Managing Overdue Payables in Tally Prime

In Tally Prime, the Overdue Payable report provides a detailed overview of unpaid bills that a business owes to its creditors. These bills are overdue and need to be settled. This report helps businesses manage their liabilities and ensure that they are aware of any overdue payments to vendors.

Overdue Payable Report in Tally Prime

Steps to Access Overdue Payables:

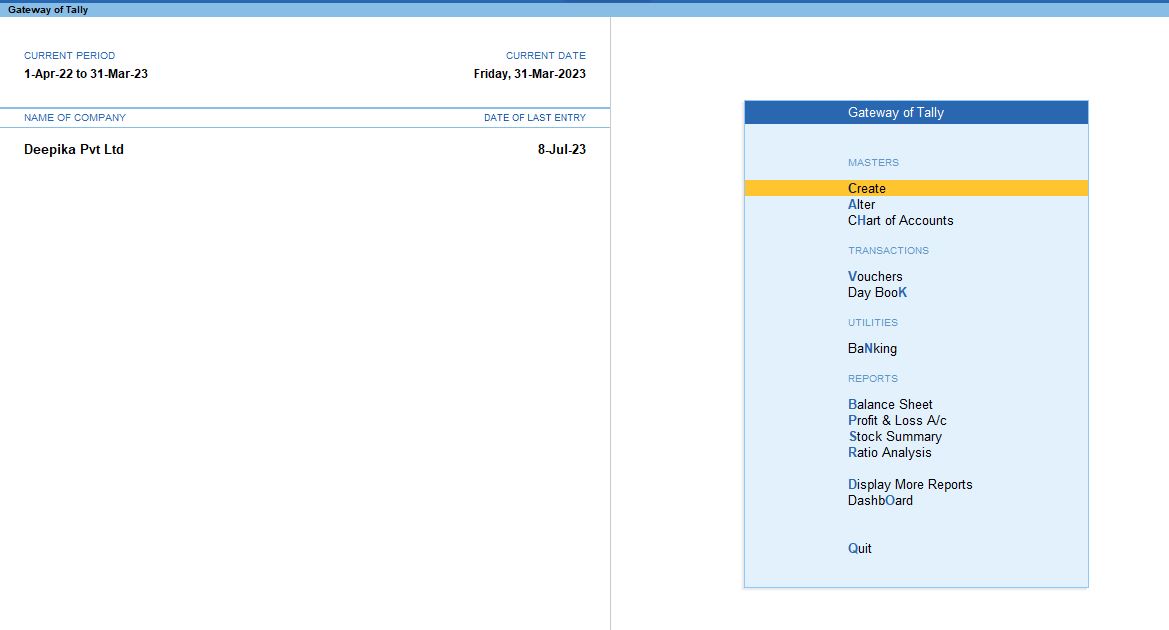

1. Open Tally Prime and Load the Company:

- Start Tally Prime and load the company whose stock items you want to verify.

2. Go to Gateway of Tally:

- From the main screen (Gateway of Tally), you can navigate to the verification tools.

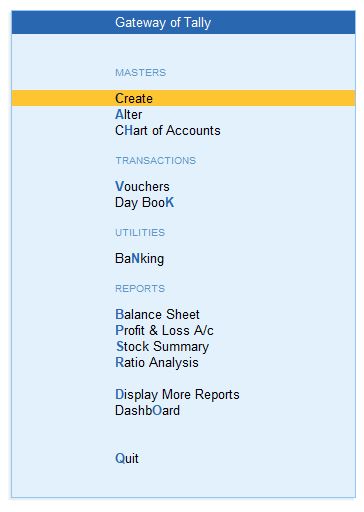

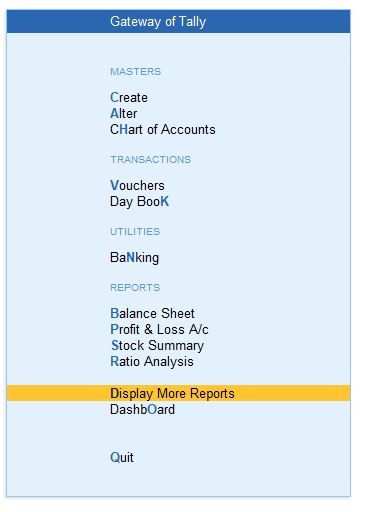

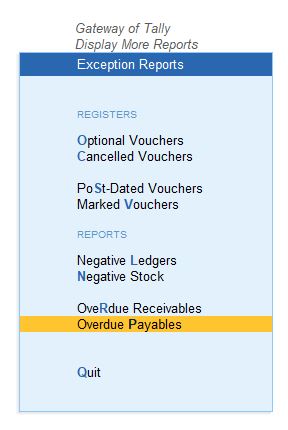

3. Navigate to Display More Reports:

- Press D (or click on Display More Reports) from the Gateway of Tally screen.

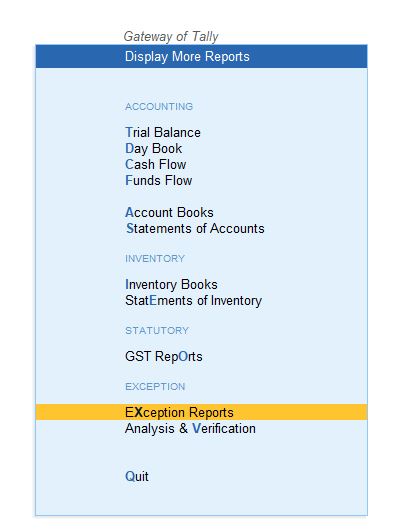

4. Go to Analysis & Verification:

- In the Display More Reports menu, choose Exception Reports . This section contains various tools for reviewing and verifying your data.

5. Select Exception Reports:

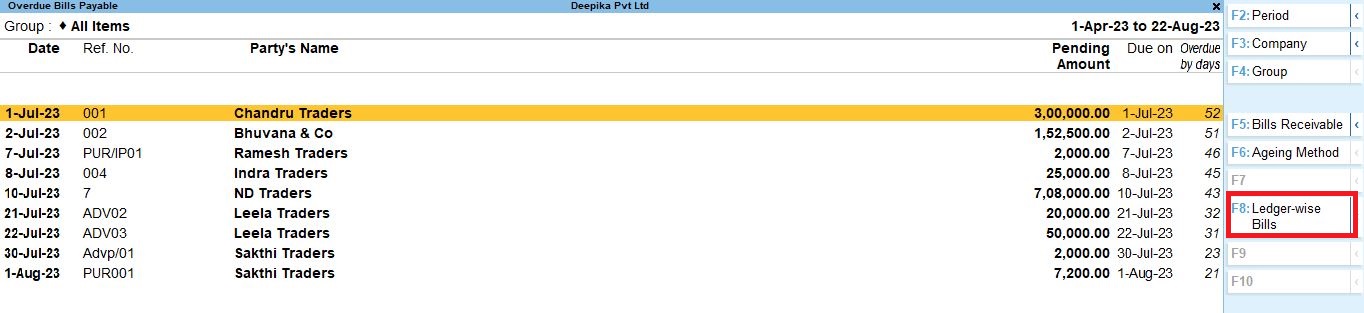

- From the Exception Reports menu, select Overdue Payables. This will open up a list.

6. Select Bills Payables:

- From the Overdue Payables menu, select Bills Payables. This will open up a list.

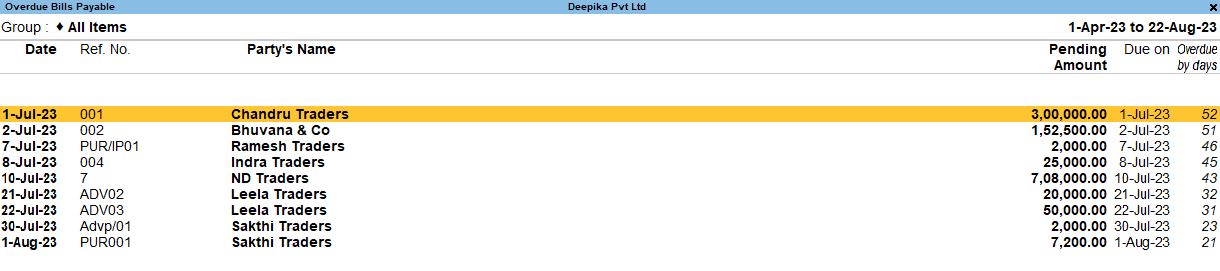

This shows all the overdue payables, which are the amounts your business owes but hasn't yet paid to creditors or vendors.

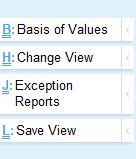

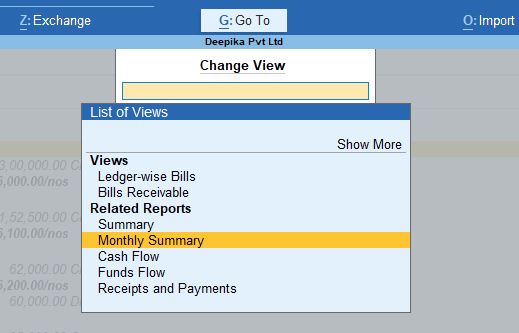

Ctrl+H: Change View Options

When you are in the Overdue Payable report, you can change how the information is displayed using Ctrl+H. Two key views are:

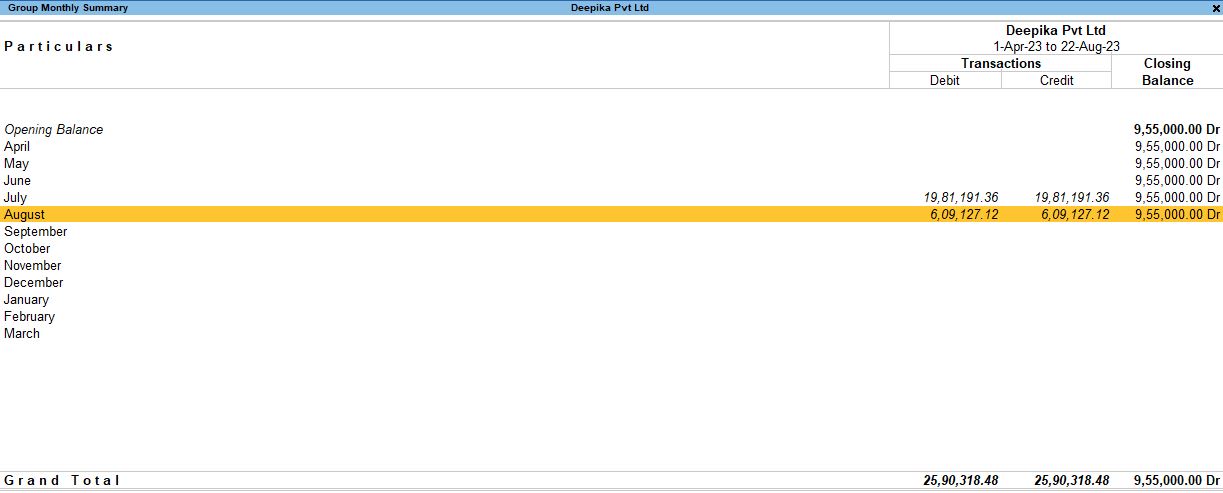

1. Monthly Summary:

- This provides a month-by-month summary of overdue payables, helping you see how much is overdue for each month.

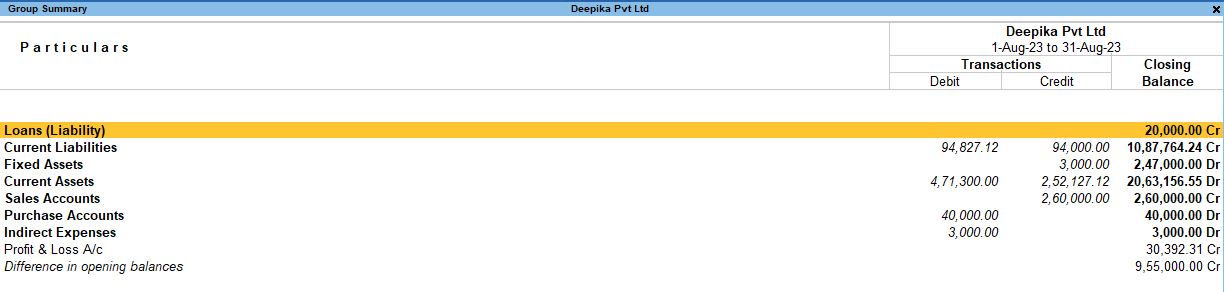

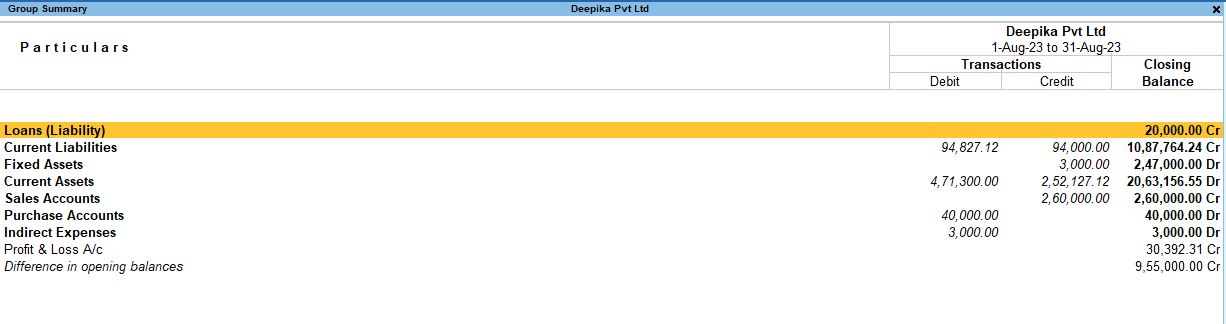

2. Group Summary:

- Groups your payables based on the ledger groups (such as Loans (Liability), Current Liabilities, Fixed Assets, etc.). This is useful for categorizing overdue payments and understanding which groups are contributing the most to the overdue amounts.

Group Summary Categories:

- Loans (Liability): Displays overdue payments related to loan liabilities.

- Current Liabilities: Overdue amounts related to short-term liabilities such as vendor payments, salaries, and taxes.

- Fixed Assets: Overdue payments related to fixed asset purchases.

- Current Assets: Shows overdue payables related to advances or other current asset items.

- Sales Accounts: Although less common for payables, this may show any overdue sales-related payments.

- Purchase Accounts: This shows vendor payments that are overdue and need to be settled.

- Indirect Expenses: Overdue payments related to indirect expenses like rent, utilities, or office expenses.

Ledger-wise Bills View

To see detailed information at the Ledger-wise Bills level, press F8. This gives a detailed list of bills that are overdue for each specific ledger (vendor).

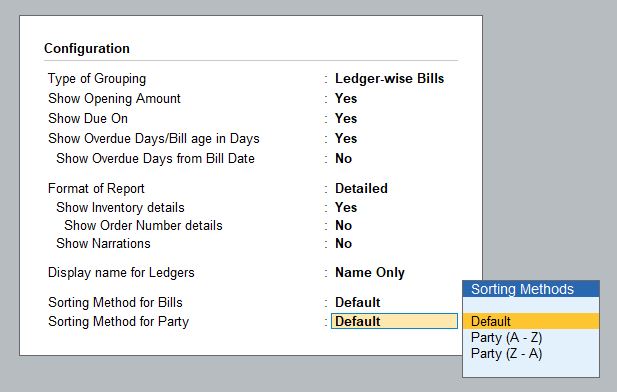

Configuration Options (F12):

- Type of Grouping: Select Ledger-wise Bills to organize the overdue payments by vendor ledger.

- Show Opening Amount: Displays the opening balance for each vendor.

- Show Due On: Shows the due date of each bill.

- Show Overdue Days/Bill Age in Days: Displays how many days a bill has been overdue.

- Show Overdue Days from Bill Date: Shows the overdue period calculated from the bill date.

- Format of Report: Set to Detailed for more granular details about each bill.

- Show Inventory Details: Include inventory information related to each bill (useful for tracking goods tied to payments).

- Show Order Number Details: Displays the order number linked to the bill.

- Show Narrations: Displays any notes or narrations tied to the transaction.

- Display Name for Ledger: Set as Name Only for a simplified view of vendor names.

- Sorting Method for Bills: Default (you can change it based on preference).

- Sorting Method for Party: Default (again, based on preference).

This configuration helps in obtaining a complete overview of each overdue bill per vendor, along with additional details such as inventory or order numbers, making it easier to prioritize payments.

Group Monthly Summary

Steps to Access:

1. F8 → Ledger-wise Bills → Group Monthly Summary → Group Summary.

This view allows you to summarize overdue payables on a monthly basis for different groups of accounts. It’s especially useful for tracking patterns in overdue payments over time and across different accounting groups.

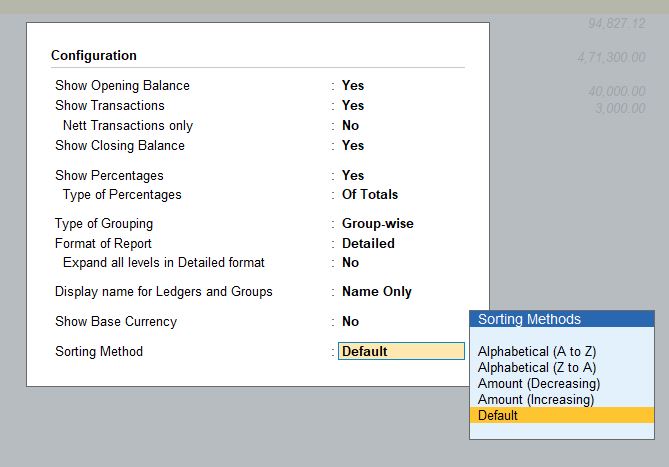

Configuration Options (F12):

- Show Opening Balance: Display the opening balance for the group in question.

- Show Transactions: Display the total transactions for each group.

- Nett Transactions: Display net transactions (total debit minus credit).

- Show Closing Balance: Display the closing balance for each group.

- Show Percentages: Display percentages (e.g., percentage of total overdue amounts).

- Type of Percentages: Can be set to of Totals (to show percentages relative to the total value of overdue payments).

- Type of Grouping: Choose Group-wise to categorize overdue payables by different accounting groups.

- Format of Reports: Select Detailed to see itemized information for each group.

- Display Name for Ledgers and Groups: Select Name Only for clarity and simplicity.

- Show Base Currency: Displays the amounts in the base currency (useful for businesses dealing with multiple currencies).

- Sorting Method: Default (can be changed based on preference).

This configuration is designed to give a detailed and organized view of overdue payables by group, allowing businesses to pinpoint specific areas where payments are overdue.

How to Use the Overdue Payable Report

- Identify High-Priority Payments: Using the Ledger-wise Bills view, you can prioritize payments to vendors based on how long the bills have been overdue and the amounts.

- Track Payment Patterns: The Monthly Summary view helps in identifying trends over time, such as periods where there are more overdue payments, allowing businesses to make better financial plans.

- Organize Payables by Group: The Group Summary allows you to categorize overdue payments by different accounting groups (such as Loans or Purchase Accounts), providing clarity on which type of transactions are contributing the most to overdue payables.

- Ensure Timely Payments: By regularly reviewing overdue payables, businesses can manage cash flow more effectively and avoid any penalties for late payments.

Conclusion

The Overdue Payable report in Tally Prime is an essential tool for businesses to track and manage unpaid bills. By utilizing features like Ledger-wise Bills, Group Monthly Summary, and Group Summary, businesses can easily categorize and analyze overdue payables and take timely action to settle payments. This not only ensures better relationships with vendors but also improves overall financial health.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions