Simplified TCS Tax Payment in Tally Prime: A Step-by-Step Tutorial

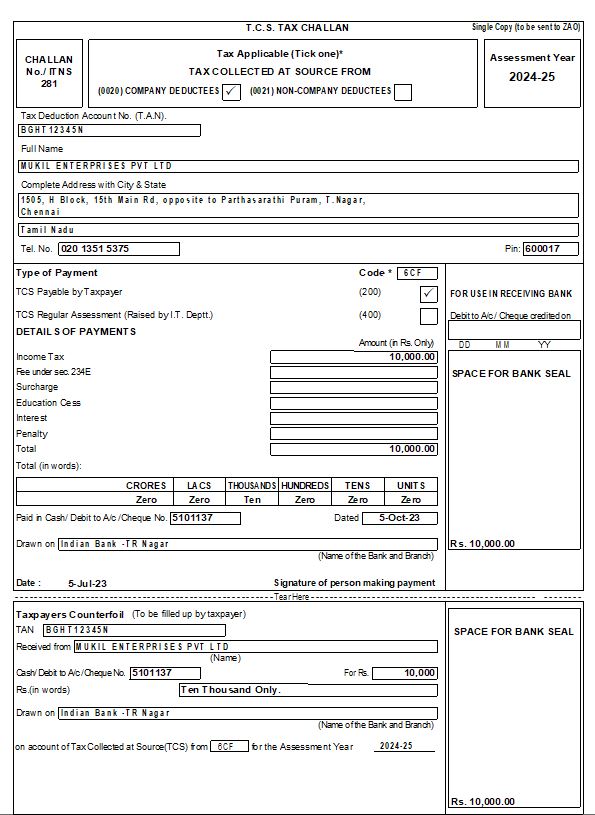

05th July 2023 Mukil Enterprises Pvt. Ltd., have collected TCS Amount towards Multiple Nature of Goods in May-June 2023. The tax is paid to the government.

| Return Period | Incomes Received and Collected Month | Monthly Tax Liability Amount (₹) | Due Date for Payment | Actual Payment Date | Interest Rate (p.m) | Form Type |

|---|---|---|---|---|---|---|

| 4th Quarter | May 23 | 10,950 | 7th June 23 | 5th July 23 | 1.5% | Form 27EQ |

| June 23 | 10,071 | 7th July 23 | 5th July |

| Filing Due Dates for Form 27EQ | |

|---|---|

| Periodicity (Quarter) | Government and Non-Government Entities |

| April to June | 15th July |

| July to September | 15th October |

| October to December | 15th January |

| January to March | 15th May |

05th July 2023 Mukil Enterprises Pvt. Ltd., have collected TCS Amount towards Multiple Nature of Goods in May-June 2023. The tax is paid to the government.

- Navigate to Payment Voucher Entry:

- Open Tally Prime software.

- Go to the "Vouchers" section.

- Choose "Payment" as the voucher type.

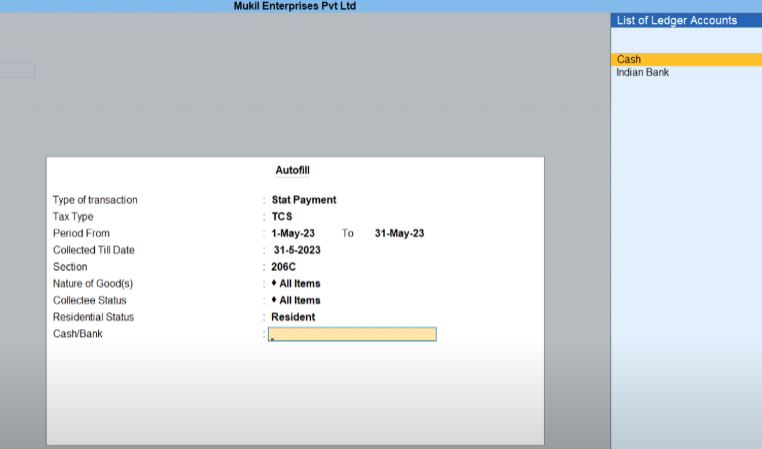

- Autofill Options:

- Since you want to autofill the details for TCS payment, select the option for "Autofill" available in the payment voucher.

- Enter Transaction Details:

- Type of Transaction: Specify as "Stat Payment" to indicate a statutory payment.

- Tax Type: Select "TCS" to specify that it's a Tax Collected at Source payment.

- Period From: Enter the starting date of the period for which the TCS payment is applicable, in this case, 1st May 2023.

- Period Till: Enter the ending date of the period, which is 31st May 2023.

- Collected Till Date: Specify the last date until which TCS was collected, which is 31st May 2023.

- Section: Enter the applicable section, which is "206C" for TCS.

- Nature of Good(s): Specify "All Item" to indicate that TCS applies to all items.

- Collectee Status: Choose "All Item" to apply TCS to all types of collectees.

- Residential Status: Select "Resident" to specify that the collectees are residents.

- Cash/Bank: Choose "Indian Bank" to specify the mode of payment.

- Save and Verify:

- Save the payment voucher after ensuring that all the details are correctly entered and autofilled.

- Navigate to Payment Voucher Entry:

- Open Tally Prime software.

- Go to the "Accounting Vouchers" section.

- Choose "Payment" as the voucher type.

- Autofill Options:

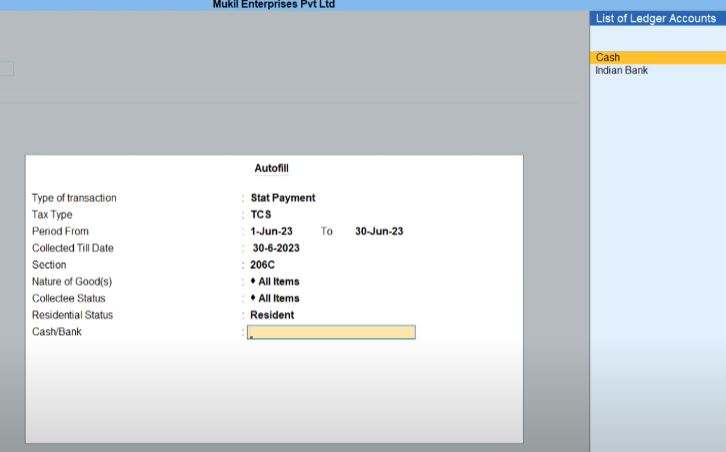

- Since you want to autofill the details for TCS payment, select the option for "Autofill" available in the payment voucher.

- Enter Transaction Details:

- Type of Transaction: Specify as "Stat Payment" to indicate a statutory payment.

- Tax Type: Select "TCS" to specify that it's a Tax Collected at Source payment.

- Period From: Enter the starting date of the period for which the TCS payment is applicable, in this case, 1st June 2023.

- Period Till: Enter the ending date of the period, which is 30th June 2023.

- Collected Till Date: Specify the last date until which TCS was collected, which is 30th June 2023.

- Section: Enter the applicable section, which is "206C" for TCS.

- Nature of Good(s): Specify "All Item" to indicate that TCS applies to all items.

- Collectee Status: Choose "All Item" to apply TCS to all types of collectees.

- Residential Status: Select "Resident" to specify that the collectees are residents.

- Cash/Bank: Choose "Indian Bank" to specify the mode of payment.

- Save and Verify:

- Save the payment voucher after ensuring that all the details are correctly entered and autofilled.

Print Invoice

- Open Tally Prime:

- Launch Tally Prime software on your computer.

- Navigate to Voucher Entry:

- Go to the " Vouchers" section.

- Select Sales Voucher:

- Choose the sales voucher for which you want to print the invoice.

- Verify and Finalize:

- Ensure that all the details in the sales voucher are accurate and final before proceeding to print the invoice.

- Print Invoice:

- Once you are ready to print the invoice, locate the print option. This is typically found in the menu bar or can be accessed using a keyboard shortcut (such as Ctrl+P or Alt+P).

- Adjust Printer Settings:

- Before printing, ensure that your printer is connected and turned on. Adjust any necessary settings such as paper size, orientation, and number of copies.

- Preview and Print:

- Tally Prime may provide a preview of the invoice before printing. Review the preview to ensure everything appears as expected.

- Once you are satisfied with the preview, click the print button to initiate printing.

- Save or Send:

- After printing, you may choose to save a digital copy of the invoice or send it directly to the recipient via email or other means, depending on your requirements.

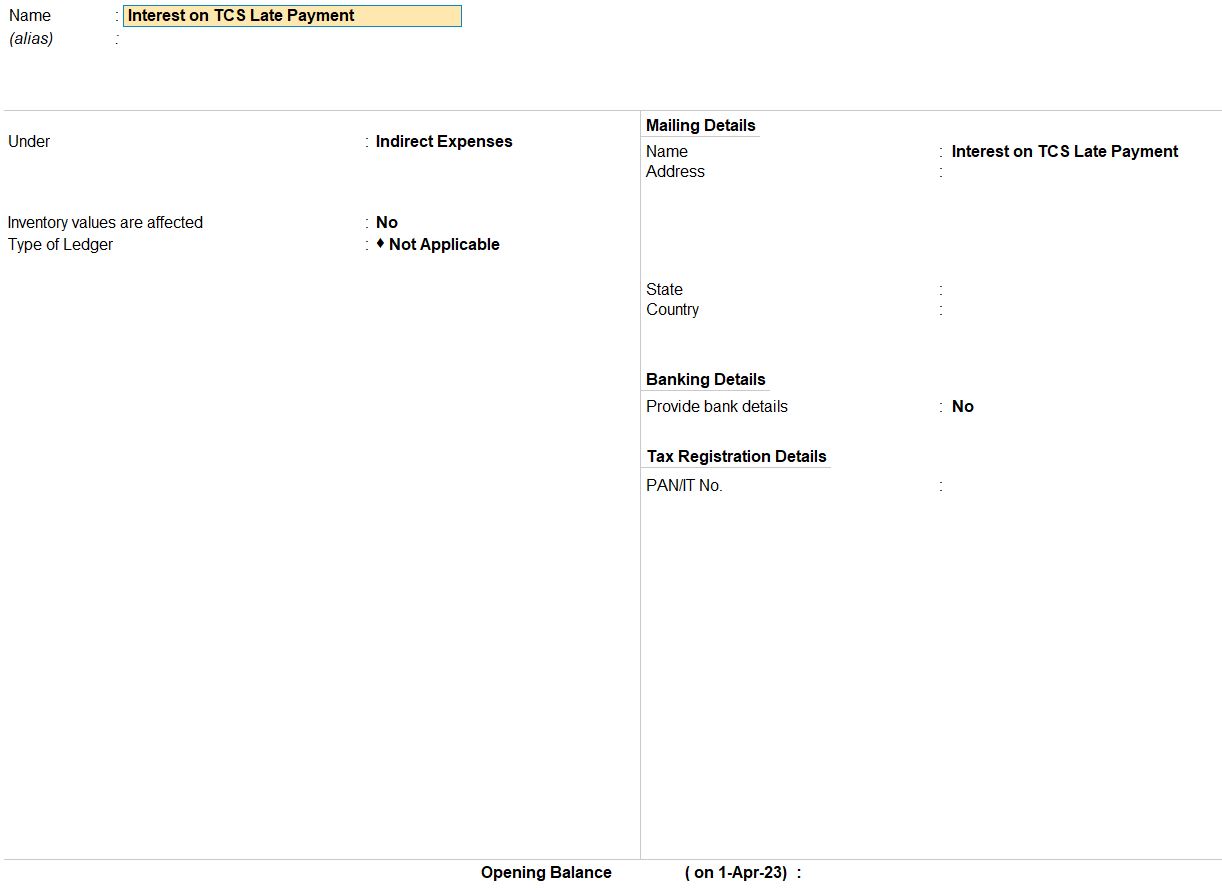

Interest on TCS Late Payment

- Navigate to Ledger Creation:

- Open Tally Prime software.

- Go to the "Accounting Vouchers" section.

- Create New Ledger:

- From the menu, select "Ledger."

- Choose "Create" to add a new ledger.

- Enter Ledger Details:

- Name: Enter "Interest on TCS Late Payment" as the name of the ledger.

- Under: Select "Indirect Expenses" to categorize it correctly.

- Save Changes:

- After entering all the necessary details, save the ledger.

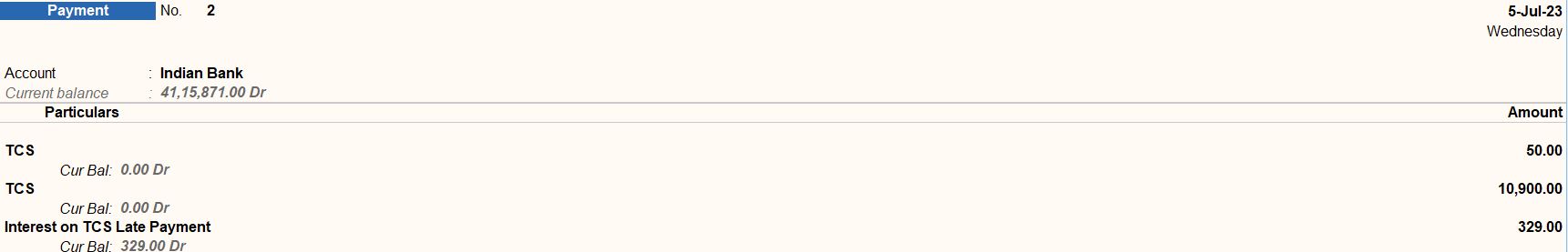

- Navigate to Payment Voucher Entry:

- Open Tally Prime software.

- Go to the "Accounting Vouchers" section.

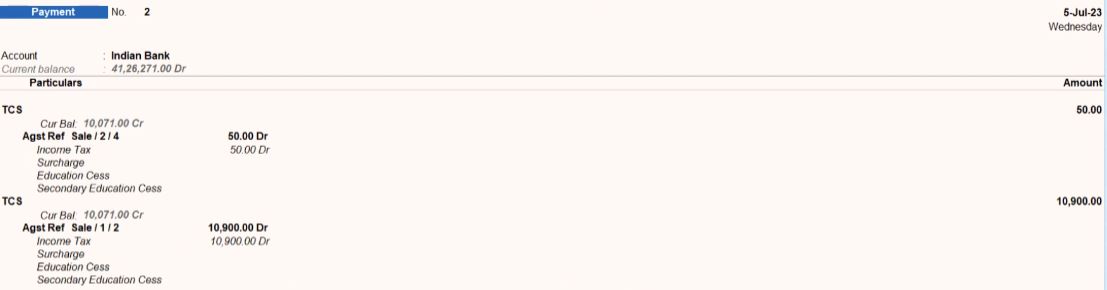

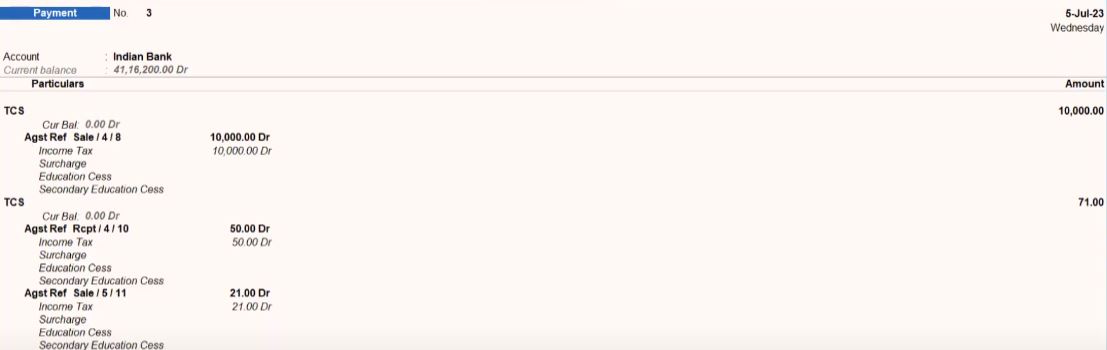

- Enter Date and Voucher Details:

- Set the voucher date as per the transaction date.

- Choose "Payment" as the voucher type.

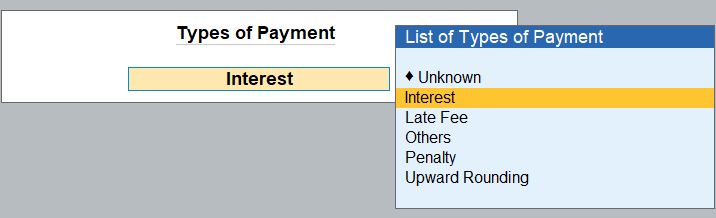

- Enter Transaction Details:

- Account: Indian Bank under.

- Particular: TCS (Tax Collected at Source) with an amount of ₹50.

- Particular: TCS with an amount of ₹10,900.

- Particular: Interest on TCS Late Payment under Types of Payment “Interest” with an amount of ₹329.

- Save and Verify:

- Save the payment voucher after ensuring that all the details are correctly entered.

- Once you are satisfied with the preview, click the print button to initiate printing.

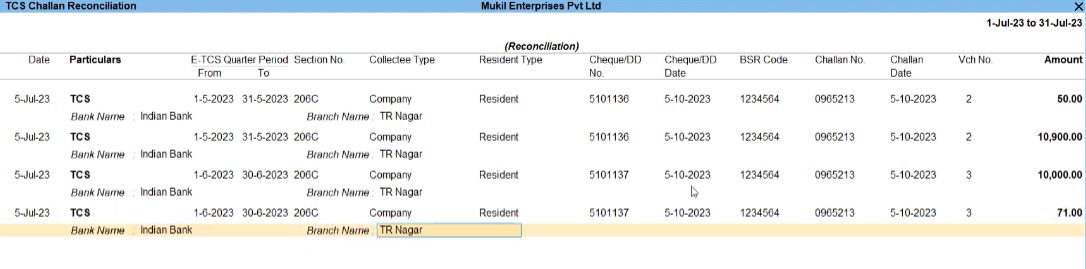

Reports Challan Reconciliation

- Open Tally Prime

- Launch the Tally Prime software on your computer.

- Navigate TCS Reports:

- From the Gateway of Tally, go to "Display" (located on the left-hand side).

- Then, select "More Reports" from the options.

- Access TCS Reports:

- Under "More Reports," choose "TCS Reports."

- Select Challan Reconciliation:

- From the TCS Reports menu, select "Challan Reconciliation."

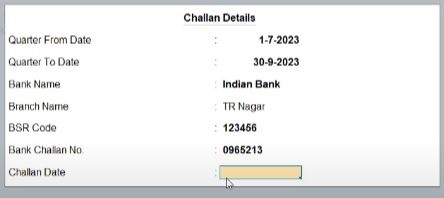

- Enter Challan Details:

- In the Challan Reconciliation screen, enter the following details:

- Quarter From Date: Specify the starting date of the quarter, which is 1st July 2023.

- Quarter To Date: Specify the ending date of the quarter, which is 30th September 2023.

- Bank Name: Enter the name of the bank where the TCS was deposited, which is Indian Bank.

- Branch Name: Specify the branch name, which is TR Nagar.

- BSR Code: Enter the BSR (Basic Statistical Return) Code for the bank branch, if applicable.

- Bank Challan No: Input the bank challan number related to the TCS deposit, which is 0955213.

- Challan Date: Enter the date of the challan, which is 5th October 2023.

- View Challan Reconciliation Reports:

- After entering the necessary details, you can view the Challan Reconciliation report, which provides information about TCS deposits and reconciles them with the relevant challan details.

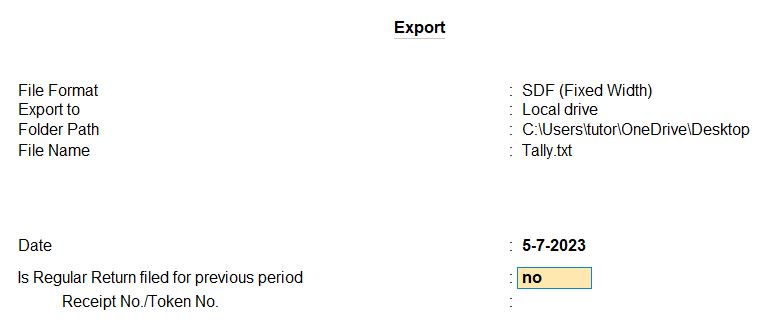

Export Reports

- Open Tally Prime

- Launch Tally Prime software.

- Navigate to TCS Reports:

- Go to Gateway of Tally

- Select "Display More Reports."

- Choose "TCS Reports."

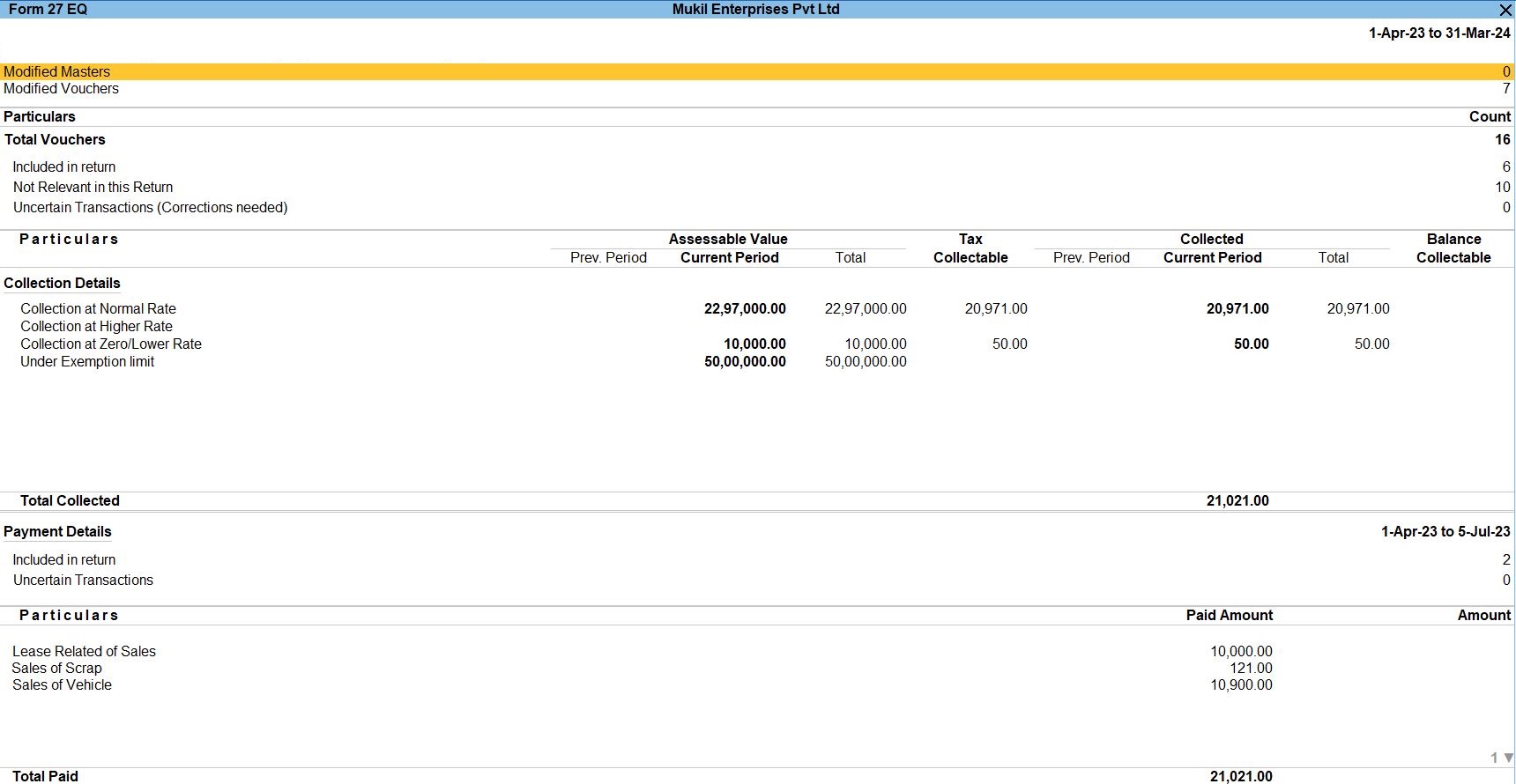

- Select Form 27 EQ:

- Click on "From 27 EQ" to generate the report.

- Export the Report:

- Once the report is displayed, press Alt+E to export.

- Choose "E Return" from the export options.

- Specify Export Settings:

- Select "SDF (Fixed Width)" as the file format.

- Choose "Export to: Local Drive."

- Specify the folder path where you want to save the exported file, for example, "C:\Users\tutor\OneDrive\Desktop."

- Enter the file name as "Tally.txt."

- Additional Information:

- Enter the date as 05-10-2023.

- Specify whether a regular return was filed for the previous period (Y for Yes or N for No).

- Enter the receipt number or token number if applicable.

- Complete Export:

- Once all the details are entered, press Enter to export the report.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions