Decoding GST in Tally Prime: A Comprehensive Overview

What is GST?

- GST, or Goods and Services Tax, is a comprehensive indirect tax levied on the supply of goods and services at each stage of the production and distribution chain.

- It is designed to replace multiple indirect taxes that were previously imposed by the central and state governments.

- The primary goal of GST is to create a more efficient and transparent taxation system

GST Implementation in India

- The journey of GST started in the year 2003.

- It has crossed many political and administrative hurdles.

- In India, GST was implemented on 01 July 2017.

Why GST Introduced in India

- The indirect taxation system had inefficiencies and limitations due to:

- Multiple taxes (Central levies like Excise Duty, Service Tax, and other Cesses, state levies like VAT, Entry Taxes, Octroi, Luxury Tax, Entertainment Tax, Purchase tax).

- Multiple tax rates.

- Multiple points of taxation (during manufacture, trade, rendering services, and so on).

Structure of GST

- Central Tax

- State Tax

- Integrated Tax

- UT Tax

Registration

- Only registered businesses are allowed to claim Input Tax Credit.

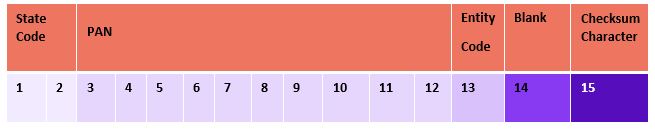

- On registration, each business will be allocated a unique 15-digit PAN based registration number.

- This is called the GST Identification Number (GSTIN).

Business Liable to Register under GST

- The annual aggregate turnover threshold beyond which a business becomes liable to be charged GST.

- On the day, a dealer crosses the Rs. 10 lakh/20 lakh turnover threshold, he should register under GST.

Process of Registration under GST

- Existing Dealers

- Existing dealers who have already registered under the existing indirect taxes system, like VAT, Central Excise, and Service Tax, will be auto-migrated to GST.

- New Dealers

- As we know, when a dealer crosses the Rs. 10 lakh/20 lakh aggregate turnover threshold, he is liable to apply for GST registration.

Composition Taxpayer

- Is required to pay tax at a certain percentage of turnover.

- Need not maintain detailed records and documents nor follow the rules and procedures of issuing a tax invoice, maintaining stock, filing invoice-wise sales and purchases, and so on.

- Only needs to file periodic returns, usually on a quarterly basis.

- Will not be allowed to avail Input Tax Credit (ITC).

- Is not allowed to collect tax on sales.

Supply of Goods and Services

- Scope of supply: The term Supply includes all forms of supply of goods or services, supplied or to be supplied, for a consideration, during or for the furtherance of business.

- Place of supply: In the GST taxation system, the place of supply will play a vital role in determining which tax to be charged.

Two Key Aspects

- Location of the Supplier

- Location of Supply

- Time of Supply

- Point of Taxation (POT) refers to the point in time when tax is required to be paid.

- This is a mechanism used to determine the point in time when the tax liability will arise.

Time of Supply under Two Heads

- Time of Supply of Goods

- Time of Supply of Service

Value of Supply

- The taxable value of all the goods and services consumed in an economy is arrived at based on various metrics.

Registration Types

- Regular

- This is the most common type of GST registration and is applicable to businesses whose turnover exceeds the prescribed threshold limit set by the GST authorities.

- For example, as of my last knowledge update in January 2022, in India, businesses with an annual aggregate turnover exceeding a certain amount are required to register for GST.

- In India, for instance, businesses with an aggregate turnover exceeding INR 20 lakhs (INR 10 lakhs for special category states) are required to register under GST.

- Composition

- This is the most common type of GST registration and is applicable to businesses whose turnover exceeds the prescribed threshold limit set by the GST authorities.

- For example, as of my last knowledge update in January 2022, in India, businesses with an annual aggregate turnover exceeding a certain amount are required to register for GST.

- In India, for instance, businesses with an aggregate turnover exceeding INR 20 lakhs (INR 10 lakhs for special category states) are required to register under GST.

- Unregistered/Consumer

- A Special Economic Zone is a designated area within a country that is subject to specific economic regulations and policies that differ from the rest of the country.

- SEZs are created to promote economic activities, exports, and employment.

- The term "Regular - SEZ" suggests that the business, even though it operates within an SEZ, has opted for the regular GST registration instead of any special scheme or composition scheme specific to SEZs.

Tally Prime

Learn All in Tamil © Designed & Developed By Tutor Joes | Privacy Policy | Terms & Conditions