Generating Overdue Receivables Reports with Tally Prime

The Overdue Receivables report in Tally Prime provides insights into bills that are overdue from customers. It helps businesses manage and track receivables effectively by highlighting the overdue bills, enabling them to take action to collect payments.

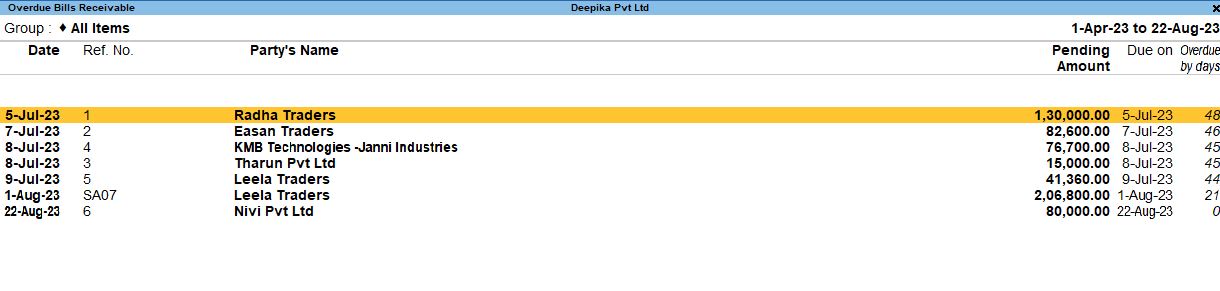

Overdue Receivables: Bills Receivable

Steps to Access Overdue Receivables:

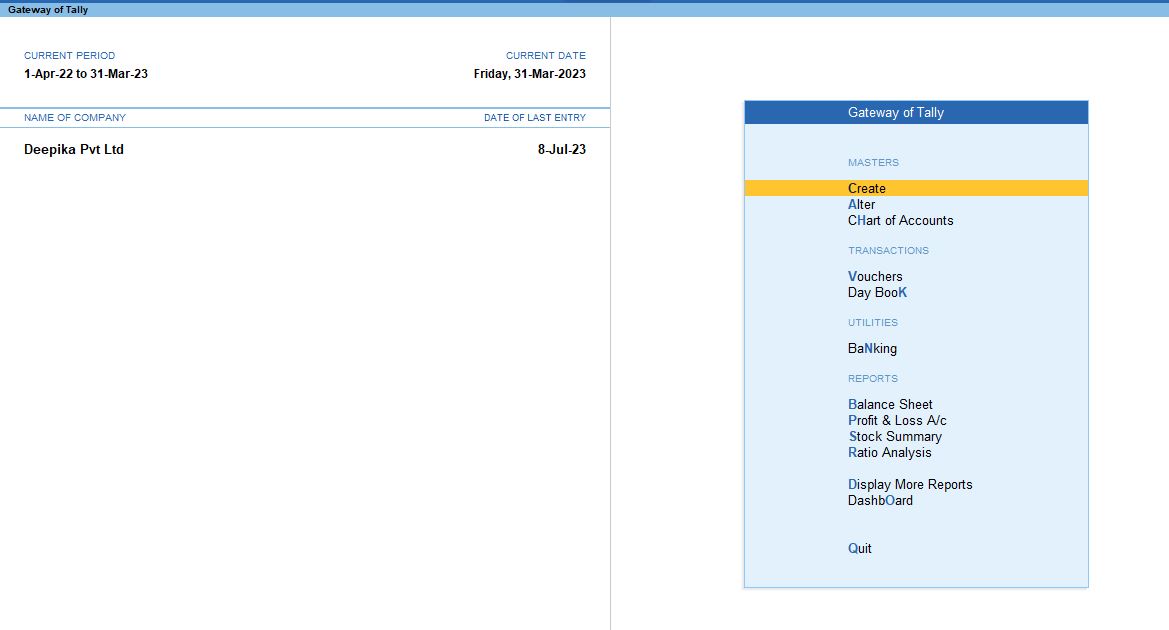

1. Open Tally Prime and Load the Company:

- Start Tally Prime and load the company whose stock items you want to verify.

2. Go to Gateway of Tally:

- From the main screen (Gateway of Tally), you can navigate to the verification tools.

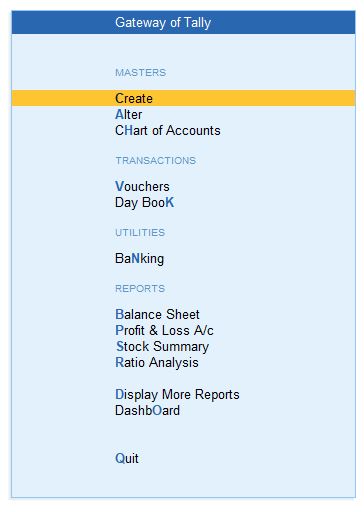

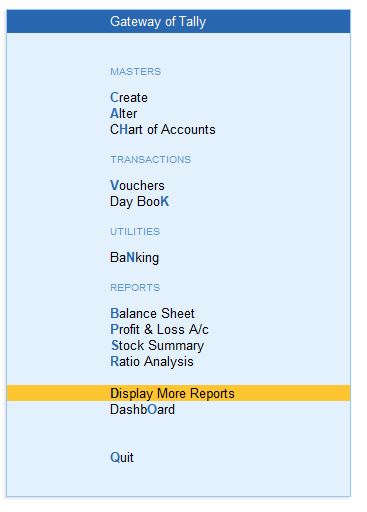

3. Navigate to Display More Reports:

- Press D (or click on Display More Reports) from the Gateway of Tally screen.

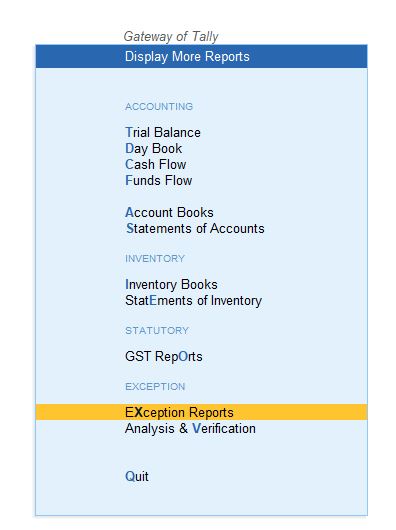

4. Go to Analysis & Verification:

- In the Display More Reports menu, choose Exception Reports . This section contains various tools for reviewing and verifying your data.

5. Select Exception Reports:

- From the Exception Reports menu, select Overdue Receivable. This will open up a list.

This will display a list of all bills receivable that are overdue, helping you track pending payments from your customers.

- Bills Receivable: This shows all outstanding bills where the customer owes money to the business. It includes the due date, amount, and days overdue for each bill. The focus here is on managing and following up on overdue customer payments.

Key Features:

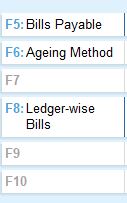

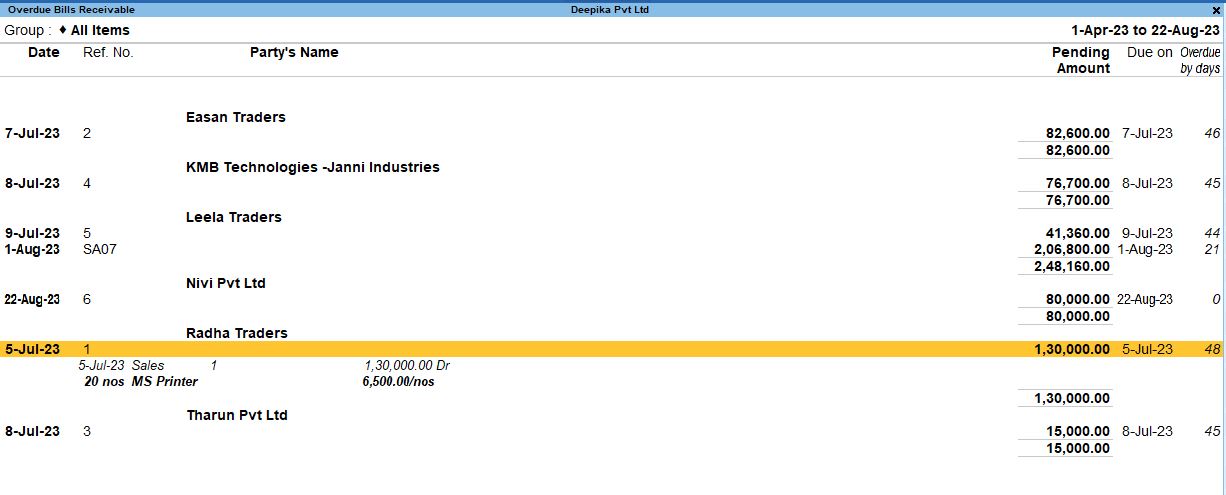

- F8: Ledger-wise Bills: This option allows you to view the overdue receivables on a ledger-wise basis. It categorizes overdue bills by customer ledger, providing a more organized way of tracking outstanding payments.

- Group Monthly Summary: This is a further breakdown of overdue receivables, showing a month-by-month summary of overdue bills by customer ledger. This report helps you see which months have the highest overdue amounts and identify patterns in delayed payments.

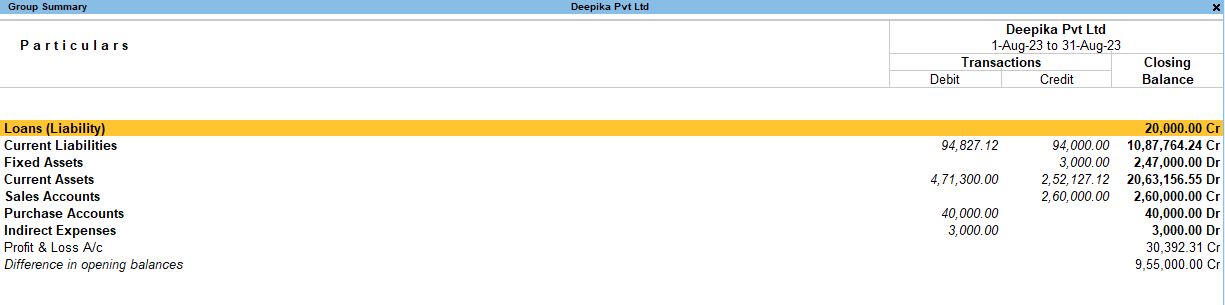

Group Summary in Overdue Receivables

Steps to Access Group Summary:

1. F8 → Group Summary → Choose a particular group such as Loans (Liability), Current Liabilities, Fixed Assets, Current Assets, Sales Accounts, Purchase Accounts, or Indirect Expenses.

The Group Summary provides an overview of overdue receivables categorized by different accounting groups, making it easier to track the specific groups contributing to overdue receivables.

Group Summary Categories:

- Loans (Liability): Displays overdue receivables related to loans under liability accounts. It shows the loans given to or received from third parties that are overdue.

- Current Liabilities: Overdue amounts associated with current liabilities, including short-term obligations.

- Fixed Assets: Overdue receivables linked to fixed assets transactions.

- Current Assets: Overdue amounts related to current assets, such as advances or other short-term asset categories.

- Sales Accounts: Overdue receivables tied to sales made to customers, essential for tracking unpaid invoices.

- Purchase Accounts: Unpaid amounts related to purchase transactions that are still overdue.

- Indirect Expenses: Overdue payments related to indirect expenses incurred by the business.

This categorization helps in quickly identifying which type of transaction or group is contributing the most to overdue receivables.

Ledger Monthly Summary in Overdue Receivables

Steps to Access Ledger Monthly Summary:

1. F8 → Ledger-wise Bills → Group Monthly Summary → Ledger Monthly Summary.

The Ledger Monthly Summary offers a detailed month-by-month breakdown of the overdue receivables for each individual ledger (customer). This view is beneficial for assessing a particular customer’s overdue amounts and analyzing their payment patterns.

Key Features of Ledger Monthly Summary:

- Monthly Breakdown: You can see how much is overdue each month for a specific customer, helping you identify any consistent delays in payments.

- Aging of Receivables: This report also helps you perform aging analysis, which shows how long overdue payments have been outstanding. For instance, if payments are overdue by 30 days, 60 days, 90 days, etc.

- Actionable Insights: You can use this report to prioritize follow-up on overdue payments based on the age of the outstanding amounts.

Understanding Overdue Receivables and Action Steps:

Overdue receivables can significantly impact the business's cash flow, making it essential to keep track of these amounts closely. The Overdue Receivables report allows businesses to:

- Track Customer Payment Behavior: By analyzing the overdue receivables, businesses can track which customers consistently delay payments and take proactive steps, such as adjusting credit terms or initiating collection efforts.

- Focus on Collections: This report enables you to identify the largest overdue amounts, helping the business focus on collecting the most significant outstanding receivables first.

- Improve Cash Flow Management: By regularly reviewing overdue receivables, businesses can improve their cash flow and avoid liquidity issues.

Conclusion

The Overdue Receivables report in Tally Prime is a powerful tool that helps businesses manage outstanding customer payments by providing detailed views of overdue bills. With features like Ledger-wise Bills, Group Monthly Summary, and Ledger Monthly Summary, businesses can categorize and analyze overdue receivables effectively. This allows for better decision-making regarding collections and overall financial management.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions