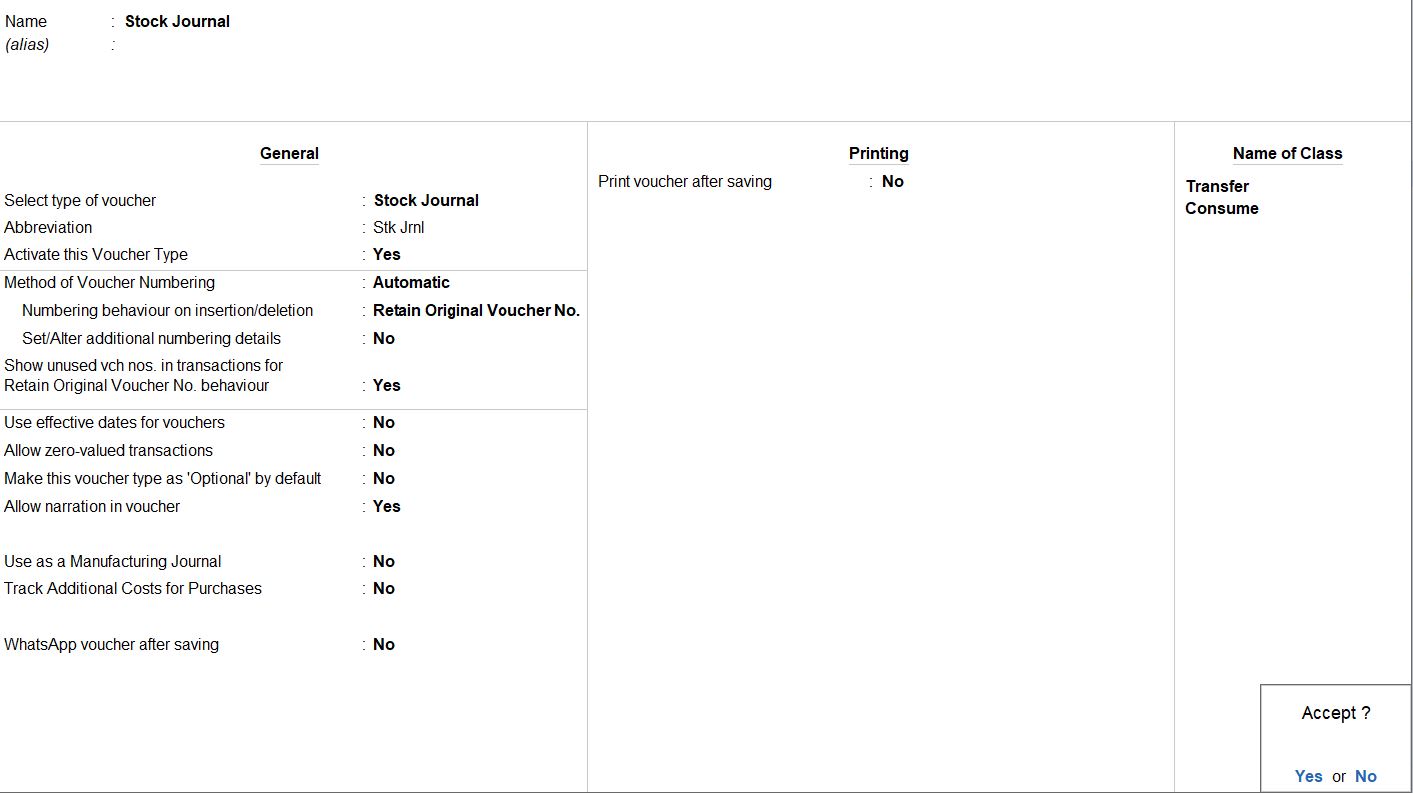

Stock Journal Class

- Navigate to Stock Journal Voucher Configuration:

- Go to Gateway of Tally.

- Select "Alter" from the main menu.

- Configure Classes:

- Under " Vouchers Types ," select "Stock Journal."

- Enable Class Usage:

- In the configuration settings, find the option related to class usage.

- Ensure that "Use class for Inter-location Transfers" is set to "Yes" for the class named "Transfer."

- Similarly, set "Use class for Job Costing Consumption" to "Yes" for the class named "Consume."

- Save Changes:

- After configuring the settings, save the changes.

- Recording Transactions:

- Now, when you create a Stock Journal voucher, you'll have the option to select classes for each transaction line item.

- If you're recording a transfer between locations, you can select the "Transfer" class for the relevant line items.

- If you're recording consumption for job costing purposes, you can select the "Consume" class.

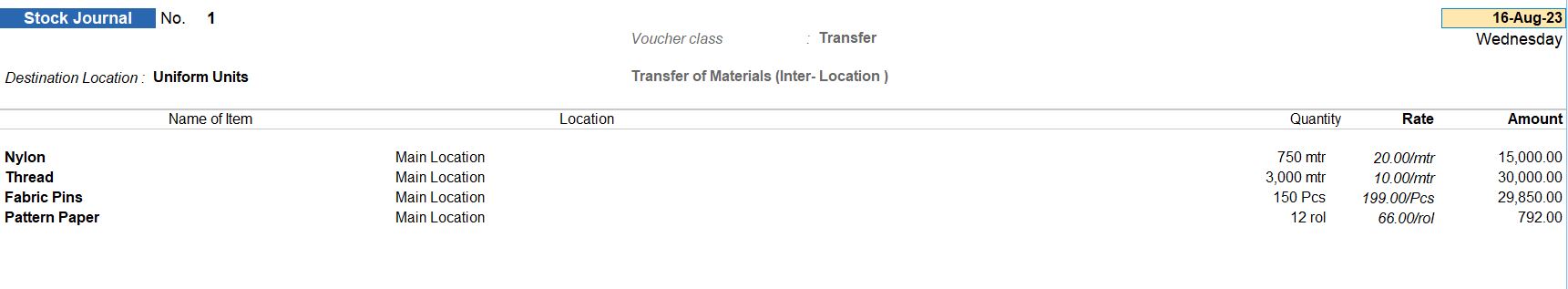

16-08-2023 we transfer some goods from working fields.

| Item | Unit | Qty |

|---|---|---|

| Nylon | meter | 750 |

| Thread | meter | 3000 |

| Fabric Pins | Pcs | 150 |

| Pattern Paper | Roll | 12 |

- Navigate to Stock Journal Voucher:

- Open Tally Prime software.

- Go to Gateway of Tally.

- Select "Stock Journal" under the "Vouchers" section.

- Enter Voucher Date:

- Set the voucher date as 16-08-2023.

- Enter Voucher Class:

- Select "Transfer" as the voucher class.

- Select Destination Location:

- Choose "Uniform Units" as the destination location for the transfer.

- Enter Item Details:

- Enter the details of each item transferred, including item name, location (main location), quantity, rate, and amount.

- Here's the breakdown:

- Nylon: 750 meters at a rate of ₹20 per meter, total amount ₹15,000.

- Thread: 3000 meters at a rate of ₹10 per meter, total amount ₹30,000.

- Fabric Pins: 150 pieces at a rate of ₹199 per piece, total amount ₹29,850.

- Pattern Paper: 12 rolls at a rate of ₹66 per roll, total amount ₹792.

- Save and Confirm:

- Double-check all the details entered.

- Save the stock journal voucher.

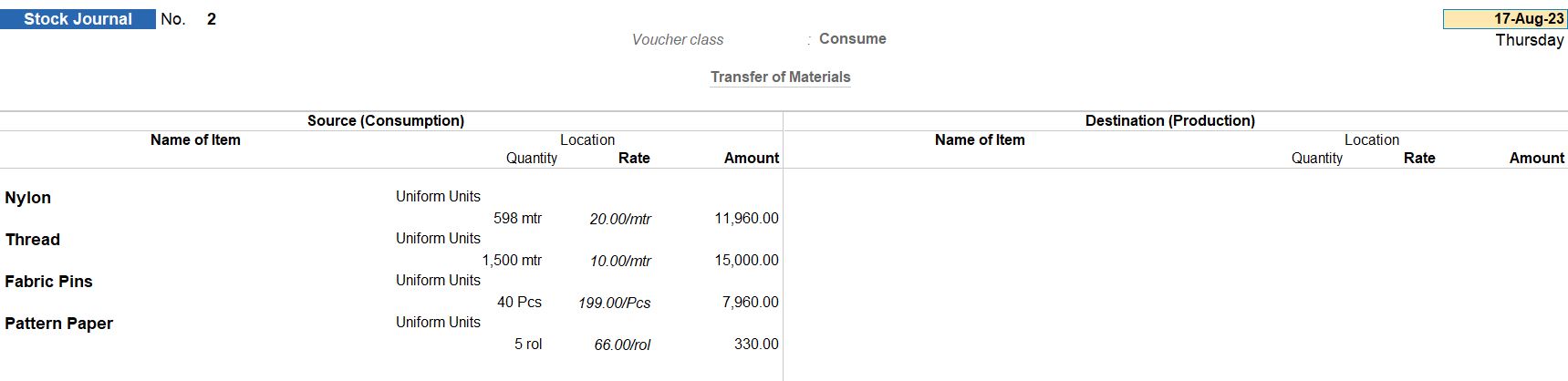

17-08-2023 Record the usage of materials for Stitching work.

| Item | Unit | Qty |

|---|---|---|

| Nylon | meter | 598 |

| Thread | meter | 1500 |

| Fabric Pins | Pcs | 40 |

| Pattern Paper | Roll | 5 |

- Navigate to Stock Journal Voucher:

- Open Tally Prime software.

- Go to Gateway of Tally.

- Select "Stock Journal" under the "Vouchers" section.

- Enter Voucher Date:

- Set the voucher date as 17-08-2023.

- Enter Voucher Class:

- Select "Consume" as the voucher class.

- Enter Source and Destination Details:

- In the stock journal, you'll be recording the consumption of materials (source) and their usage in production (destination).

- Here's how to enter the details:

- Source (Consumption):

- Name of Item: Nylon, Thread, Fabric Pins, Pattern Paper.

- Location: Uniform Units (assuming this is where the materials are consumed).

- Quantity, Rate, and Amount: Use the provided values.

- Destination (Production):

- Name of Item: Same as the source items.

- Location: Uniform Units (assuming this is where the production takes place).

- Quantity, Rate, and Amount: Leave these blank as they are calculated automatically based on the consumption details.

- Save and Confirm:

- Save the stock journal voucher.

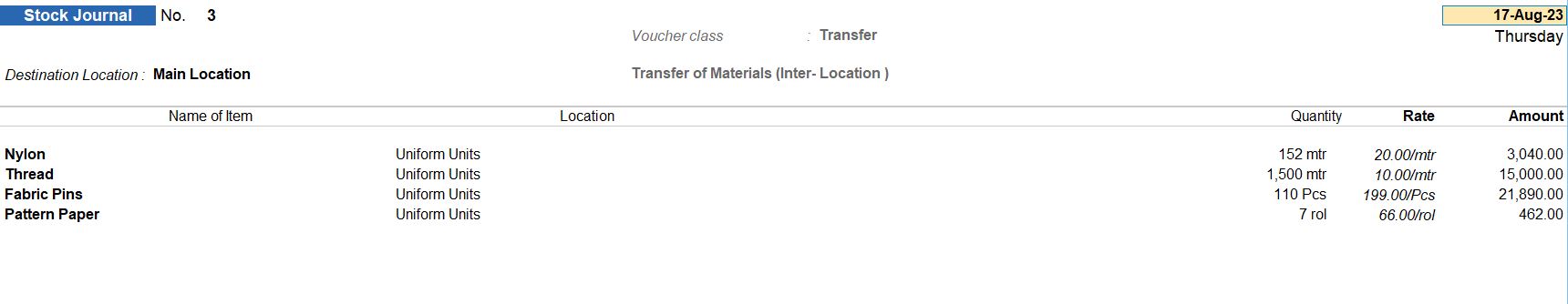

22-08-2023 After using goods in Stitching work, we transfer the remaining materials from the main location.

| Item | Unit | Qty |

|---|---|---|

| Nylon | meter | 152 |

| Thread | meter | 1500 |

| Fabric Pins | Pcs | 110 |

| Pattern Paper | Roll | 7 |

- Navigate to Stock Journal Voucher:

- Open Tally Prime software.

- Go to Gateway of Tally.

- Select "Stock Journal" under the "Vouchers" section.

- Enter Voucher Date:

- Set the voucher date as 22-08-2023.

- Enter Voucher Class:

- Select "Transfer" as the voucher class.

- Enter Source and Destination Details:

- In the stock journal, you'll be recording the transfer of remaining materials from the production location (Uniform Units) to the main location.

- Here's how to enter the details:

- Name of Item: Nylon, Thread, Fabric Pins, Pattern Paper.

- Location: Main Location.

- Quantity, Rate, and Amount: Use the provided values.

- Save and Confirm:

- Save the stock journal voucher.

24-08-2023 recording and managing expenses is a crucial aspect of the construction project.

| Expenses | Amount (₹) |

|---|---|

| Wages | 15,000 |

| Transport | 1,500 |

| Canteen Expense | 1,250 |

| Other Expenses | 1,000 |

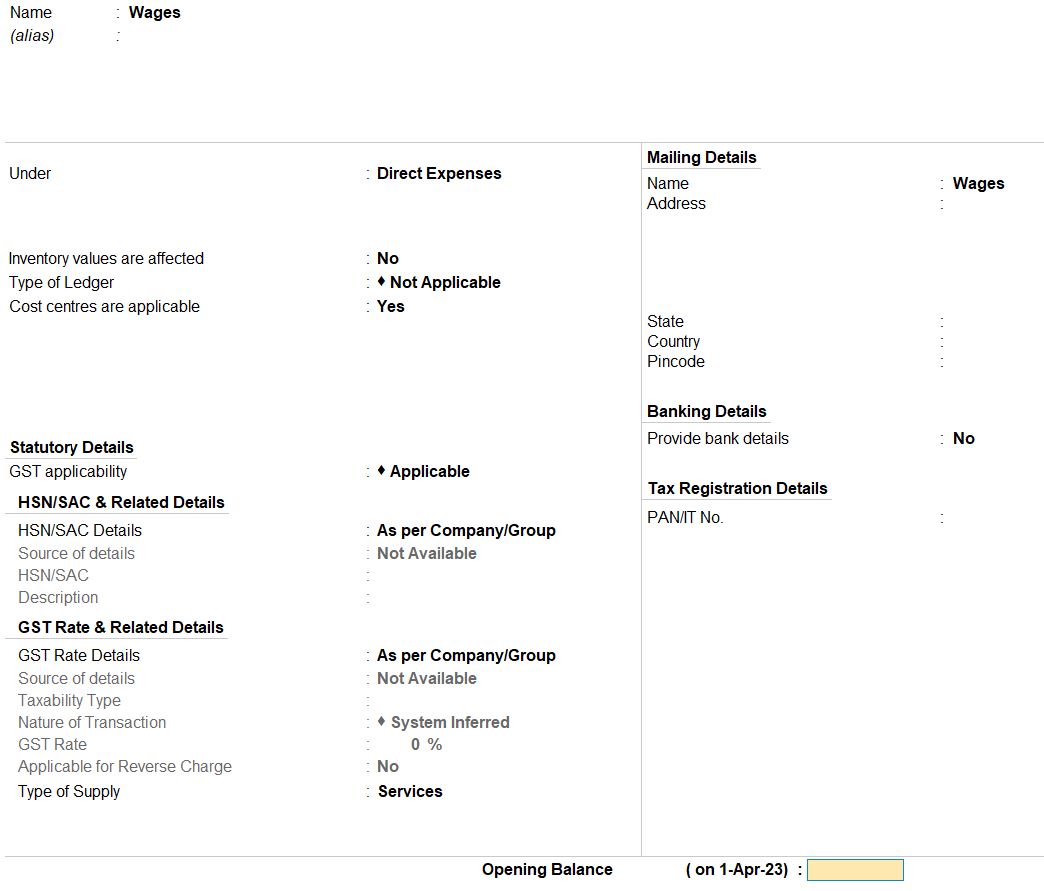

Wages

- Navigate to Ledger Creation:

- Open Tally Prime software.

- Go to the Gateway of Tally.

- Access Ledger Creation:

- From the main menu, navigate to "Accounts Info" or "Masters" section.

- Choose "Ledgers" to create a new ledger.

- Select Ledger:

- Select "Create" to add a new ledger.

- Create New Ledger:

- Enter "Wages" as the name of the ledger.

- Under: Choose "Direct Expenses" to categorize it correctly.

- Cost Centres Applicable: Set this option to "Yes" to enable cost centers for this ledger.

- Save Changes:

- After entering all the necessary details, save the ledger.

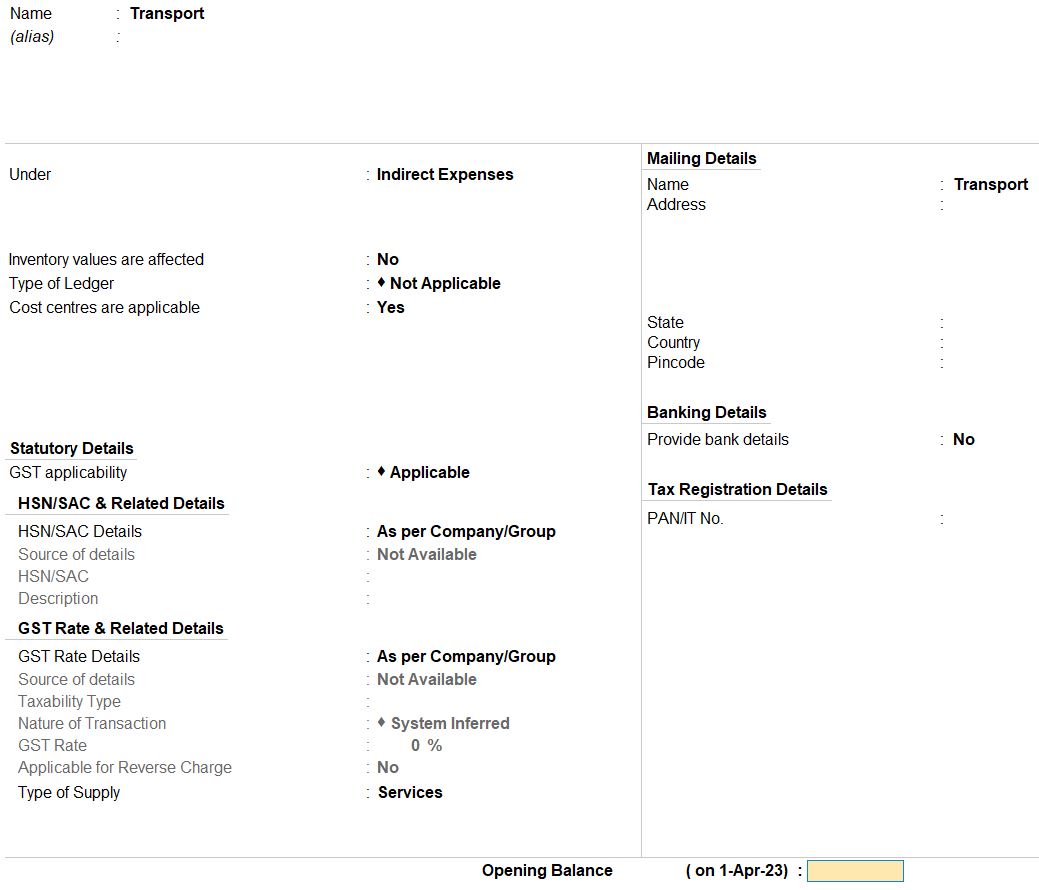

Transport

- Navigate to Ledger Creation:

- Open Tally Prime software.

- Go to Gateway of Tally.

- Under "Accounts Info", select "Ledgers".

- Create New Ledger:

- Select "Create" to add a new ledger.

- Enter Ledger Details:

- Name: Enter "Transport" as the name of the ledger.

- Under: Choose "Indirect Expenses" to categorize it correctly.

- Cost Centres Applicable: Set this option to "Yes" to enable cost centers for this ledger.

- Save Changes:

- After entering all the necessary details, save the ledger.

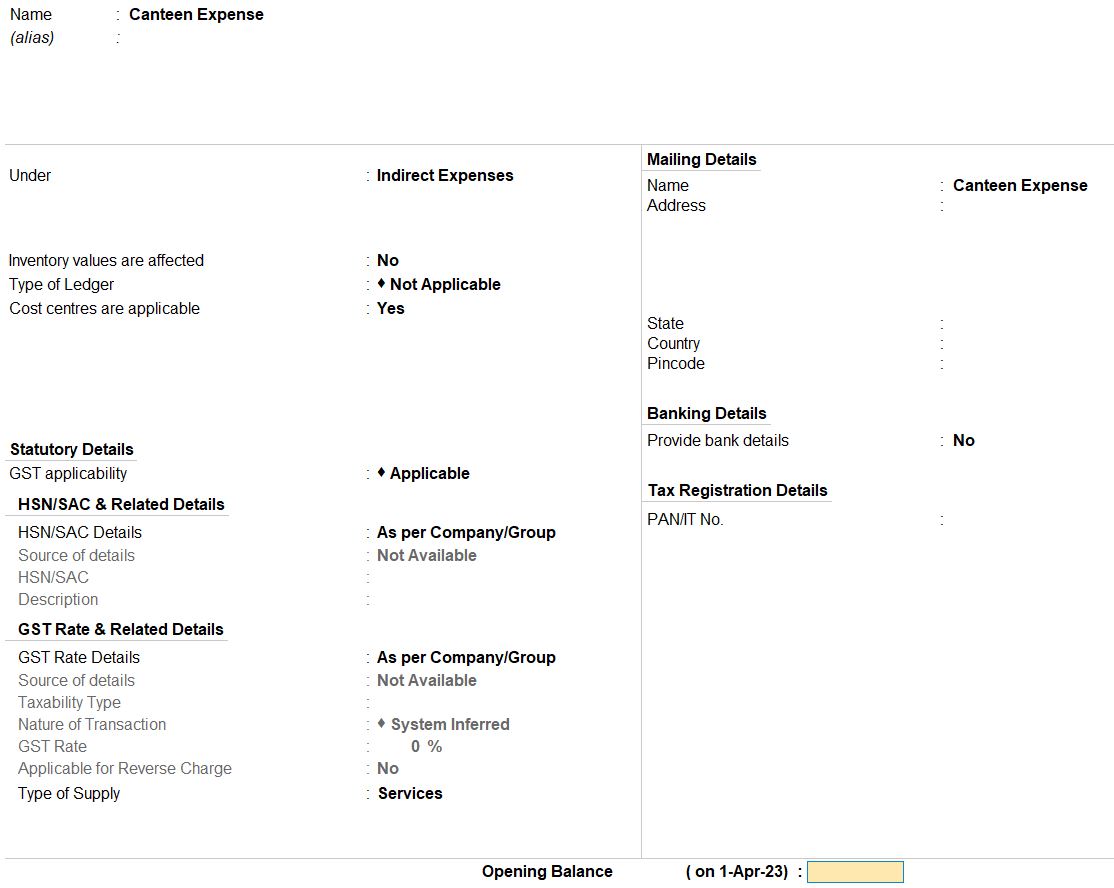

Canteen Expense

- Navigate to Ledger Creation:

- Open Tally Prime software.

- Go to Gateway of Tally.

- Under "Accounts Info", select "Ledgers".

- Create New Ledger:

- Select "Create" to add a new ledger.

- Enter Ledger Details:

- Name: Enter "Canteen Expense" as the name of the ledger.

- Under: Choose "Indirect Expenses" to categorize it correctly.

- Cost Centres Applicable: Set this option to "Yes" to enable cost centers for this ledger.

- Save Changes:

- After entering all the necessary details, save the ledger.

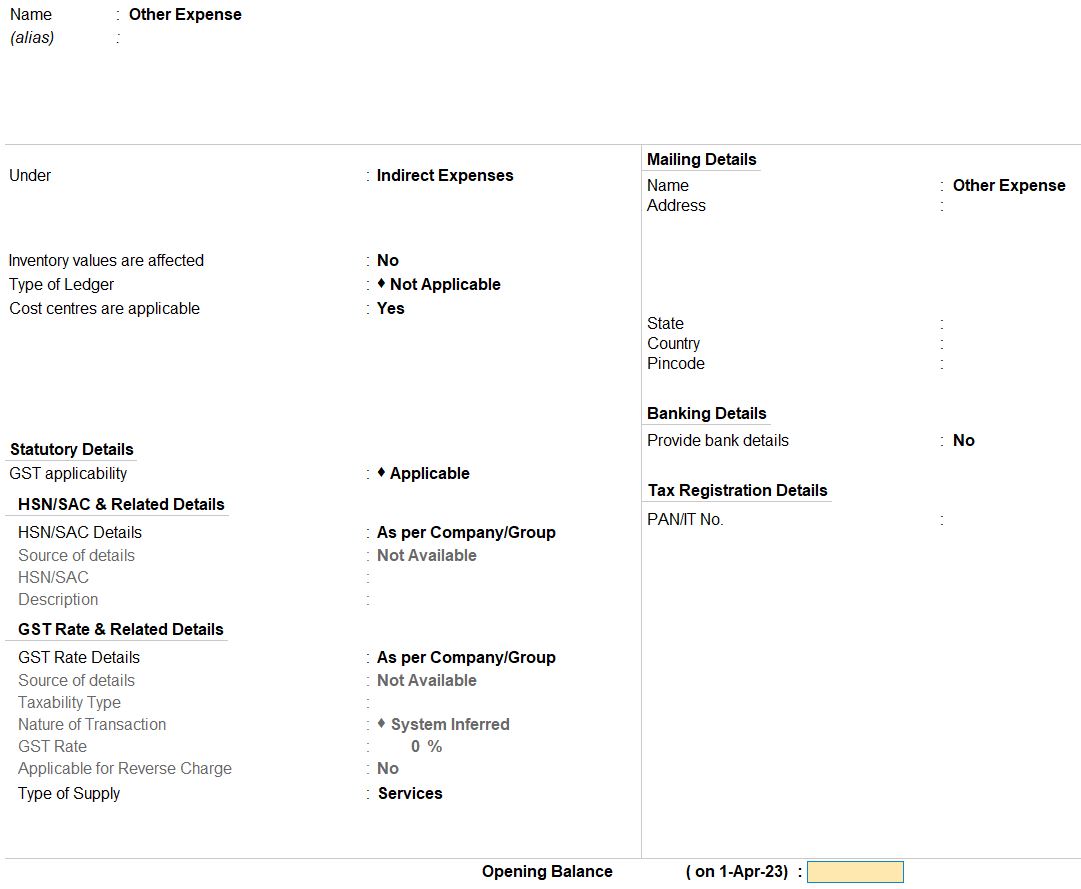

Other Expense

- Navigate to Ledger Creation:

- Open Tally Prime software.

- Go to Gateway of Tally.

- Under "Accounts Info," select "Ledgers."

- Create New Ledger:

- Select "Create" to add a new ledger.

- Enter Ledger Details:

- Name: Enter "Other Expenses" as the name of the ledger.

- Under: Choose "Indirect Expenses" to categorize it correctly.

- Cost Centers Applicable: Set this option to "Yes" to enable cost centers for this ledger.

- Save Changes:

- After entering all the necessary details, save the ledger.

- Navigate to Payment Voucher:

- Open Tally Prime software.

- Go to Gateway of Tally.

- Under "Vouchers," select "Payment Voucher."

- Enter Payment Details:

- Date: Set the appropriate date for the transaction.

- Debit Entries:

- Select "Wages" ledger and enter the amount of ₹15,000.

- Select "Transport" ledger and enter the amount of ₹1,500.

- Select "Canteen Expense" ledger and enter the amount of ₹1,250.

- Select "Other Expenses" ledger and enter the amount of ₹1,000.

- Select "Indian Bank" ledger and enter the total amount of ₹18,750 (sum of debit amounts).

- Enter Cost Centre Details:

- While entering each debit entry, assign the "Stitching Project" cost center to each ledger.

- Save and Confirm: Save the payment voucher.

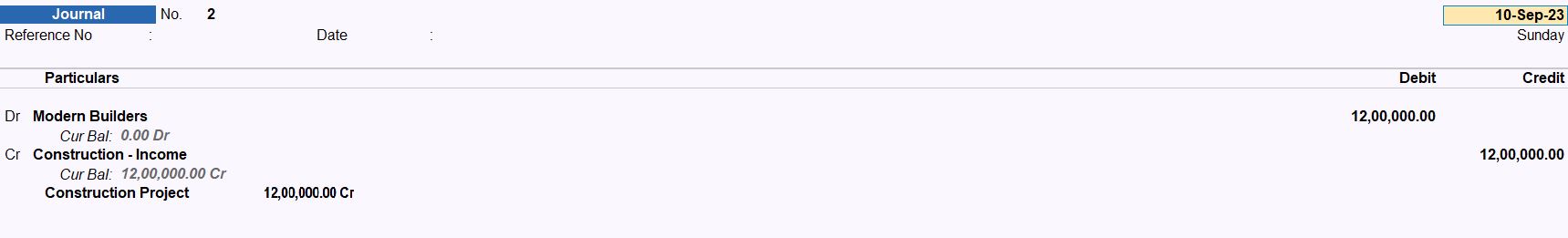

10-09-2023 We Receive a Building Construction order from Morden Builders net worth Rs.12,00,000.

- Navigate to Journal Voucher:

- Go to Gateway of Tally.

- Select "Accounting Vouchers."

- Select Journal Voucher:

- Choose "Journal Voucher" from the list of voucher types.

- Enter Journal Details:

- Set the voucher date as 10-09-2023.

- Debit Modern Builders (Sundry Debtors):

- Under "Particulars," select "Modern Builders."

- Select "Sundry Debtors" as the ledger.

- Enter the amount as Rs. 12,00,000 in the Debit side.

- Credit Construction - Income (Indirect Income):

- Under "Particulars," select "Construction - Income."

- Select "Indirect Income" as the ledger.

- Enter the amount as Rs. 12,00,000 in the Credit side.

- Save the Voucher:

- After entering all the journal details, save the voucher.

15-09-2023 We receive an amount of Rs.8,50,000 from Morden Builders through bank cheque no 14785.

- Navigate to Receipt Voucher:

- Go to Gateway of Tally.

- Select "Vouchers."

- Select Receipt Voucher: Choose "Receipt Voucher" from the list of voucher types.

- Enter Voucher Details:

- Set the voucher date as 15-09-2023.

- Enter Bank Account Details:

- Under "Account," select "Indian Bank."

- Enter bank cheque no 14785 in the appropriate field.

- Enter Party Details:

- Under "Particulars," select "Modern Builders."

- Enter the amount received, which is Rs. 8,50,000.

- Save the Voucher: After entering all the details, save the voucher.

17-09-2023 Cash Purchased the following goods with Reference no: AS005/23 with GST. And transfer all goods from our main godown.

| Item | HSN Code | GST | Unit | Qty | Rate |

|---|---|---|---|---|---|

| Bricks | 690100 | 18% | Nos | 50,000 | Rs. 7 |

| Sand | 2505 | 5% | Unit | 35 | Rs. 4200 |

| Gray Ton M Sand | 680221 | 18% | Unit | 40 | Rs. 3300 |

| Cement | 68109100 | 12% | Bag | 150 | Rs. 245 |

| Steel Rod | 7214 | 18% | Nos | 1000 | Rs. 500 |

- Navigate to Purchase Voucher:

- Go to Gateway of Tally.

- Select "Accounting Vouchers."

- Select Purchase Voucher: Choose "Purchase Voucher" from the list of voucher types.

- Enter Purchase Details:

- Enter the voucher date.

- Select "Indian Bank" as the Party A/c Name.

- Choose "Purchase" as the Purchase ledger.

- Enter Item Details:

- Enter each item's details: Bricks, Sand, Gray Ton M Sand, Cement, Steel Red.

- Quantity: Enter the respective quantities for each item.

- Rate: Enter the rate per unit for each item as described.

- Amount: Tally Prime automatically calculates the amount based on the quantity and rate.

- Save the Voucher: After entering all the purchase details, save the voucher.

19-09-2023 we transfer some goods from project fields.

| Item | Unit | Qty |

|---|---|---|

| Bricks | Nos | 12,000 |

| Sand | Unit | 15 |

| Gray Ton M Sand | Unit | 20 |

| Cement | Bag | 50 |

| Steel Rod | Nos | 750 |

- Navigate to Stock Journal Voucher:

- Go to Gateway of Tally.

- Select "Accounting Vouchers."

- Select Stock Journal Voucher: Choose "Stock Journal" from the list of voucher types.

- Enter Voucher Details:

- Set the voucher date as 19-09-2023.

- Enter Destination Location:

- Under "Destination Location," select "Morden Builders Godown."

- Enter Item Details:

- Enter each item's details: Bricks, Sand, Gray Ton M Sand, Cement, Steel Rod.

- Quantity: Enter the respective quantities for each item.

- Rate: Enter the rate per unit for each item as described.

- Amount: Tally Prime automatically calculates the amount based on the quantity and rate.

- Save the Voucher: After entering all the stock journal details, save the voucher.

23-09-2023 After using goods in construction work, we transfer the remaining materials from the main location.

| Item | Unit |

|---|---|

| Bricks | Nos |

| Sand | Unit |

| Gray Ton M Sand | Unit |

| Cement | Bag |

| Steel Road | Nos |

- Navigate to Stock Journal Voucher:

- Go to Gateway of Tally.

- Select "Accounting Vouchers."

- Select Stock Journal Voucher: Choose "Stock Journal" from the list of voucher types.

- Enter Voucher Details:

- Set the voucher date as 23-09-2023.

- Enter Destination Location:

- Under "Destination Location," select "Morden Builders Godown."

- Enter Item Details:

- Enter each item's details: Bricks, Sand, Gray Ton M Sand, Cement, Steel Rod.

- Quantity: Enter the remaining quantities for each item.

- Rate: Enter the rate per unit for each item as described.

- Amount: Tally Prime automatically calculates the amount based on the quantity and rate.

- Save the Voucher: After entering all the stock journal details, save the voucher.

24-09-2023 recording and managing expenses is a crucial aspect of the construction project.

| Expenses | Amount (₹) |

|---|---|

| Wages | 1,15,000 |

| Transport | 12,500 |

| Canteen Expense | 3,000 |

| Other Expenses | 3,500 |

- Navigate to Payment Voucher:

- Go to Gateway of Tally.

- Select "Accounting Vouchers."

- Select Payment Voucher:

- Choose "Payment Voucher" from the list of voucher types.

- Enter Voucher Details:

- Set the voucher date as 24-09-2023.

- Enter Expense Details:

- Under "Particulars," select the respective expense ledger for each expense item: Wages, Transport, Canteen Expense, Other Expenses.

- Enter the amounts for each expense item: Rs. 1,15,000 for Wages, Rs. 12,500 for Transport, Rs. 3,000 for Canteen Expense, and Rs. 3,500 for Other Expenses.

- Enter Bank Account Details:

- Under "Account," select "Indian Bank."

- Enter the total payment amount of Rs. 1,34,000 in the Credit side.

- Save the Voucher:

- After entering all the payment details, save the voucher.

26-09-2023 we received the balance amount from Morden Builders.

- Navigate to Receipt Voucher:

- Go to Gateway of Tally.

- Select "Accounting Vouchers"

- Select Receipt Voucher:

- Choose "Receipt Voucher" from the list of voucher types.

- Enter Voucher Details:

- Set the voucher date as 26-09-2023.

- Enter Party Details:

- Under "Particulars," select "Modern Builders."

- Enter the amount of Rs.3,50,000 in the Debit side.

- Enter Bank Account Details:

- Under "Account," select "Indian Bank."

- Enter the same amount of Rs. 3,50,000 in the Debit side.

- Save the Voucher:

- After entering all the receipt details, save the voucher.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions